Crypto inflows prolonged the multi-week streak of optimistic flows, pushing month-to-date flows to $11.2 billion.

Ethereum (ETH) led the flows, with altcoins outperforming Bitcoin (BTC), which recorded vital outflows.

Ethereum Leads Crypto Inflows as Altcoin ETF Hypothesis Builds

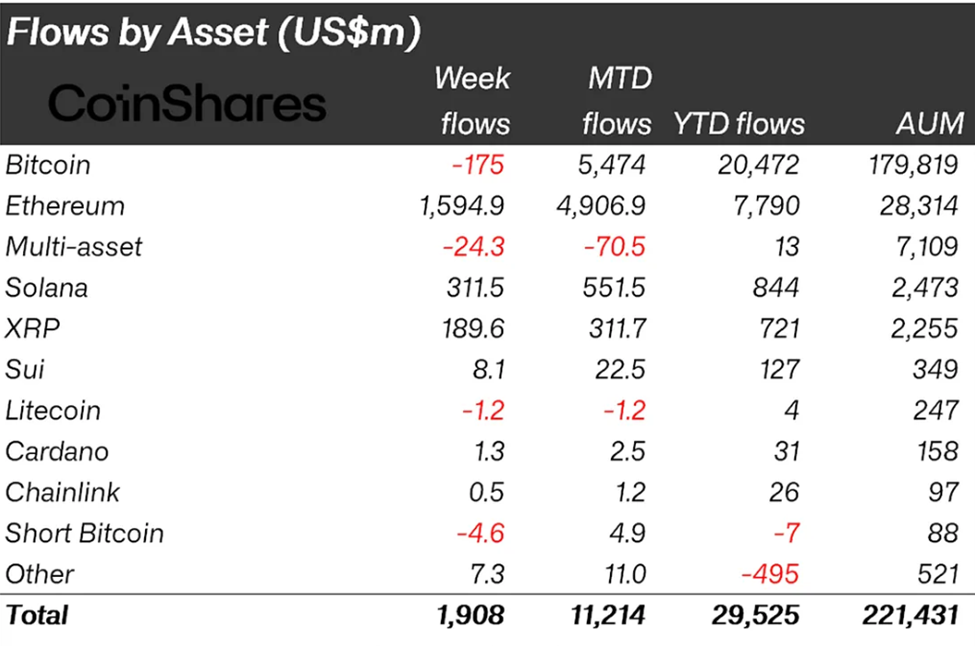

The newest CoinShares report signifies that crypto inflows reached $1.908 billion final week, a major improve from the week ending July 19, which recorded $1.049 billion.

This drop got here as Bitcoin bucked the pattern, recording $175 million in unfavorable flows. In the meantime, Ethereum prolonged its lead, with $1.594 billion inflows final week.

CoinShares head of analysis James Butterfill information this as Ethereum’s second-largest week ever, with year-to-date (YTD) flows surpassing 2024 totals.

“Ethereum stood out, unusually main with US$1.59bn in inflows final week, its second-strongest week on file. 12 months-to-date inflows into Ethereum have now reached US$7.79bn, surpassing the whole for all of final 12 months,” learn an excerpt within the report.

The CoinShares govt calls out Bitcoin for its notable divergence from broader altcoin tendencies, with Solana and XRP seeing robust inflows. Butterfill says the turnout factors to potential ETF (exchange-traded fund) anticipation somewhat than a broad altcoin season.

“This has raised the query of whether or not we’re coming into an altcoin season…These altcoin inflows could also be pushed much less by broad-based enthusiasm and extra by anticipation surrounding potential US ETF launches,” the report added.

In the meantime, Ethereum’s notable efficiency in final week’s crypto inflows is unsurprising. Coming forward of its 10th anniversary, the altcoin has seen a major surge in institutional curiosity.

Amongst them are Bit Digital’s pursuit of a $1 billion pivot to Ethereum and BlackRock’s head of digital property leaving to affix the Ethereum Treasury firm SharpLink Gaming.

Ethereum Turns into Institutional Favourite as Market Rotation Accelerates

Additional, BlackRock’s Ethereum ETF inflows surpassed its Bitcoin fund (IBIT) final week.

In an announcement to BeInCrypto, Andreas Brekken, CEO and founding father of SideShift.ai, ascribed Ethereum’s efficiency to institutional conviction arriving en masse.

Equally, MEXC Analysis Chief Analyst Shawn Younger highlights Ethereum’s accelerating momentum because it nears the $4,000 mark. Like Brekken, Younger cites robust institutional demand and a good macro backdrop.

With over $5 billion in inflows into US spot ETH ETFs throughout 16 consecutive days, Younger notes that Ethereum is more and more thought-about the cornerstone of on-chain monetary infrastructure.

“This development displays the elevated conviction in Ethereum’s utility, sustainability, and long-term endurance, significantly as a result of its use in tokenization, stablecoins, and on-chain settlement,” Younger said in an announcement shared with BeInCrypto.

He emphasizes ETH’s resilience amid latest market dips, rising dominance within the crypto market cap, and its management function in an rising capital rotation from Bitcoin to altcoins.

Technically, Ethereum has held key assist ranges whereas exhibiting relative energy. In keeping with the analyst, bettering depth throughout altcoins alerts a broader shift in market sentiment.

Based mostly on this, Younger factors to a potential breakout towards $4,500 if upcoming GDP and FOMC information spark a risk-on rally. Nevertheless, the analyst additionally cautions {that a} macro downturn may result in a pullback to $3,300.

“Softer inflation information or dovish language from the Fed could reinforce the view that the speed hike cycle is nearing its finish, doubtlessly triggering a broader risk-on shift throughout the markets — a pattern that sometimes advantages the crypto sector considerably,” he chimed.

As of this writing, Ethereum was buying and selling for $3,886, up by over 3% within the final 24 hours.

Nonetheless, with ETF adoption accelerating and ETH accounting for a rising share of institutional portfolios, Ethereum is well-positioned to steer the following leg of crypto market growth.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.