Altcoin/ETH buying and selling pairs can supply merchants alternatives to earn twin income. They will enhance their ETH holdings and await ETH’s value to rise, thereby attaining double returns.

Nonetheless, this technique isn’t simple. Figuring out when capital will circulation into altcoin/ETH pairs is probably the most troublesome half. Under are some notable insights from market analysts.

Indicators That Capital Might Quickly Move into Altcoins

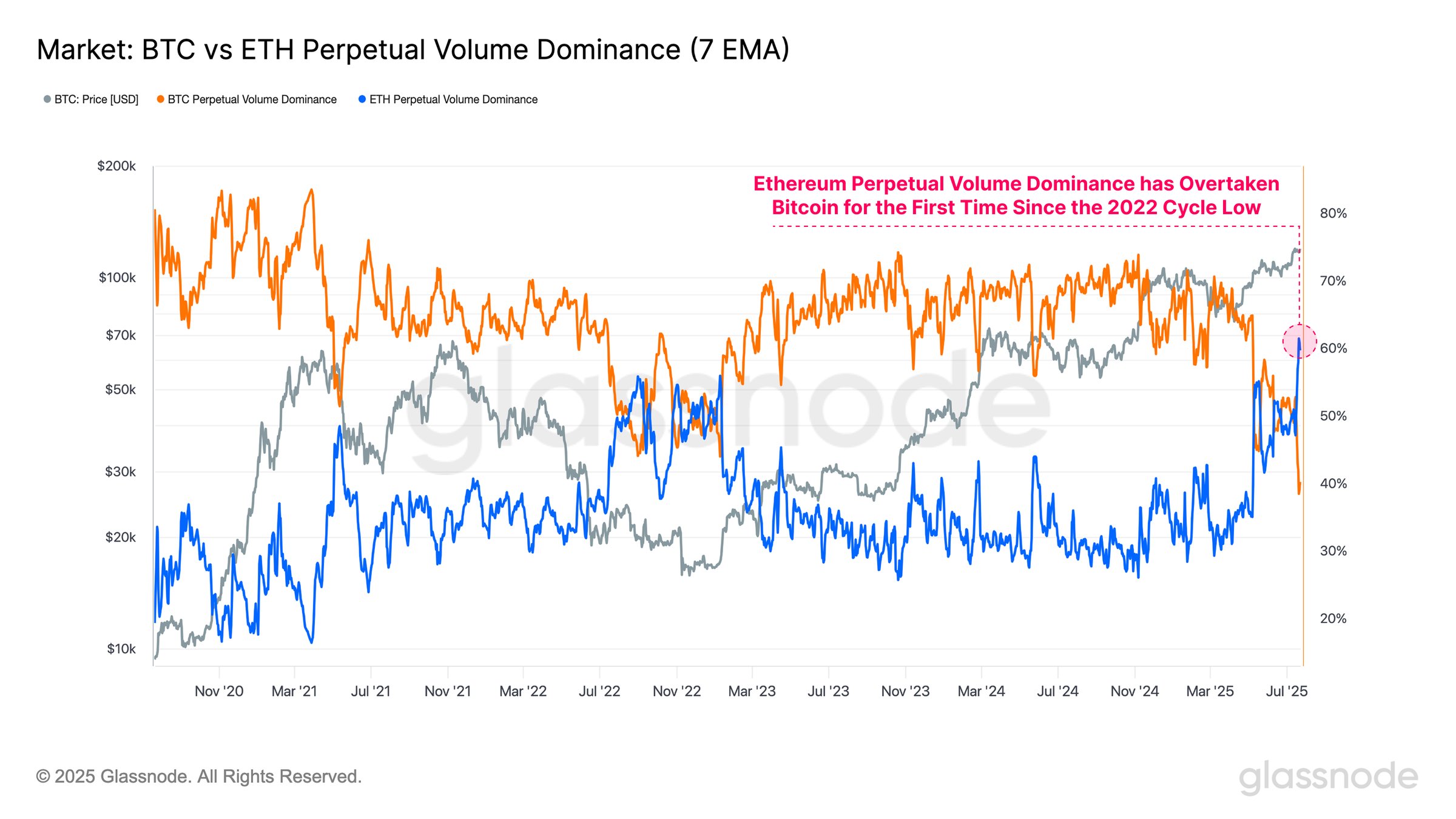

Ethereum’s perpetual quantity dominance just lately surpassed Bitcoin’s for the primary time because the cycle low in 2022. This marks the most important recorded quantity skew in favor of ETH.

ETH accounted for greater than 60% of perpetual quantity by the top of July. This means that merchants are actually buying and selling ETH extra actively than BTC.

In response to Glassnode, this shift additionally factors to a rising speculative curiosity within the altcoin sector.

“This shift confirms a significant rotation of speculative curiosity towards the altcoin sector,” Glassnode reported.

Glassnode’s view aligns with the latest opinions of a number of market analysts. They imagine the market is at the moment in Part 2 (capital flowing into ETH) and is getting ready to enter Part 3 (capital transferring into different altcoins).

When Ought to Traders Pay Consideration to Altcoin/ETH?

When traders purchase ETH and await income, they search for alternatives in underperforming Altcoin/ETH pairs as an alternative of merely holding ETH.

The primary concern is that these pairs include double danger. The primary is a drop in ETH’s value. The second is a sell-off within the altcoin/ETH pair, which might result in double losses. Nonetheless, with correct timing, traders can earn double features from each side.

By observing the efficiency of altcoin market cap (TOTAL3 – excluding BTC and ETH) relative to ETH, well-known market analyst Benjamin Cowen famous that Altcoin/ETH pairs have dropped a mean of 40% because the 2025 peak.

He predicted additional declines so long as ETH’s rally continues.

Analyst Colin Talks Crypto shared an analogous view however believes {that a} reversal will come finally.

“It’s ETH Season. ETH could outperform decrease ALTS for some time but. If I have been to take a guess, I’d say the trail will go one thing like this, right down to the decrease pattern line. When this line drops it means ALTs lose worth comparatively to ETH. Solely within the very ultimate stage of the bull run do ALTs carry out higher than each ETH and BTC,” Colin Talks Crypto predicted.

This evaluation means that the golden time to commerce Altcoin/ETH pairs might fall within the yr’s ultimate quarter. Nonetheless, alongside the best way, there could also be short-term recoveries in these pairs. A number of different analysts agree with this view.

Analyst Rekt Fencer additionally relied on the above chart and provided a extra particular state of affairs: when ETH reaches $7,000–$8,000, rotate into Altcoin/ETH pairs to maximise returns.

Nonetheless, by monitoring the ratio of the OTHERS market cap (excluding the highest 10) to ETH, one would possibly spot earlier indicators.

This ratio has risen from 0.21 to 0.27 over the previous month, indicating that altcoins exterior the highest 10 are starting to outperform ETH. This displays investor sentiment shifting towards mid-cap and low-cap alternatives.

The publish Analysts Predict the Subsequent Wave of Capital Move Into Altcoin/ETH Pairs appeared first on BeInCrypto.