Welcome to the US Crypto Information Morning Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso and hold your eyes open as crypto progressively leaps into Wall Avenue’s bloodstream. Neither Bitcoin nor Ethereum is used this time, as two Nasdaq-listed companies make billion-dollar bets on BNB.

Crypto Information of the Day: 10X Capital’s $500 Million PIPE to Launch First Public BNB Treasury Car on Nasdaq

10X Capital and CEA Industries Inc. (VAPE) introduced a $500 million non-public placement to create the world’s largest publicly listed BNB-exclusive digital asset treasury firm.

The deal, upsized resulting from oversubscription, will shut on July 31, 2025, and, with full warrant train, may attain $1.25 billion in gross proceeds.

“Saying our $500 Million Non-public Placement to Set up the Largest Publicly-Listed BNB-exclusive Digital Asset Treasury Firm within the World!” 10X Capital shared in a put up.

YZi Labs (previously Binance Labs) led the deal, which was participated in by over 140 crypto-native and institutional buyers, together with Pantera Capital, Blockchain.com, and Arrington Capital.

The providing contains $400 million in money and $100 million in crypto, plus as much as $750 million from potential warrant workouts.

The brand new treasury automobile will purchase and handle BNB, specializing in long-term holding and income methods like staking and lending inside the BNB Chain and Binance ecosystem.

Incoming CEO David Namdar, co-founder of Galaxy Digital, described the transfer as an institutional gateway.

“By making a US-listed treasury automobile, we’re opening the door for conventional buyers to take part in a clear method,” learn an excerpt within the press launch, citing Namdar.

The enterprise brings different heavyweights from conventional finance (TradFi) and crypto specialists to the desk. This improvement provides to the rising momentum for BNB treasuries.

BeInCrypto just lately reported that Windtree Therapeutics and Nano Labs are additionally pushing the development.

“Treasury firms have confirmed to be the cleanest, most clear gateway for establishments to entry digital property,” mentioned Hans Thomas, CEO of 10X Capital.

Liminatus Pharma Plans $500 Million BNB Funding By New Subsidiary

Past 10X Capital, Windtree Therapeutics, and Nano Labs, one other institutional pivot towards crypto and BNB sprouted on Monday.

Liminatus Pharma Inc. (LIMN), a preclinical biopharmaceutical firm centered on most cancers immunotherapies, revealed plans to boost $500 million to spend money on BNB through a newly shaped subsidiary referred to as American BNB Technique.

The transfer comes after an inner evaluation of blockchain-integrated finance methods. This displays a rising development of conventional public firms looking for treasury diversification through digital property.

“BNB Coin was chosen over quite a few digital property resulting from its strong expertise, international consumer base, worth producing options equivalent to Launchpool participation and staking fashions, and the continued growth of the BNB Chain,” mentioned Chris Kim, CEO of Liminatus.

For Liminatus, the BNB funding technique won’t intrude with its biotech mission however is meant to help long-term progress and improve shareholder worth.

The proposed construction will deal with long-term holding of BNB, not short-term hypothesis, and leverage custody infrastructure from Ceffu, a Binance-affiliated entity, to keep up safety and compliance requirements.

“This isn’t a short-term speculative initiative, however somewhat a value-driven technique based mostly on the long-term progress potential and power of the BNB ecosystem,” the corporate famous in its announcement.

Placement agent Digital Providing is managing the capital increase, and the plan stays topic to regulatory approvals and market circumstances.

If finalized, Liminatus would develop into one of many first US-listed biotech companies to anchor a part of its capital technique in a Layer-1 blockchain token.

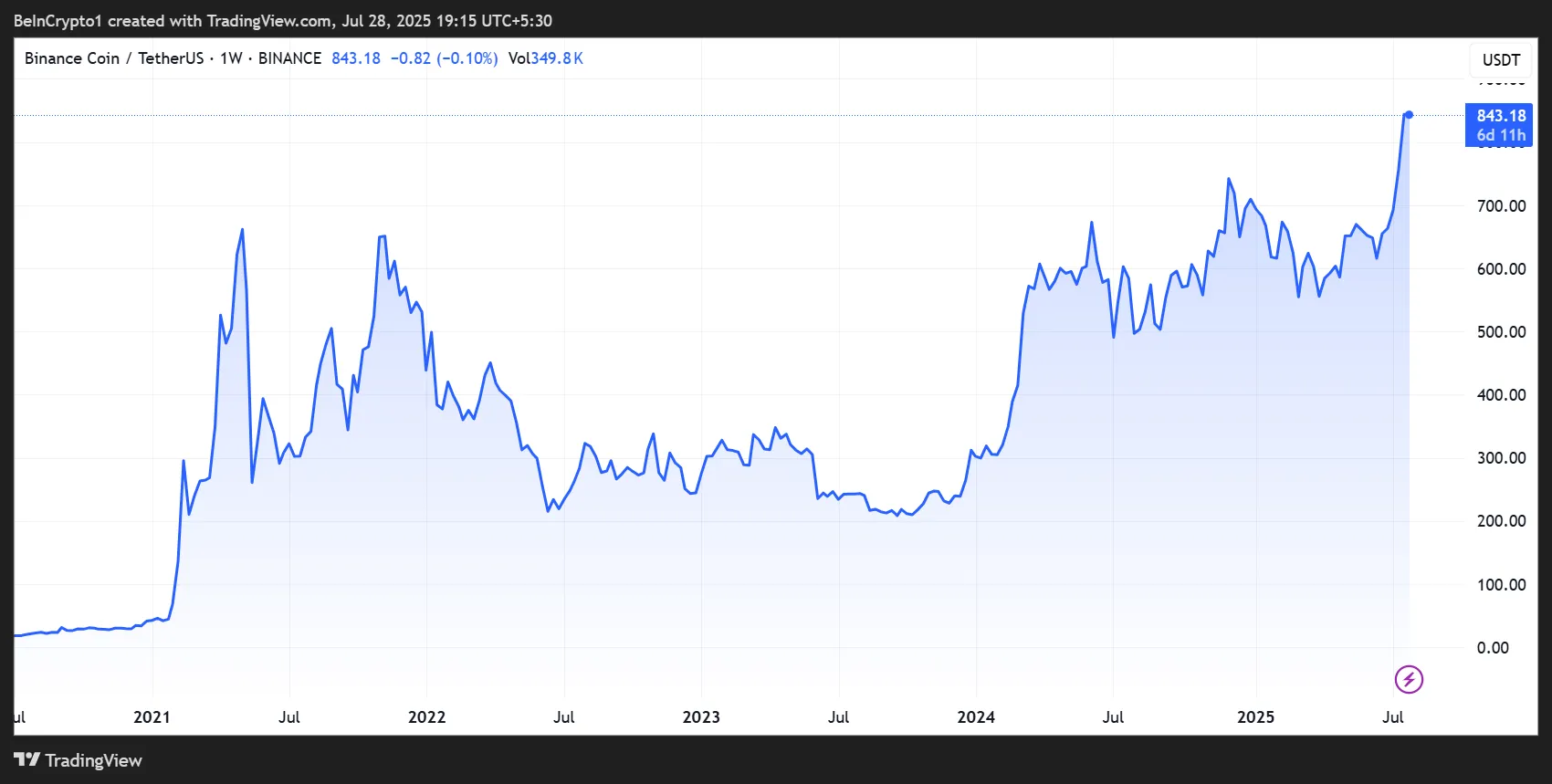

Chart of the Day

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to observe at present:

Crypto Equities Pre-Market Overview

| Firm | On the Shut of July 25 | Pre-Market Overview |

| Technique (MSTR) | $405.89 | $416.00 (+2.49%) |

| Coinbase International (COIN) | $391.66 | $395.30 (+0.93%) |

| Galaxy Digital Holdings (GLXY) | $30.59 | $31.85 (+4.12%) |

| MARA Holdings (MARA) | $17.25 | $17.74 (+2.84%) |

| Riot Platforms (RIOT) | $14.54 | $14.65 (+0.76%) |

| Core Scientific (CORZ) | $13.76 | $13.87 (+0.80%) |

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.