Ethereum (ETH) has lately surged to a 7-month excessive, but the cryptocurrency has but to breach the psychological $4,000 degree.

The altcoin has proven spectacular development, however overcoming this important barrier might show difficult. As traders watch carefully, ETH’s subsequent strikes may decide the long run worth course.

Ethereum is Noting A Market Prime

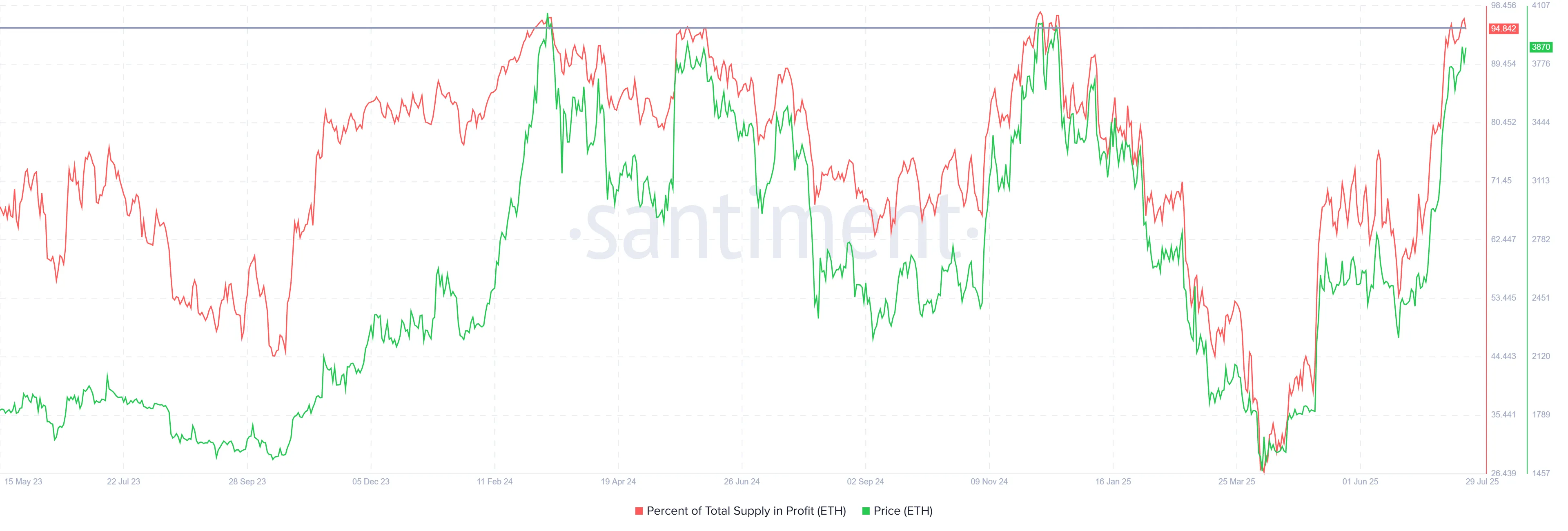

At present, 94% of Ethereum’s complete provide is in revenue. Traditionally, when the worthwhile provide surpasses 95%, it indicators a market high. This has been adopted by worth corrections as traders start to safe earnings. Consequently, Ethereum’s worth may face a pullback if the pattern continues, doubtlessly reversing latest features.

Market tops typically point out that bullish momentum has saturated, and plenty of traders start to promote their holdings. This shift may sluggish Ethereum’s upward motion, because the market reacts to potential saturation.

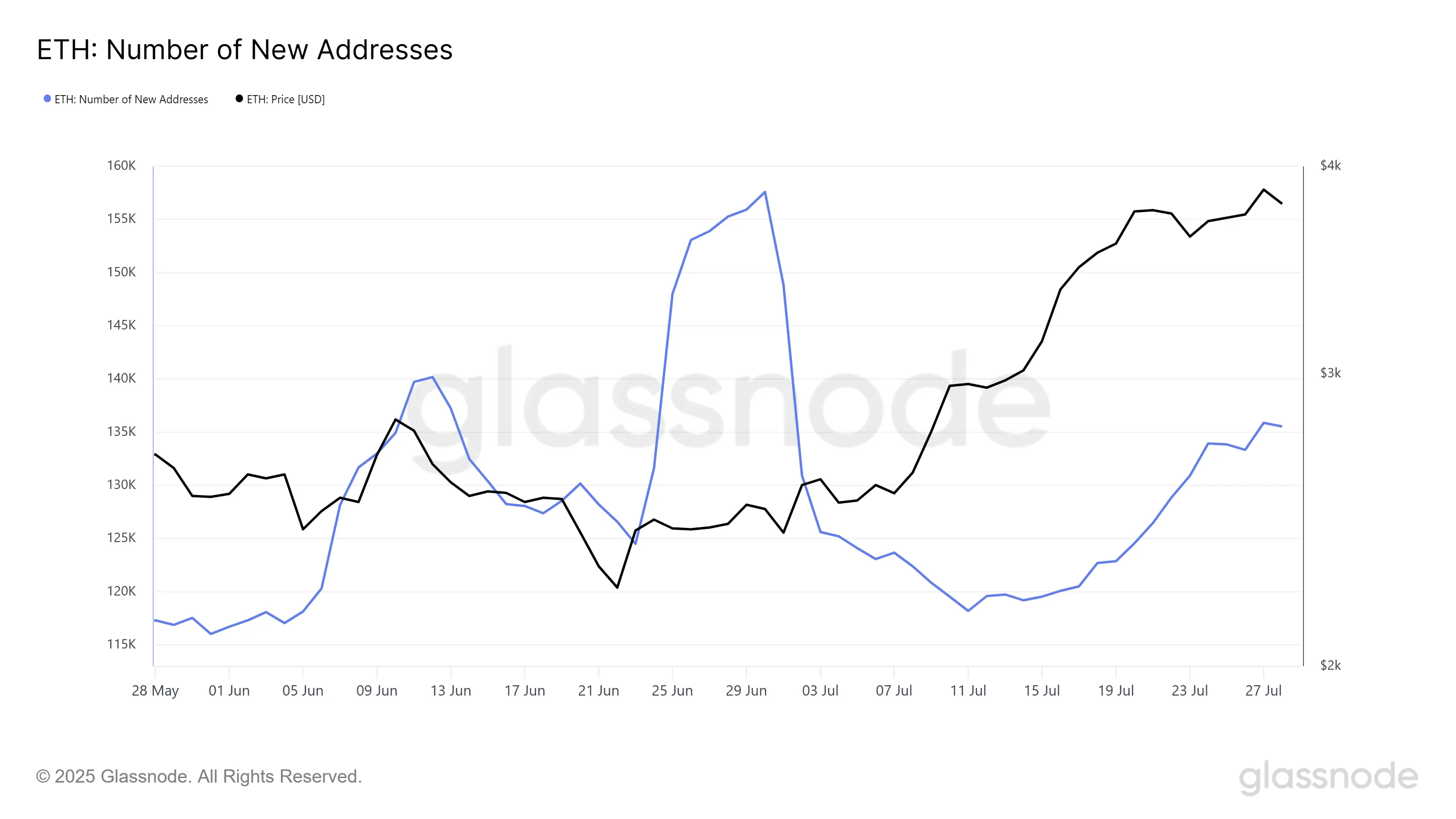

Ethereum’s macro momentum has seen a blended pattern, with new tackle exercise being a focus. Earlier this month, the variety of new addresses spiked however then sharply declined. Nevertheless, latest knowledge exhibits a 13% enhance in new addresses during the last 10 days, rising from 119,184 to 135,532.

If this development in new addresses continues, it may counter the affect of the market high, offering Ethereum with assist to maintain its worth features. New traders may assist strengthen the demand for Ethereum, lowering the chance of a market pullback.

ETH Worth Wants A Push

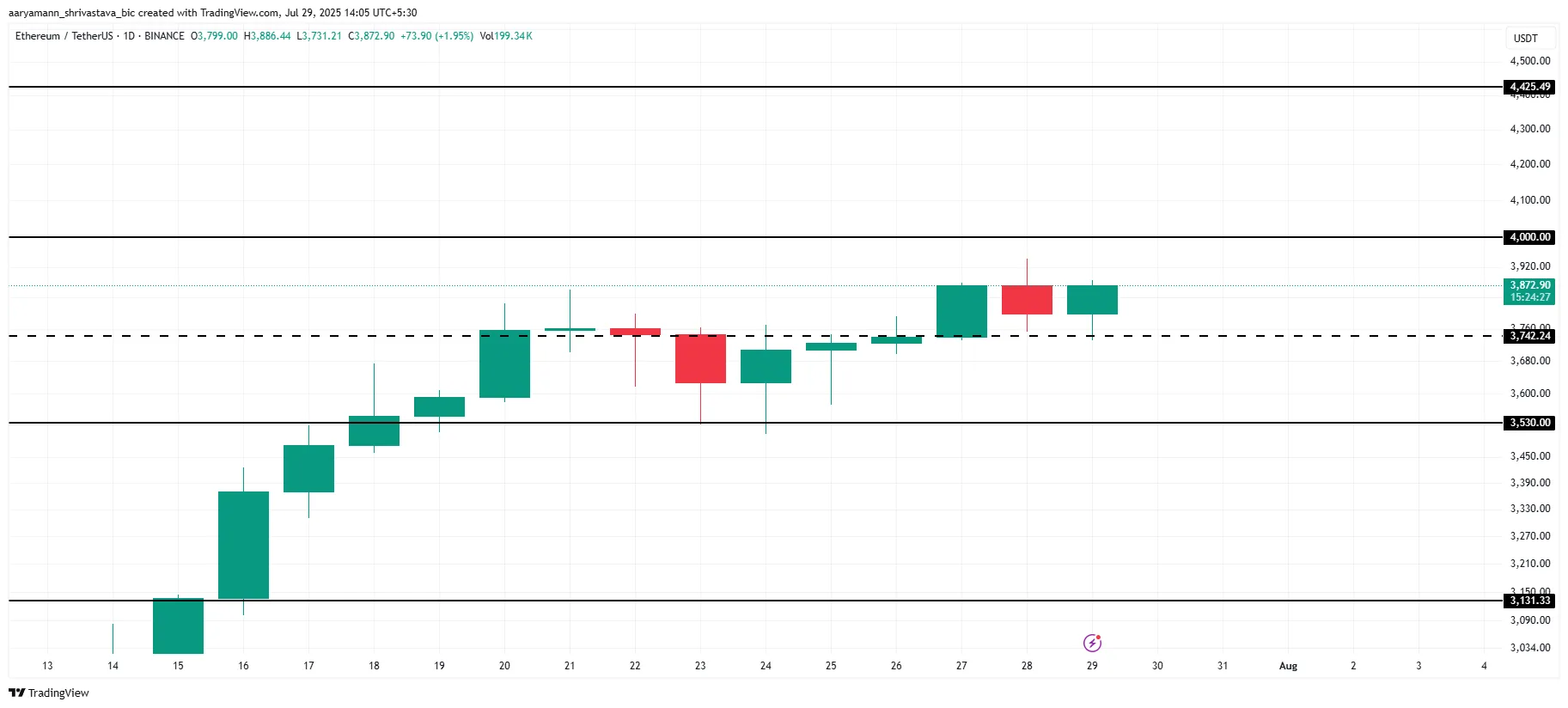

Ethereum’s present worth stands at $3,872, holding above its native assist degree of $3,742. Whereas ETH is approaching the $4,000 mark, it has not but managed to breach it. This resistance may proceed to carry, limiting Ethereum’s instant potential for additional features.

If the market high indicators a reversal, Ethereum’s worth may drop to $3,530 or decrease. A pointy decline to $3,131 can be a chance, erasing a lot of the latest features made prior to now month. Such a transfer would invalidate the bullish sentiment that has pushed Ethereum’s development.

However, if the inflow of recent addresses continues and strengthens, Ethereum might lastly break via the $4,000 resistance. Ought to this occur, ETH may rise in the direction of $4,425, with a renewed surge in worth. This might invalidate the bearish thesis and push Ethereum into a brand new bullish part.

Disclaimer

According to the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.