August is not precisely identified for being an important month for Bitcoin (BTC). It has been over a decade now that the main cryptocurrency has been buying and selling on exchanges, and this month typically brings a number of the largest dips, irrespective of how robust the development is.

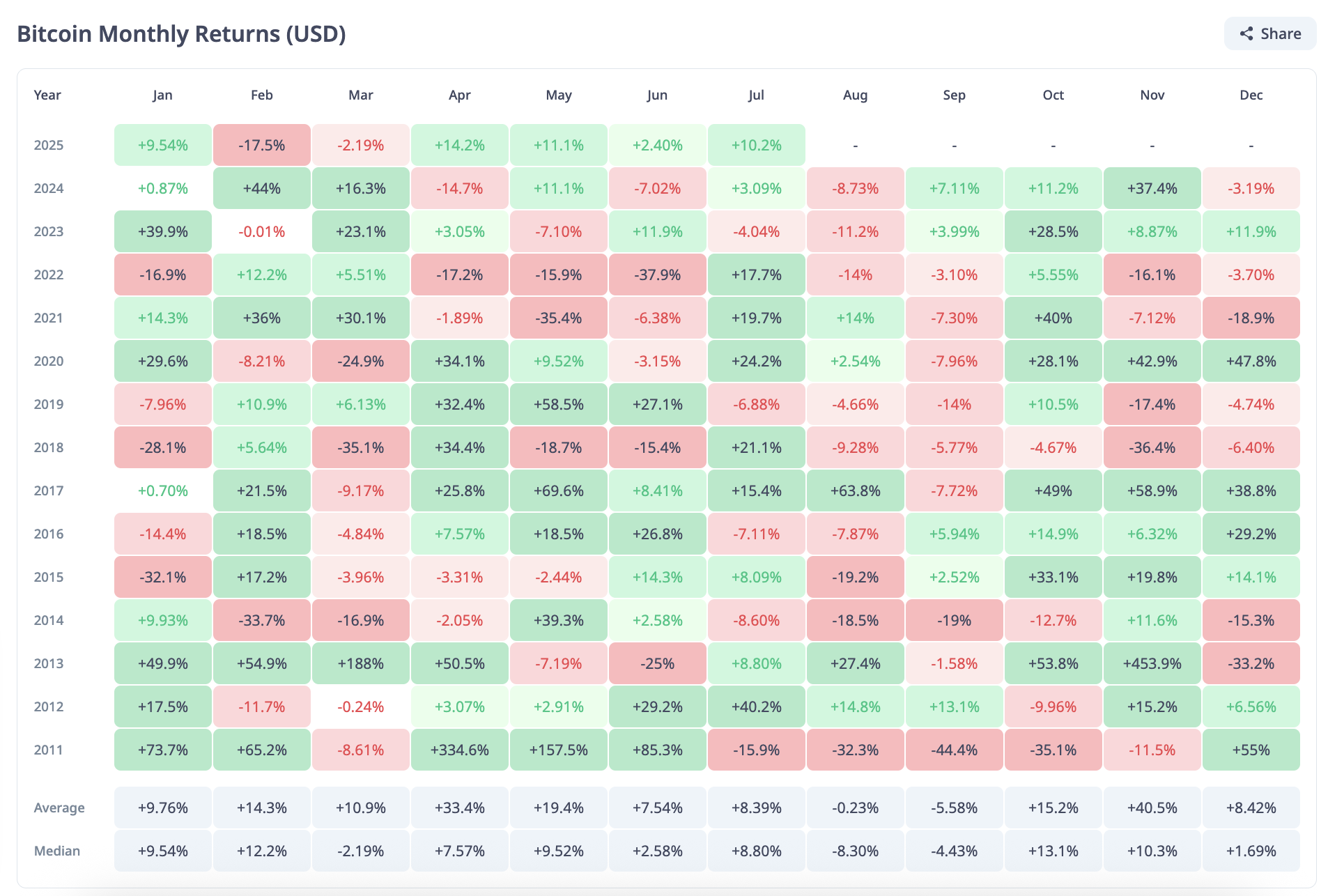

In case you look again during the last 13 years, Bitcoin has solely closed August within the inexperienced 4 instances. The remainder? It is principally purple, with losses typically crossing into double-digit territory.

In keeping with CryptoRank, the median August return is round -8.3%, and in some years, like 2011, 2014 or 2015, it received fairly ugly. Even in comparatively good years like 2022 and 2023, BTC noticed dips of 14% and 11.2% in August, respectively.

It has been the identical story yearly: Summer time rallies go bust, volumes get skinny, and costs quietly go down as merchants vanish and macro fears begin to set in.

However this is the catch — 2025 is not enjoying by the standard guidelines. After a shaky begin, Bitcoin made a comeback, gaining virtually 30% in Q2, and in July it surged by a strong 10.3%. The value construction appears to be stabilizing fairly than hitting its restrict.

Curse or cycle break?

There’s been no early August dump to this point, and on-chain information suggests the promoting strain is not as robust because it has been in earlier years. Change balances are decrease, there’s extra money coming in and the concern of one other summer-long droop is beginning to fade — at the very least for now.

If Bitcoin can have August, it will not simply be a one-off — it might be the beginning of an even bigger change in how the market behaves. This autumn is normally when issues get busy, and breaking the August curse would possibly set the tone for what’s subsequent.

This time, it appears just like the market is extra ready, and perhaps, simply perhaps, August will lastly give Bitcoin an opportunity to shine.