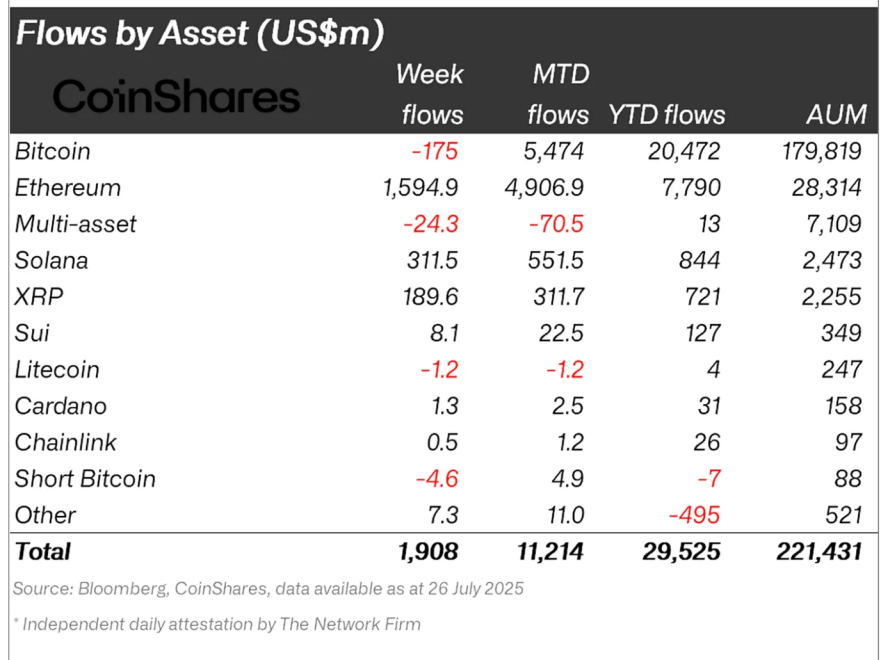

The digital asset funding area maintained its upward trajectory final week, with inflows into crypto funding merchandise reaching $1.9 billion, in keeping with the most recent information revealed by CoinShares.

This marks the fifteenth straight week of constructive internet inflows, indicating sustained institutional curiosity whilst market situations stay unstable. The report highlights a major surge in capital deployment in comparison with earlier months, with July’s month-to-date whole already at $11.2 billion, setting a brand new month-to-month file.

James Butterfill, head of analysis at CoinShares, emphasised the magnitude of those flows, noting they’ve already surpassed the $7.6 billion seen in December 2024, which had been buoyed by post-election optimism in america.

Nonetheless, regardless of the sturdy general figures, regional stream dynamics revealed combined investor conduct. Whereas the US and Germany collectively attracted over $2 billion, different areas similar to Brazil, Canada, and Hong Kong skilled capital outflows totaling almost $270 million.

Ethereum Outpaces Bitcoin Amid Shifting Institutional Preferences

In a noteworthy shift, Ethereum emerged because the main asset by inflows final week, recording $1.59 billion. This marked the second-largest weekly haul for Ethereum funding merchandise on file. With year-to-date inflows now at $7.79 billion, Ethereum has already outpaced its whole consumption for the whole thing of 2024.

This pattern factors to rising institutional curiosity in Ethereum’s evolving function inside the digital asset ecosystem, notably as developments surrounding ETH spot ETFs and staking alternate options proceed to realize traction.

Bitcoin, however, noticed minor internet outflows totaling $175 million. Whereas modest in absolute phrases, the divergence in stream developments in comparison with Ethereum and different altcoins has prompted dialogue a couple of attainable transition towards an “altcoin season.”

Butterfill, nonetheless, cautioned in opposition to drawing broad conclusions too quickly. Nonetheless, the report highlighted notable exercise in a number of altcoins: Solana and XRP recorded $311 million and $189 million in inflows respectively, whereas SUI attracted $8 million.

In the meantime, different property like Litecoin and Bitcoin Money registered small outflows, suggesting selective curiosity quite than a broad-based rotation.

ETF Anticipation Could Be Fueling Altcoin Demand

One of many key drivers behind the renewed curiosity in choose altcoins could also be expectations round potential spot ETF approvals in america.

Crypto regulatory anticipation has traditionally had an outsized influence on asset flows, and present momentum round Solana and XRP might replicate a forward-looking positioning by buyers hoping to capitalize on future ETF launches.

Notably, this aligns with patterns noticed in late 2023 and early 2024 when Bitcoin ETF hypothesis triggered related influx spikes.

Trying forward, sustained inflows into altcoins will seemingly rely upon broader regulatory developments and macroeconomic cues, together with choices from the US Securities and Trade Fee and world central banks.

For now, Ethereum’s influx dominance and Bitcoin’s relative stagnation current a curious distinction that will probably be intently monitored within the weeks to come back.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.