- Hoskinson believes ADA might 100x—and possibly function Bitcoin’s DeFi spine (formidable!).

- Derivatives information exhibits lowered open curiosity and rising quick positions, signaling fading bullish sentiment.

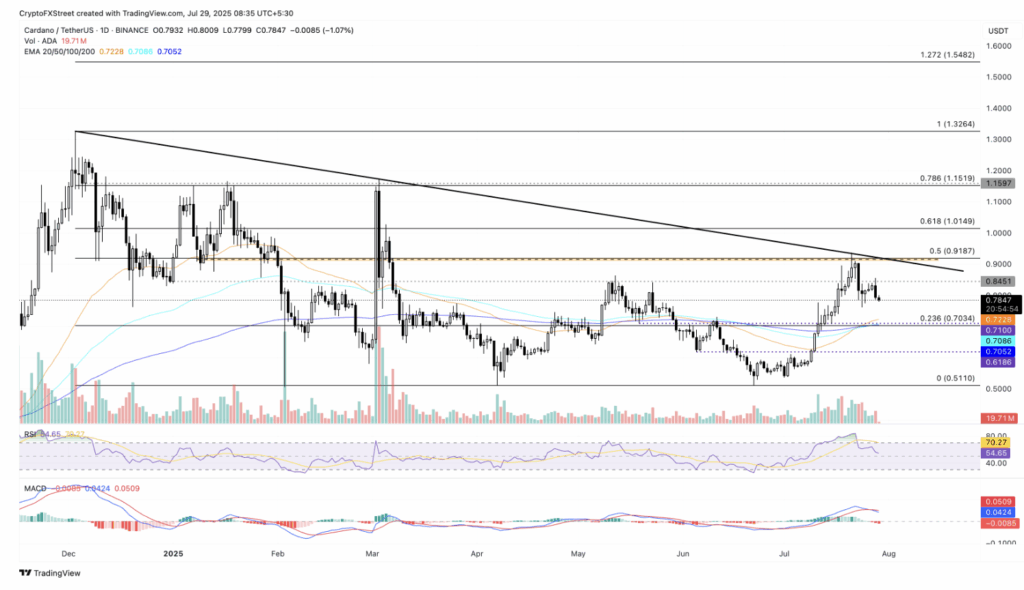

- ADA seems to be technically set for a drop to its 50-day EMA until bulls present up quick.

Cardano (ADA) isn’t having the smoothest week. It dropped one other 1% on Tuesday, extending Monday’s 5% decline. Regardless of the dip, co-founder Charles Hoskinson jumped on a podcast and dropped a fairly daring take—he thinks Cardano might outperform Bitcoin… and possibly even grow to be its yield layer. That’s… quite a bit.

On the charts although, it’s not wanting too fairly. Technicals and derivatives recommend ADA is likely to be headed for an even bigger pullback, possibly right down to its 50-day EMA.

Hoskinson Sees Massive Issues Forward for ADA—Like Actually Massive

In a current chat with Jason Yanowitz over at Blockworks, Charles acquired actual formidable. He mentioned Bitcoin would possibly hit $1 million sometime, which is a strong 10x from right here. However Cardano? He’s calling a 100x… possibly even a 1000x. Sure, you learn that proper.

If these numbers performed out, Bitcoin’s market cap could be sittin’ at $23 trillion, whereas Cardano could be someplace between $2.7 trillion and $27 trillion. The higher vary appears, uh, a bit on the market—particularly since establishments are throughout Bitcoin currently. However hey, goals gas crypto, proper?

Charles additionally dropped the thought of Cardano performing as Bitcoin’s yield layer—principally letting BTC holders faucet into staking, yield farming, and all the nice DeFi stuff by way of Cardano. He talked about airdrops too. Like, ADA holders would possibly get annual ones from associate chains. First up? Midnight (NIGHT) tokens. And guess what? Half of these tokens (12B) are earmarked for ADA holders.

ADA Derivatives Cooling Off—OI and Longs Fade

In the meantime, CoinGlass information exhibits ADA open curiosity (OI) slipping from $1.74B to $1.51B. That’s a chunky $230M exit in only a week. Not nice. Merchants appear to be backing off, and the lengthy/quick ratio simply dropped from 0.9272 to 0.8864.

Extra merchants are betting towards ADA too—quick positions climbed to 53.01%, up from 51.89%. The bullish vitality’s clearly fading a bit, particularly with the broader market feeling wobbly.

Heading Towards the 50-Day EMA?

So right here’s the place the charts are available. ADA simply bounced off a multi-month resistance trendline (yeah, the one connecting these December and March highs). It additionally failed to interrupt above the 50% Fib degree at $0.9187.

Now? The trail of least resistance appears to be pointing towards that 50-day EMA, presently round $0.7228. The MACD simply flipped bearish too, with pink histogram bars popping again up. RSI sits at 54, leaning towards impartial however trending downward—much less shopping for, extra ready.

That mentioned, if momentum shifts, ADA might flip again and attempt to break above that resistance once more at $0.9187. However proper now, odds are leaning towards one other short-term dip.