Key Takeaways

- A dovish rate of interest by the Fed may spark robust bullish worth motion for Bitcoin and altcoins.

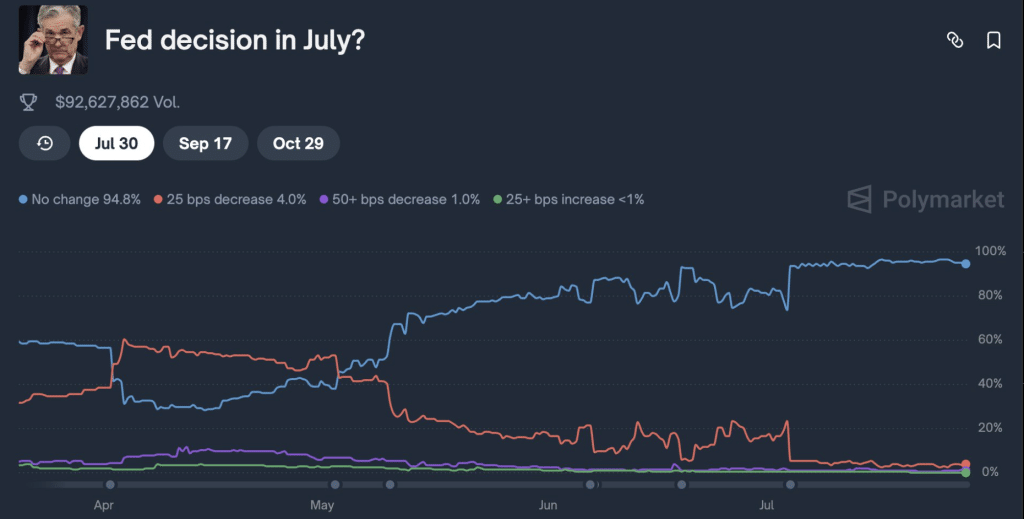

- Crypto consultants and Customers share the expectation of the FOMC on Polymarket with 95% unchanged charges.

- The value of Bitcoin trades round $118,000 as crypto merchants and buyers patiently await FOMC outcomes.

Forward of the Federal Open Market Committee (FOMC) scheduled for July 29-30, the monetary market, together with cryptocurrency, has been confronted with market uncertainties relating to a possible rate of interest lower as merchants and buyers stay cautious forward of its outcome.

This week’s assembly comes in the back of intense stress from U.S. President Donald Trump urging Fed Chair Jerome Powell to chop the rate of interest, which was adopted by a tour of the U.S. Federal Reserve, and sustaining his stance that he believes Powell will lower the rate of interest.

Market uncertainties forward of the FOMC have led to crypto property, together with Bitcoin and Ethereum, buying and selling round $118,400 and $3,830, respectively, as of the time of writing, forward of market hypothesis and the potential impression of this rate of interest lower on crypto property.

Crypto Market Expectation and Knowledgeable Predictions

FOMC Predictions – Supply Polymarket

Forward of the FOMC outcome on July 30, Polymarket customers predict the Fed determination in July may have no change in rate of interest lower, with roughly 95% of customers predicting no change and 5% predicting an rate of interest lower when the FOMC outcome comes out.

Whereas the crypto market continues to take a position on a possible rate of interest lower, there’s a catch if the rate of interest have been to be lowered, primarily based on crypto consultants’ hypothesis and the way the market has responded up to now.

In accordance with crypto dealer Misterrcrypto, a dovish tone and no fee lower by Powell may sign bullish worth motion for the crypto market, together with the worth of altcoins breaking out from their worth vary in the previous couple of days forward of the FOMC outcome.

Listed below are some instances that would have an effect on the crypto market forward of the FOMC outcome on July 30.

Case 1 – Charges Unchanged, Dovish Tone

If the Fed decides to maintain the rate of interest unchanged, or lower the speed (Dovish outlook).

Crypto Market Response: Bullish market response for Bitcoin and altcoins with robust potential to interrupt to the upside and potential new highs for different crypto property.

For instance, throughout COVID-19, the Fed lower the rate of interest, resulting in one of many largest crypto rallies resulting from big liquidity presence as the worth of Bitcoin rallied from a area of $4,000 to $69,000 and altcoins hit over 1,000X within the crypto bull market of 2020.

Case 2 – Charges Hike or Sign Charge Hike (Hawkish Tone)

The Fed’s fee hike or a possible future fee hike may sign persistent inflation.

Crypto Market Response: This might sign bearish market sentiment and a possible withdrawal by establishments from crypto into safer and fewer dangerous funding property. This was seen within the 2022 Fed hawkish transfer, resulting in the worth of Bitcoin crashing to decrease areas of $20,000.

Case 3 – Feds Maintain Charge however Stay Impartial/Combine Tone

If the Feds pause or give an unclear message round future insurance policies, the crypto market may expertise short-term volatility and sideways motion, so long as there aren’t any clear instructions on the charges.

Though the present market worth motion lacks quantity forward of the FOMC outcome popping out quickly. A good outcome may see the worth of Bitcoin rally to potential new highs.

Bitcoin Technical Evaluation – Value Holds Regular Forward of FOMC

Bitcoin Value Evaluation – Supply TradingView

The value of BTC has remained in a spread for over 10 days since hitting all-time highs of $123,000, as the worth trades in a spread round $115,500 to $118,600 forward of the FOMC. A dovish outcome may see the worth breakout above $120,000, probably aiming for brand spanking new highs forward of its month-to-month shut.

Total market sentiment for bitcoin and altcoins stays bullish following a robust market response in July, as the worth is predicted to construct on present worth motion heading into August.

Associated Learn

PUMP Token Crashes as Crypto Merchants Remorse ICO Participation

Ethereum Outperforms Bitcoin – Market Expectations From Crypto Consultants

Pump.Enjoyable Token – ‘Can It’s Value Recuperate’?