Bitcoin trades at a essential degree, holding regular above $118,000 however failing to achieve momentum for a breakout. Worth motion has continued to tighten over the previous a number of days, and analysts now anticipate a serious transfer as soon as both key provide zones are absorbed or demand breaks under. The market sits on edge, ready for affirmation of the subsequent development.

Associated Studying

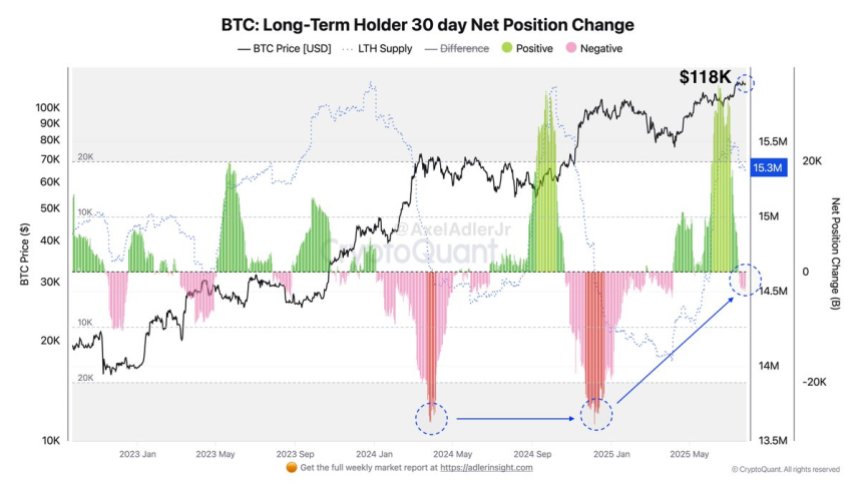

Contemporary knowledge from CryptoQuant highlights a notable shift in long-term holder (LTH) habits. At $118K, LTH provide started to say no, signaling the beginning of a distribution part. These holders, recognized for accumulating throughout downtrends and promoting into power, are actually regularly offloading their positions. This transition typically marks the later phases of a bullish development and echoes patterns from earlier macro cycles.

As Bitcoin struggles to interrupt previous resistance and LTHs cut back publicity, strain continues to construct. A clear breakout above the present vary may reignite momentum and drive BTC to new highs, whereas a break under assist could set off a sharper correction. Both manner, the present standoff received’t final for much longer. The approaching days may convey the decisive transfer that units the tone for Bitcoin’s subsequent main leg.

LTH Distribution Begins As Bitcoin Mirrors Fall 2024 Sample

Prime analyst Axel Adler has highlighted a key growth in Bitcoin’s present construction. In keeping with Adler, LTH provide has declined by 52,000 BTC thus far, marking a major shift in habits. These holders, sometimes seen because the market’s most affected person contributors, are actually starting to cut back their publicity—simply as Bitcoin stays locked in a decent consolidation vary.

This shift from accumulation to distribution intently mirrors the LTH habits seen throughout fall 2024, when Bitcoin climbed from $65,000 to $100,000. In that interval, long-term traders steadily offered into power because the market pushed increased, locking in earnings as late-stage momentum kicked in. Adler means that if the present development continues, the distribution part will intensify with every worth leg up—simply because it did in earlier macro cycles.

The timing of this transition is essential. Bitcoin continues to hover slightly below all-time highs, whereas altcoins have begun to point out indicators of elevated volatility. As Ethereum and different main belongings start to maneuver extra aggressively, capital rotation could speed up. Whether or not this advantages or pressures Bitcoin stays to be seen.

Associated Studying

BTC Holds Regular As Tight Vary Continues

Bitcoin stays in a decent consolidation vary between $115,724 and $122,077, with the 4-hour chart exhibiting worth presently hovering round $118,817. After bouncing from the decrease boundary final week, BTC has managed to recuperate and now trades above the 50 SMA ($118,175), 100 SMA ($118,228), and effectively above the 200 SMA ($113,777). These transferring averages have flattened, reflecting the continuing equilibrium between consumers and sellers.

Regardless of a number of exams of the $118K zone, BTC continues to respect the important thing assist ranges, exhibiting resilience as promoting strain stays muted. Quantity, nevertheless, stays low—suggesting that merchants are nonetheless in wait-and-see mode, in search of a decisive breakout earlier than committing to bigger positions.

Associated Studying

The higher resistance at $122K stays untouched since mid-July, and every strategy has been met with rejection. A clear break above this degree with quantity affirmation would sign a continuation of the broader uptrend and will set off a transfer towards new all-time highs. On the draw back, a break under $115K would invalidate the present construction and sure result in elevated volatility.

Featured picture from Dall-E, chart from TradingView