Ethereum (ETH) worth is flirting with the $4,000 stage as soon as once more, rising over 2.5% previously 24 hours and buying and selling close to $3,877. That has reignited hopes of a brand new leg increased and probably a recent all-time excessive.

The setup would possibly really feel acquainted, however the backdrop this time may be very completely different. As July attracts to a detailed, ETH finds itself caught in an internet of converging catalysts: heavy leveraged bets, deep-pocketed ETF inflows, thinning alternate provide, and rising energy versus Bitcoin. And all of it units the stage for a probably explosive August. Fingers crossed!

Leverage Stack is Heavy Beneath: Can ETF Inflows Stabilize the Zone?

In keeping with the newest Bitget ETH/USDT liquidation map, over $5.78 billion in cumulative lengthy leverage is presently stacked between $3,358 and $3,875. With ETH buying and selling proper across the higher finish of this zone, it’s hovering close to a hazard pocket.

A push increased may flip this zone right into a worth launchpad; or, if it slips, it may set off a cascade of liquidations.

What makes this cluster completely different from earlier leverage buildups is the sort of cash backing it.

In July 2025, ETH ETFs (Trade Traded Fund) recorded $5.12 billion in internet inflows, the very best month-to-month tally over the previous 12 months, in greenback phrases. This isn’t simply retail. It’s institutional firepower piling in, exhibiting up each in spot allocations and, clearly, in derivatives.

That conviction is what provides bulls some respiration room in what would in any other case be a high-risk leverage lure. There isn’t any good purpose to consider that the July ETF fever received’t trickle right down to August.

Ought to ETH reclaim $3,900 with momentum, it may set off a pressured quick squeeze, particularly with $1 billion+ briefly positions ready to be taken out. Sure, even quick positions are appreciable.

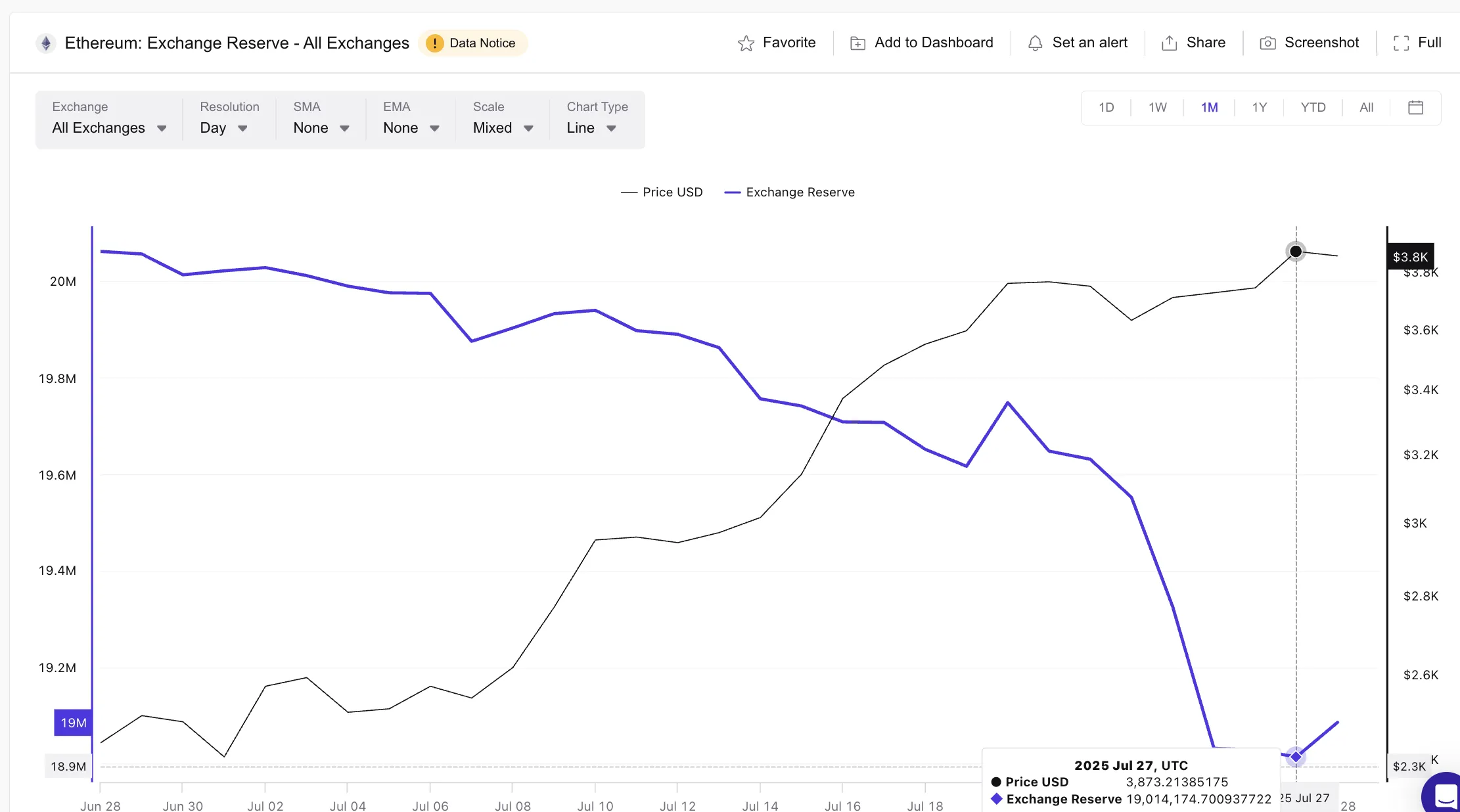

Trade Reserves Add One other Bullish Layer

Including to the bullish narrative is the low alternate reserve information. Regardless of ETH gaining over 57% from final month’s lows, alternate holdings haven’t elevated. In reality, month-to-month alternate reserves are at their second-lowest level in over a 12 months.

This isn’t nearly low provide. What’s extra hanging is that regardless of massive wallets promoting, reserves haven’t spiked.

This implies provide absorption, the place retail and institutional demand are absorbing the sell-side stress.

When ETF cash is getting into and alternate reserves are shrinking throughout a worth rise, the takeaway is easy: conviction is powerful, and sellers are being outpaced.

ETH/BTC Ratio Surges; Altseason within the Air?

Zooming out, the ETH/BTC ratio is telling its personal bullish story. The pair has climbed to 0.032, up practically 40% from June’s lows, and now sits on the brink of finishing a uncommon sequence of golden crossovers throughout the 20D, 50D, 100D, and 200D EMAs (Exponential transferring averages).

Just one transfer stays: the 50-day EMA (orange) overtaking the 200-day (blue). As soon as that occurs, it might verify a full-fledged bullish construction; the identical variety that traditionally precedes prolonged altcoin runs.

Given the context: robust ETF inflows, thinning alternate reserves, and lengthy leverage stacks — this crossover wouldn’t simply be symbolic. It may very well be the technical validation bulls want to increase momentum deeper into August.

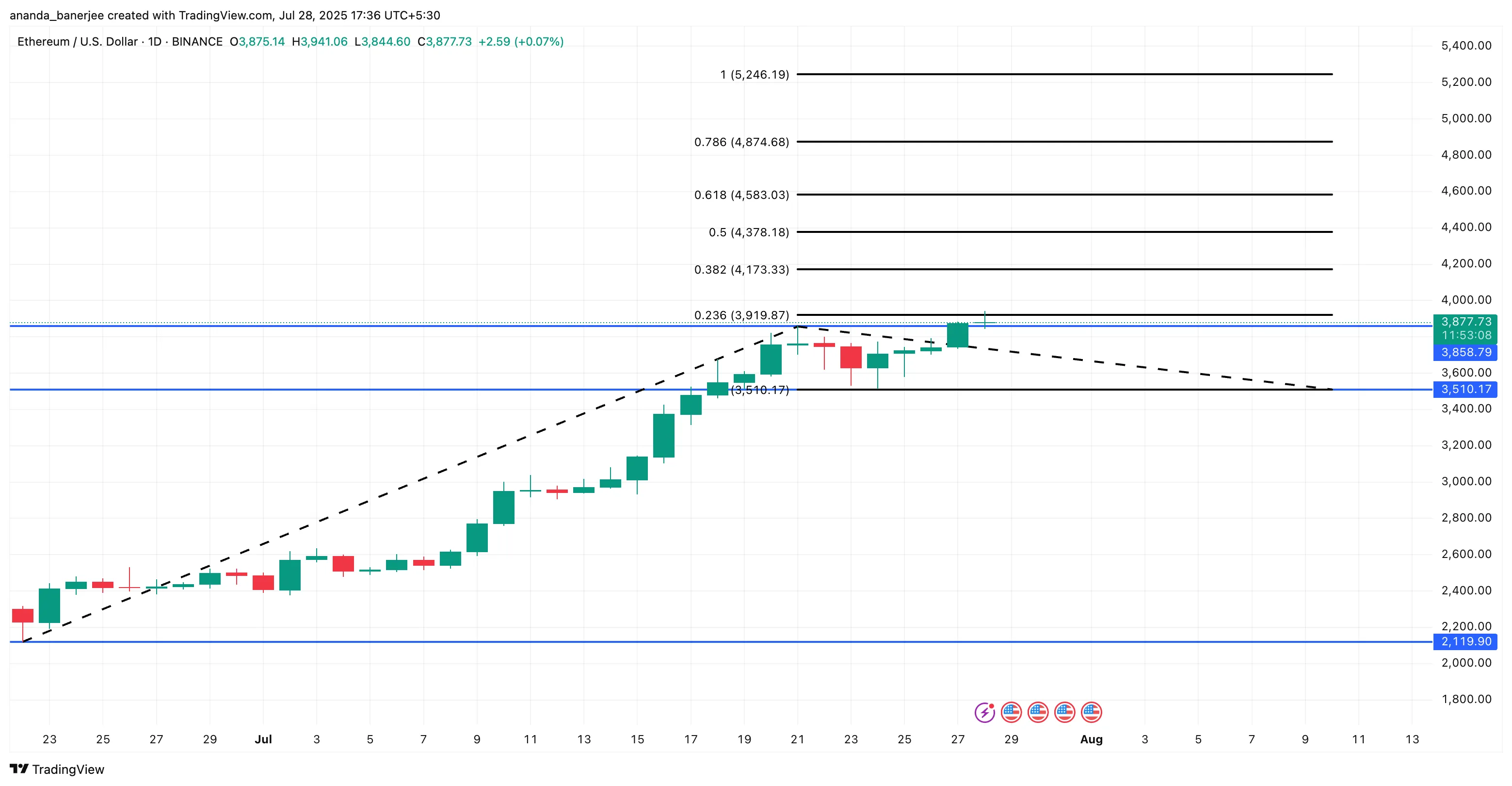

Ethereum Worth Motion: Key Resistance Defines the Battle Zone

With Ethereum’s outperformance towards Bitcoin gaining traction, that energy might quickly spill over into ETH/USD worth motion. The ETH/BTC ratio has traditionally acted as a lead indicator for USD breakouts, and with a golden crossover practically full, ETH’s momentum seems to be able to shift gear

ETH is now urgent towards the 0.236 Fibonacci extension stage at $3,919. A clear break and day by day shut above this might ignite upside momentum, with targets at:

- $4,173 (0.382 Fib)

- $4,378 (0.5 Fib)

- $4,583 (0.618 Fib)

- $4,874 (0.786 Fib)

A transfer above $4,874 would prime the Ethereum worth for a brand new all-time excessive (ATH). And with ETH doing a 55% rally in July alone, the “ATH” likelihood seems to be more and more attainable.

Nonetheless, a failure to carry above $3,919 would stall the rally, leaving ETH susceptible to a retest of assist round $3,510; the trendline invalidation stage. That’s the road bulls have to defend to keep away from re-entering a broader consolidation vary. And bear in mind, worth drips can set off the liquidation ranges that have been mentioned earlier.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Disclaimer

In step with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.