The idea of crypto margin buying and selling is gaining vital traction as traders look to take advantage of the broader-market bullishness.

Regardless of the current surge in crypto costs, specialists consider that large-cap belongings stay undervalued. Bitcoin is predicted to hit $150,000, and doubtlessly even $200,000, whereas altcoins like Ethereum, XRP and Solana are anticipated to need to 2x to 3x upside within the coming months.

Unsurprisingly, crypto margin buying and selling, which refers to borrowing funds from brokerages or exchanges to extend buying energy and purchase extra belongings, seems to be the perfect technique in opposition to the present bullish backdrop.

Nonetheless, conventional margin buying and selling has a number of key drawbacks, together with restricted leverage, curiosity fees on the borrowed sum, the danger of margin calls and the requirement to purchase and maintain spot crypto belongings.

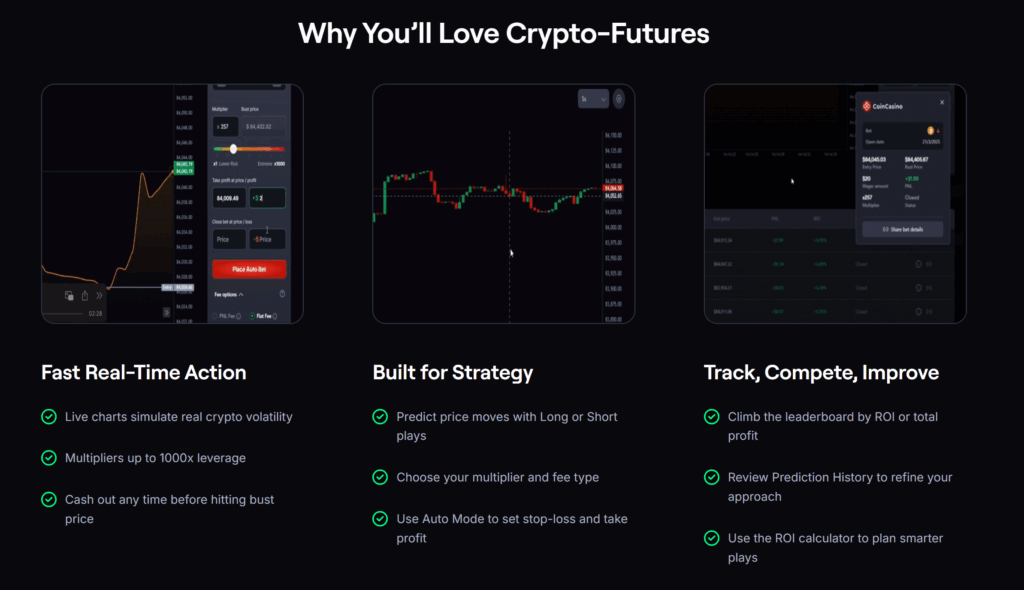

The brand new CoinFutures buying and selling platform addresses these limitations. As an alternative of working like a conventional margin alternate that lends capital at excessive curiosity, it affords as much as 1000x leverage by way of a simplified, futures-style buying and selling mannequin constructed for pace and suppleness. Better of all, there isn’t a KYC requirement for brand spanking new customers.

What Is Crypto Margin Buying and selling?

Crypto margin buying and selling permits merchants to borrow funds from an alternate or brokerage to extend their place dimension. This implies they’ll commerce with extra capital than they really maintain, amplifying each potential positive factors and losses.

For instance, with a 5x margin, a dealer with $100 can open a $500 place on Bitcoin. If the worth strikes up 10%, they earn $50 as an alternative of $10, however an identical transfer in the wrong way can shortly wipe out their capital.

Drawbacks of Conventional Margin Buying and selling

Whereas margin buying and selling is frequent in each crypto and conventional markets, it comes with a number of limitations and dangers that merchants ought to pay attention to.

In conventional finance, margin buying and selling is usually restricted to traders with accepted margin brokerage accounts and entails strict regulatory oversight. Leverage is often capped at 2x, which means merchants can solely borrow an quantity equal to their very own capital. In crypto markets, the principles are extra versatile, however the dangers stay vital.

One key draw back of margin buying and selling is the margin name. If the market strikes in opposition to a dealer’s place, they’re required to deposit extra funds to keep up the commerce. Failing to take action ends in pressured liquidation of the place.

Merchants additionally pay curiosity on the borrowed funds, which may eat into earnings over time, particularly if positions are held for longer durations.

Furthermore, margin buying and selling typically requires the dealer to really maintain the underlying crypto asset or collateral. This not solely ties up capital but additionally exposes the consumer to dangers like pockets safety and on-chain volatility.

In comparison with crypto futures platforms like CoinFutures, which provide as much as 1000x leverage with out curiosity or asset custody, margin buying and selling is extra capital-intensive and more durable to scale. It’s particularly burdensome for retail traders, who’re certain to have a troublesome time retaining tabs on margin calls, curiosity funds and pockets safety.

How CoinFutures’ 1000x Crypto Margin Buying and selling Is A Recreation-Changer

CoinFutures isn’t a typical derivatives alternate and is due to this fact able to providing a lot increased flexibility and leverage to its customers.

It’s constructed round simulated market motion, utilizing a cutting-edge algorithm that mimics actual crypto volatility. From a dealer’s perspective, buying and selling on CoinFutures is not any totally different from centralized exchanges like MEXC, besides with better leverage and fewer laws.

As an example, CoinFutures customers don’t want to purchase and maintain spot crypto belongings. As an alternative, they’ll merely guess on its value trajectory; whether or not an underlying asset will respect or depreciate in a particular timeframe.

As an example, CoinFutures permits as much as 1000x leverage. Even a 1% beneficial value motion may lead to 10x positive factors. Nonetheless, merchants want to concentrate on the danger; a 0.1% transfer in the wrong way may liquidate the complete place.

In contrast to margin buying and selling, merchants don’t have to pay any curiosity on the borrowed funds. In reality, not like most futures platforms, CoinFutures doesn’t even cost funding charges. As an alternative, customers get to have flexibility and may go for both paying a small proportion of the earnings or a flat charge.

There isn’t a deposit or withdrawal charge as properly.

CoinFutures affords enticing risk-management instruments as properly. Within the Auto Mode, merchants can arrange their very own take-profits and stop-loss ranges, defending their investments from steep losses or revenue reversals.

They will additionally use the ROI calculator to estimate potential earnings, verify liquidation costs, and consider totally different commerce setups. Merchants with the best ROI are featured on the general public CoinFutures leaderboard, including a aggressive edge to the platform.

How To Set Up 1000x Crypto Margin Trades On CoinFutures?

Step 1: Obtain CoinPoker and Entry CoinFutures

CoinFutures runs by way of the CoinPoker app, which is obtainable for Android and Home windows.

Getting began is easy, particularly with no KYC is required. Simply create a username and electronic mail account, and merchants are able to commerce. This frictionless sign-up course of makes it excellent for each crypto natives and informal customers who don’t wish to cope with conventional onboarding hurdles.

Step 2: Fund The Buying and selling Account

As soon as inside, the CoinFutures steadiness may be funded utilizing crypto belongings equivalent to BTC, ETH, USDT, SOL, BNB, or USDC, in addition to fiat fee strategies together with Visa, Mastercard, Apple Pay, Google Pay, and PIX.

No pockets connection is required.

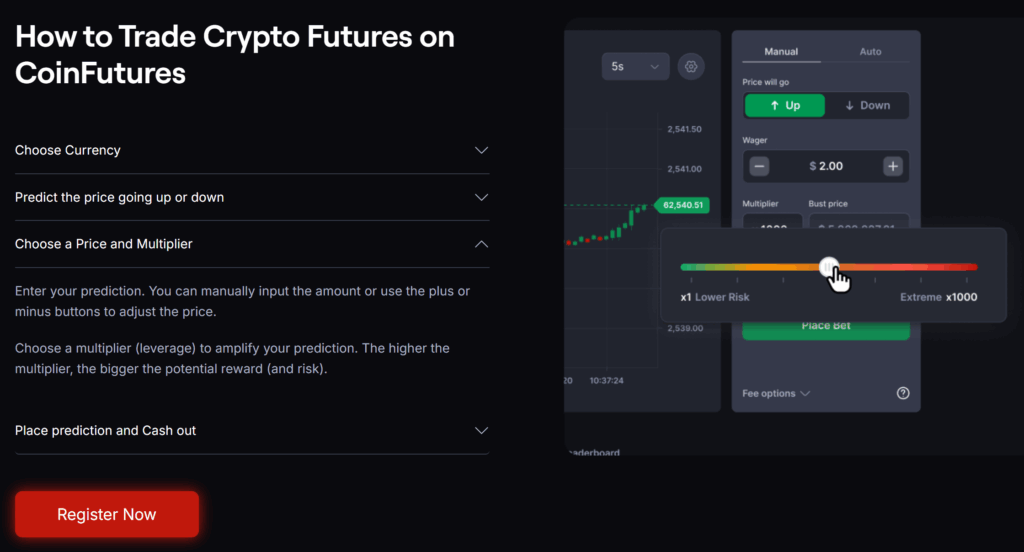

Step 3: Choose Asset, Apply Leverage and Place The Commerce

After that, merchants can choose the asset they want to commerce. CoinFutures helps a variety of cash, together with majors like Bitcoin and Ethereum, in addition to trending altcoins and meme cash.

The subsequent step is to foretell whether or not the asset’s value will transfer up or down – a simplified, binary-style method to margin buying and selling. Leverage of as much as 1000x may be utilized, although most members go for extra reasonable ranges equivalent to 5x or 20x.

An actual-time bust value calculator shows the liquidation threshold, aiding in danger administration. Moreover, CoinFutures allows pre-setting stop-loss and take-profit ranges earlier than commerce execution, serving to to keep away from frequent pitfalls like overexposure or missed exits in unstable markets.

Now, place the commerce and money out when earnings are made.

Go to CoinFutures

This text has been offered by one in every of our industrial companions and doesn’t replicate Cryptonomist’s opinion. Please bear in mind that our industrial companions could use affiliate packages to generate income by way of the hyperlinks on this article.