As July ends, merchants and traders will keep watch over August. They are going to watch a number of US financial alerts that might affect their portfolios.

This week’s US financial alerts are notably necessary with Bitcoin (BTC) eyeing the $120,000 threshold.

US Financial Indicators That Might Influence Bitcoin This Week

The crypto market is up as we speak, with Bitcoin main the cost because it closes in on $120,000. Nonetheless, whether or not this optimism is sustainable is determined by how this week’s US financial alerts unfold.

Client Confidence

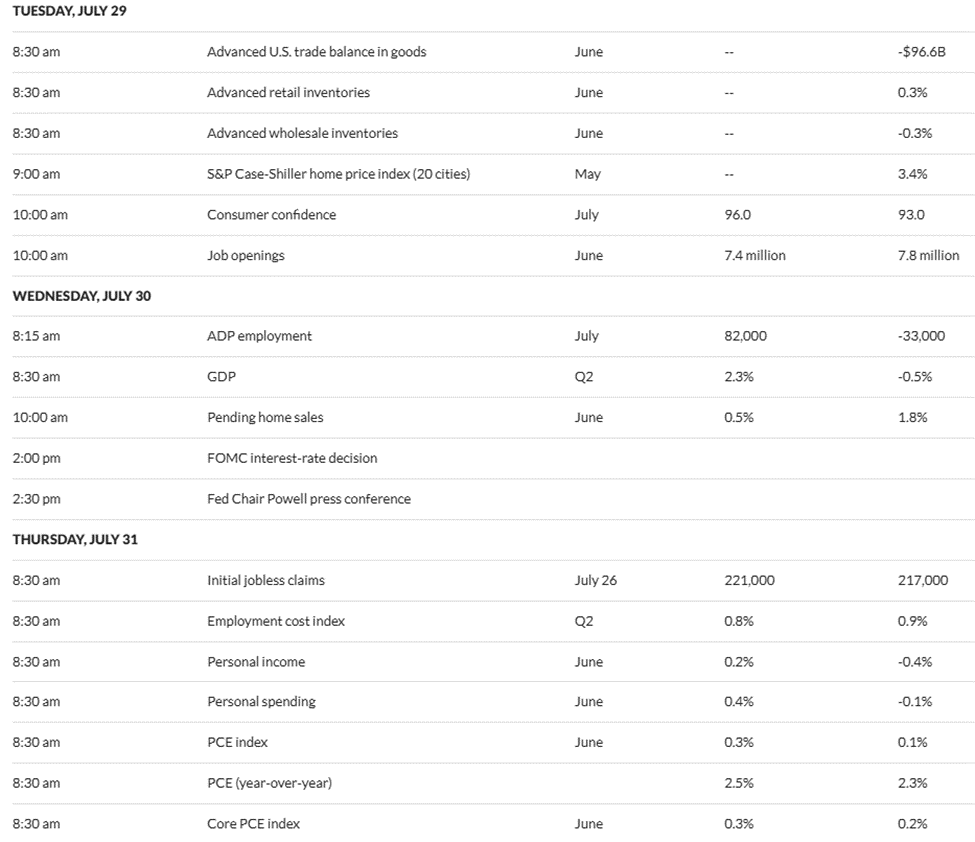

The buyer confidence report is beginning this week’s US financial alerts, that are due on Tuesday. The Convention Board’s Client Confidence Index plummeted to 93.0 in June 2025, a 5.0-point drop from Might (98.0).

In response to information on MarketWatch, the median forecast is 96.0, suggesting economists are extra optimistic for July. Nonetheless, customers specific rising issues amid Trump’s tariffs.

“Shoppers are unlikely to regain their confidence within the financial system until they really feel assured that inflation is unlikely to worsen, for instance if commerce coverage stabilizes for the foreseeable future,” Reuters reported, citing Joanne Hsu, the director of the Surveys of Shoppers.

This erosion of confidence suggests a decreased danger urge for food. Pessimistic customers are much less more likely to spend money on speculative belongings like Bitcoin, favoring safer choices like bonds or money.

If the July shopper confidence rises above expectations, it might bolster danger urge for food, probably boosting crypto.

Jobs Experiences

US labor information is one among Bitcoin’s most vital macro components in 2025. This week’s US financial alerts will characteristic a number of jobs experiences, positioning Bitcoin for volatility.

The Job Openings and Labor Turnover Survey (JOLTS) report and Job Openings are due on Tuesday and might be launched by the US Bureau of Labor Statistics (BLS).

JOLTS

The June JOLTS report, due on Tuesday, is projected to return in decrease than the 7.8 million recorded in Might. In response to economists surveyed by MarketWatch, information on job openings, hires, and separations within the US might are available in at 7.4 million.

Regardless of the projected drop, a 7.4 million studying would nonetheless exceed the multi-month low of seven.192 million recorded in March. However, it stays the important thing spotlight of this week’s US financial indicators.

ADP Employment

One other labor market information level to observe this week is the July ADP employment report. The BLS report, which is extra complete and broadly considered the official measure, indicated that private-sector employment dropped by 33,000 jobs in June 2025.

The determine was considerably decrease than economists’ expectations of a 95,000 job improve, with the decline suggesting a slowdown in hiring. Information on MarketWatch exhibits that economists projected 82,000 job will increase in July, which might nonetheless be decrease than the earlier studying.

Preliminary Jobless Claims

One other labor market information characteristic amongst US financial alerts this week is the preliminary jobless claims, due on Thursday. This weekly jobs information highlights the variety of US residents who filed for unemployment insurance coverage the earlier week.

Preliminary jobless claims got here in at 217,000 within the week ending July 19, however economists anticipate higher prospects for the week ending July 26 and anticipate as much as 221,000 purposes.

An uptick in jobless claims might sign financial weak point. This is able to improve the probability of the Fed adopting a extra accommodative financial stance.

Such a shift might result in a weaker greenback, enhancing Bitcoin’s attractiveness in its place asset. Nonetheless, if the rise in claims is seen as a brief fluctuation, the affect on Bitcoin could also be restricted.

In the meantime, analysts say a resilient labor market, coupled with sticky inflation, might permit rates of interest to stay elevated. Nonetheless, indicators of a cooling job sector might mood the Fed’s path.

Non-Farm Payrolls

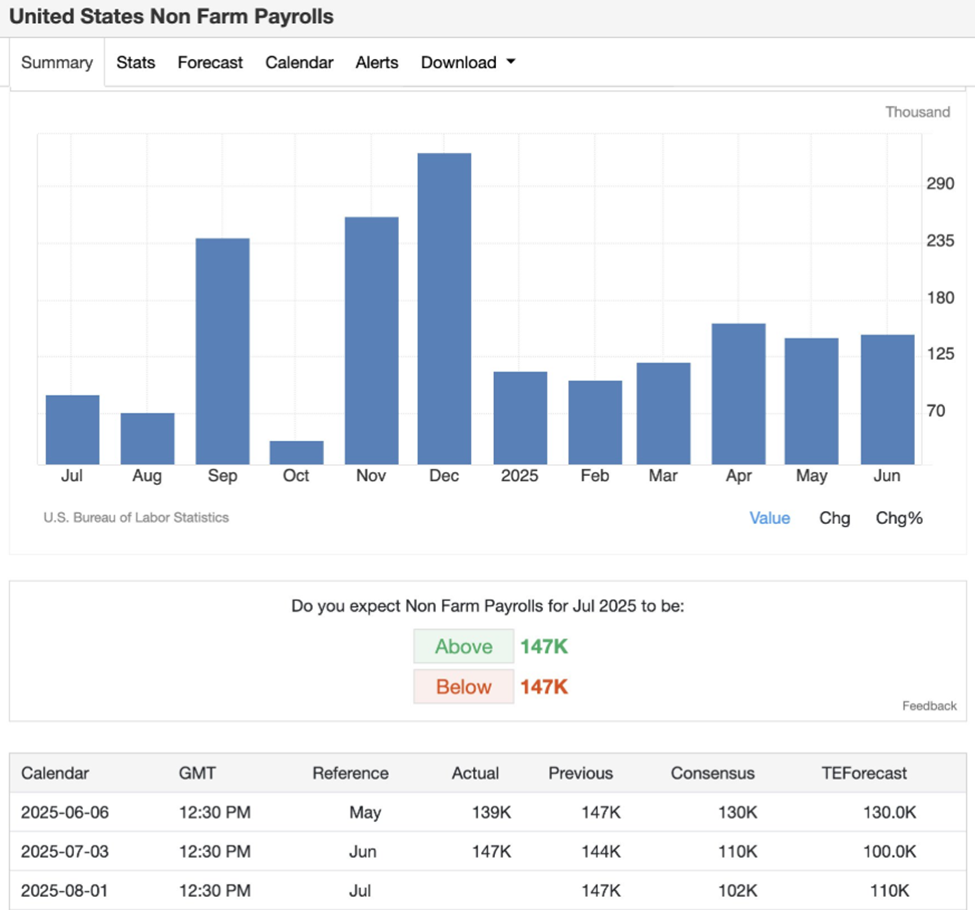

The US Employment report, or Non-Farm Payrolls (NFP) for July 2025, is scheduled for launch on Friday. The financial system added 147,000 jobs in June after 139,000 jobs in April. In the meantime, the unemployment price dropped to 4.1% in June after 4.2% in Might.

Information on MarketWatch exhibits that economists anticipate a rise of 4.2% within the US unemployment price in opposition to a slowdown in jobs to 102,000. This drop or slowdown displays potential financial impacts from President Trump’s tariffs.

Sturdy job progress might lead the Fed to take care of its present financial coverage stance and even think about tightening, which might strengthen the US greenback and probably suppress Bitcoin.

Nonetheless, if underlying financial issues immediate the Fed to undertake a extra dovish method, Bitcoin may benefit as traders search different shops of worth.

Analysts say powerful employment circumstances within the US come as employers in search of readability across the White Home’s commerce coverage progressively having to take care of frequent changes to timelines and schedules.

FOMC Curiosity Fee Choice

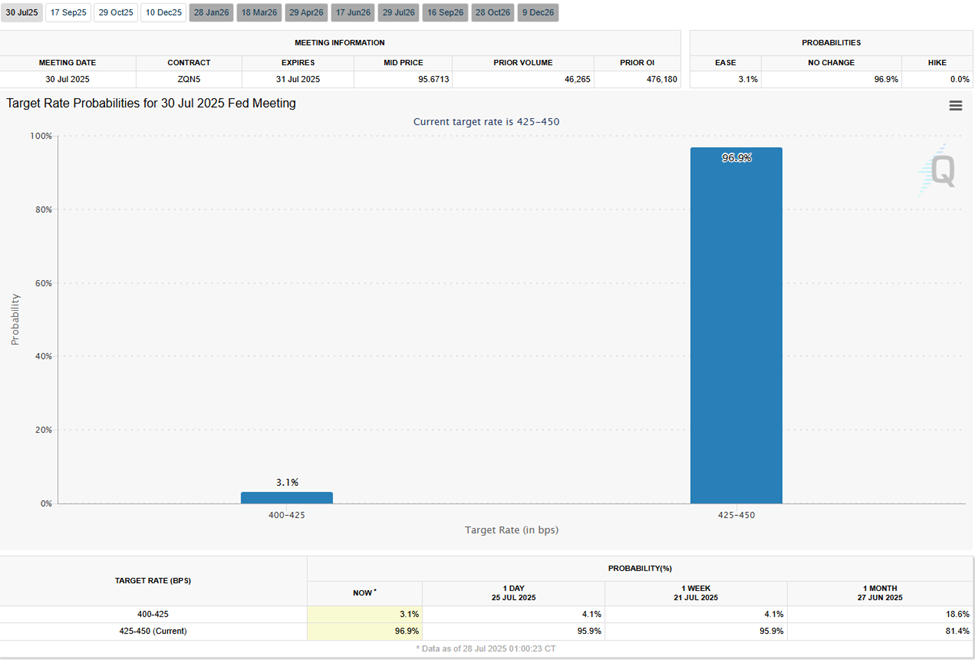

In the meantime, this week’s US financial alerts spotlight the FOMC rate of interest choice on Wednesday. This financial indicator comes after the US CPI (Client Worth Index) confirmed inflation rose to 2.7% in June.

The FOMC minutes on July 9 prompt price cuts this 12 months, with policymakers agreeing inflation had eased however remained “considerably elevated.” Moreover, uncertainty across the outlook had diminished, although not disappeared.

Nonetheless, whether or not the Fed will minimize rates of interest on July 30 stays to be seen. Information on the CME FedWatch Device exhibits that curiosity bettors see a 96.9% likelihood that the Fed will hold rates of interest unchanged between 4.25% and 4.50%.

“What’s extra attention-grabbing is the Powell press convention. A couple of days in the past, Trump met Powell, and he’s anticipating the Fed to be dovish. A couple of different Fed governors are additionally calling for low rates of interest, so this press convention might be pivotal,” one person noticed.

Certainly, past the FOMC rate of interest choice, merchants and traders will carefully look at Fed chair Jerome Powell’s speech for alerts into the Fed’s future outlook.

If Powell hints at price cuts in September, it might encourage optimism available in the market. Nonetheless, if he sounds similar to the final FOMC conferences, the crypto market would possibly see a pointy correction.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.