- Bitcoin ETFs: the sport changer

- Bitcoin value prediction

Bitcoin stays a central focus in each institutional finance and retail buying and selling, however its volatility and macro sensitivity proceed to form its outlook. Since 2020, Bitcoin has been almost 4 instances as risky as main inventory indices, underlining the dangers it poses at the same time as conventional monetary gamers begin to embrace it.

Whereas new U.S. laws just like the GENIUS Act goals to stabilize the digital asset market, such strikes do not make the general crypto market any much less risky. In actual fact, they could amplify danger, given how interconnected crypto and conventional markets have change into.

Regardless of narratives that painting Bitcoin as a hedge, it has confirmed to be a high-beta asset, which means it strikes extra aggressively in the identical path because the broader inventory market.

When the Federal Reserve hikes rates of interest to fight inflation, Bitcoin usually suffers as liquidity dries up and traders flock to safer belongings like authorities bonds.

Conversely, charge cuts and even hypothesis of financial easing sometimes set off sharp rallies, as danger urge for food returns and capital flows again into speculative belongings like crypto.

Bitcoin ETFs: the sport changer

The approval of spot Bitcoin ETFs in January 2024 was a landmark occasion, triggering a large inflow of institutional capital. These ETFs supplied conventional traders a compliant, low-friction option to achieve publicity to Bitcoin.

As establishments like BlackRock and Constancy started shopping for Bitcoin to again their ETF merchandise, demand surged, reinforcing a bullish suggestions loop: rising costs appeal to extra ETF patrons, which in flip pushes costs even increased.

The institutional pivot has additionally modified Bitcoin’s market profile. Monetary heavyweights are actually constructing strong infrastructure round Bitcoin, from custody companies to derivatives platforms. Even previous skeptics like BlackRock CEO Larry Fink have publicly embraced the asset.

Bitcoin value prediction

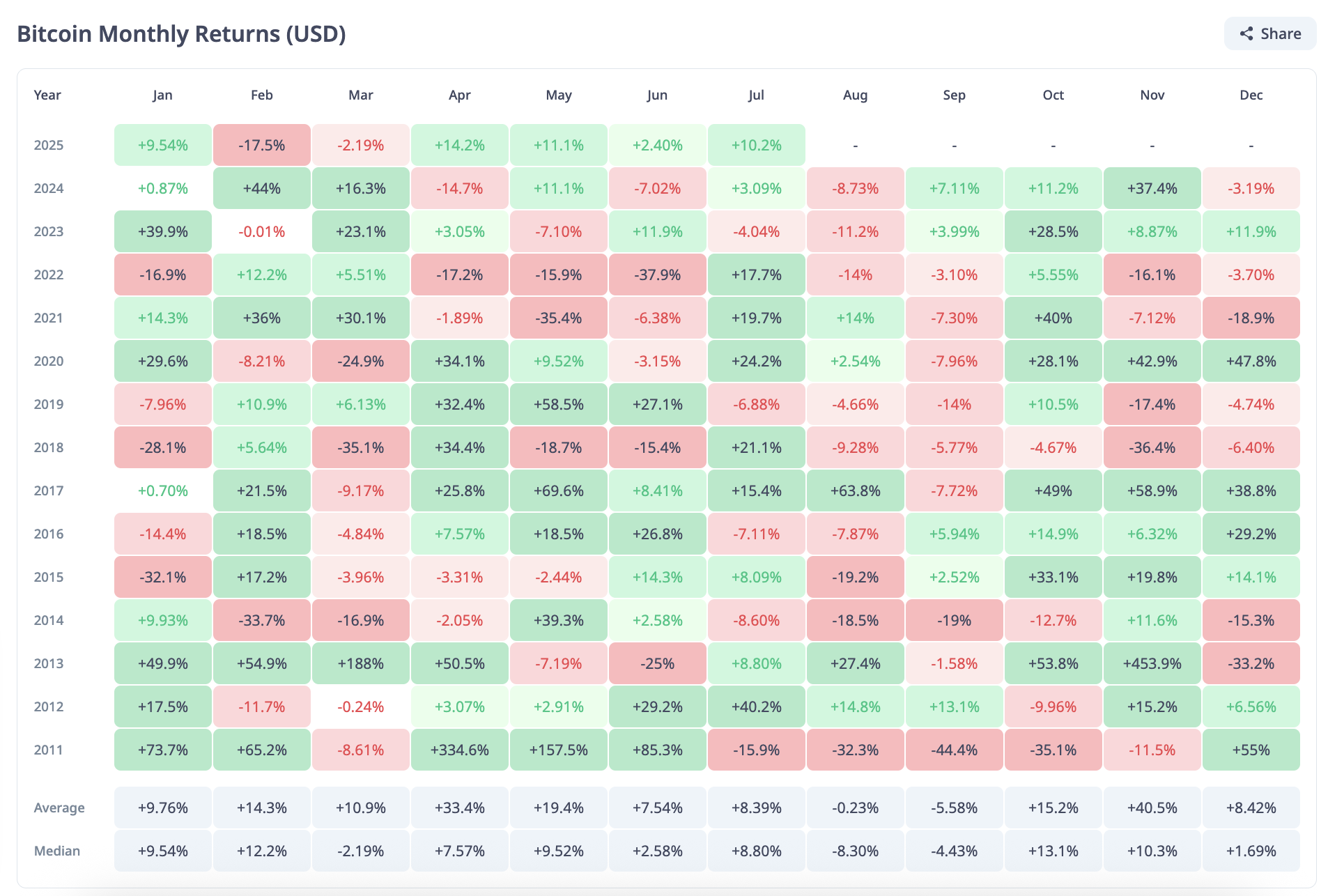

This shift marks a maturation of Bitcoin as an investable asset, although it doesn’t remove volatility, particularly throughout traditionally weak months like August. August has usually been one among Bitcoin’s worst-performing months, with median losses of -8.3% and steep historic declines in 2011, 2014, and 2015.

But, bullish long-term forecasts stay robust. Analysts like PlanB, identified for the stock-to-flow (S2F) mannequin, argue that Bitcoin is deeply undervalued in comparison with gold. With Bitcoin’s S2F ratio at roughly 120 (double that of gold), PlanB suggests BTC might be value over $1.18 million.

In the meantime, Bitwise CIO Matt Hougan predicts Bitcoin may attain $200,000 by the top of 2025, citing rising institutional demand.

Bitcoin evangelist Jeremie Davinci goes even additional, projecting a value of $500,000 and urging long-term holders to borrow towards their BTC slightly than promote it.

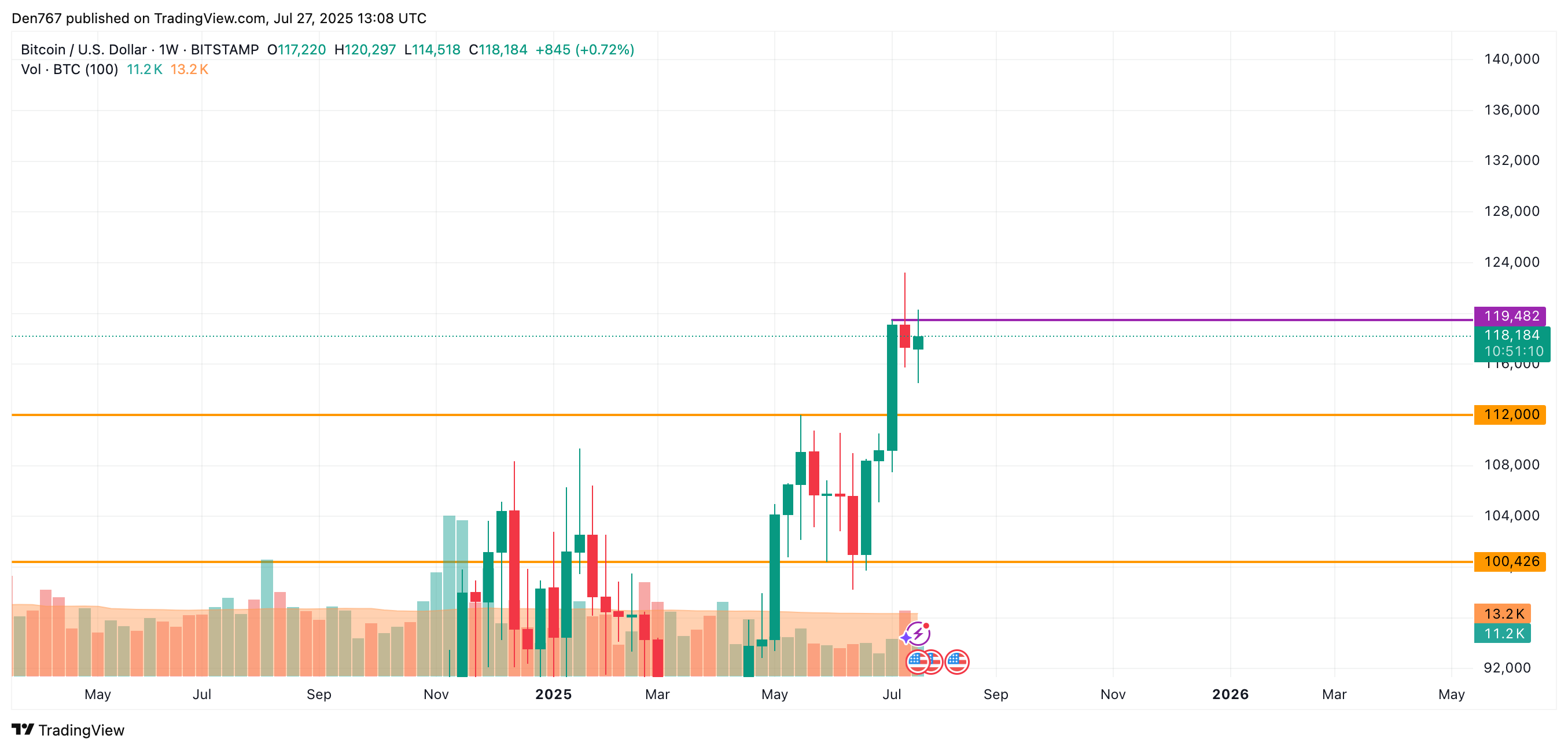

From a technical perspective, Bitcoin is at the moment buying and selling simply above key help at $117,888. If that degree breaks, merchants are watching $117,500 as the following probably check.

On the upside, a weekly shut nicely above $119,482 may reaffirm bullish momentum. However failure to carry these ranges may open the door to a decline towards $112,000.