As curiosity within the crypto market continues to develop, knowledge from Google Traits that altcoin-related search quantity is on the verge of a significant breakout. For buyers trying to keep forward of the curve, now might be a strategic time to discover a few of the greatest altcoins to purchase earlier than mainstream momentum kicks in.

Whereas costs throughout many tokens stay within the pink, seasoned buyers typically make the most of these quieter intervals to construct positions in each established property like Ethereum and Solana, and in high-potential, lesser-known tasks which will thrive in the course of the subsequent bull run.

Crypto Skilled’s Prime Altcoin to Purchase as Institutional Curiosity in Crypto Expands

Bitwise CIO Matt Hougan, in an interview on The Wolf of All Streets, shared that conventional finance corporations at the moment are shifting past Bitcoin in quest of increased returns. After making substantial features from Bitcoin ETFs, these corporations are shifting their consideration to Ethereum, Solana, and crypto treasury firms.

Hougan describes this development as the start of “altseason” in TradFi, noting that it’s nonetheless in its early phases however anticipated to achieve momentum within the coming months.

Listed here are the highest altcoins to purchase now, as highlighted by ClayBro on his YouTube channel. His video can also be out there to view beneath, providing insights into why these picks may carry out properly within the present market.

Ethereum (ETH)

On the time of writing, Ethereum is buying and selling round $3,781, down 2% over the previous 24 hours. Regardless of the dip, sentiment stays optimistic as analysts anticipate a possible breakout.

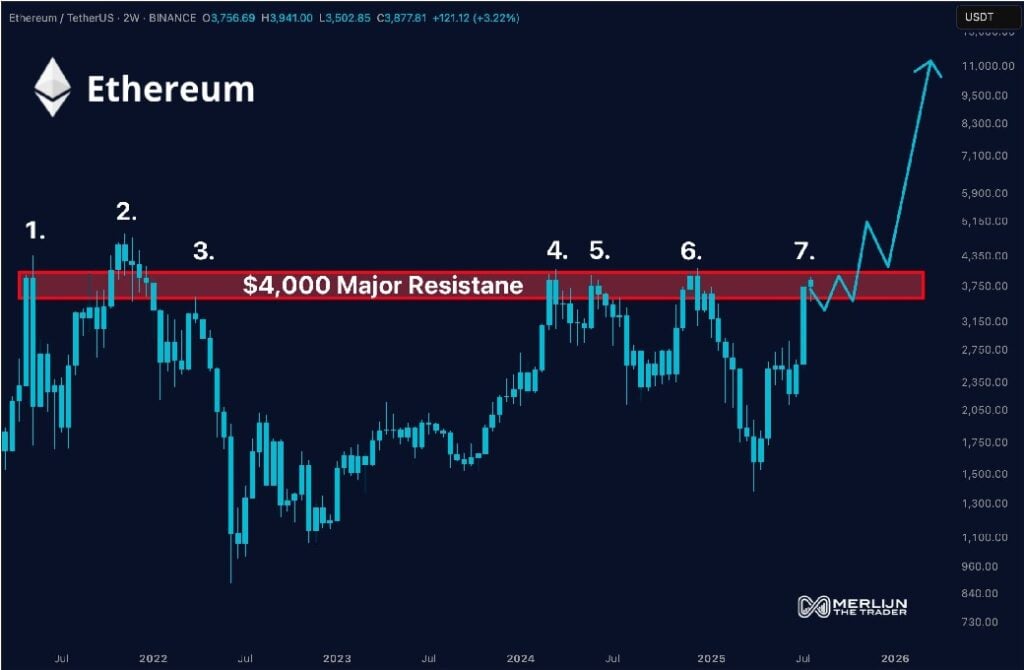

Merlijn The Dealer on X highlighted that the $4,000 degree for Ethereum represents a significant long-term resistance and referred to it because the “last boss.” This worth ceiling has held agency since 2021, with $ETH going through rejection at this degree seven instances.

Supply – Merlijn The Dealer by way of X

In line with Merlijn, $4,000 is not only one other resistance level however the gateway to cost discovery. He emphasised that Ethereum is now testing this barrier extra aggressively than ever earlier than.

An information from Lookonchain, institutional demand for Ethereum continues to rise, with a newly created pockets receiving 12,000 $ETH (price $45 million) from Galaxy Digital’s OTC pockets. Since July 9, 9 recent wallets have collectively amassed 640,646 $ETH valued at round $2.43 billion.

Analysts imagine this accumulation displays long-term staking methods and rising anticipation surrounding spot Ethereum ETFs, highlighting growing institutional confidence in Ethereum’s future and its increasing presence within the digital asset house.

Cardano (ADA)

Cardano has declined by 10% over the previous week, slipping from $0.86 to $0.77. Analysts imagine this dip is probably going pushed by profit-taking somewhat than unfavorable developments.

Regardless of the short-term pullback, Cardano founder Charles Hoskinson stays assured within the token’s potential. In a current interview with Blockworks, he projected that $ADA may rise 100x to 1000x, doubtlessly reaching between $80 and $800 if it turns into the “yield layer of Bitcoin DeFi.”

Hoskinson argued that $ADA presents stronger upside potential than Bitcoin, highlighting the added advantages of yield and ecosystem rewards for holders.

At current, $ADA is going through resistance at $0.93. A breakout above this degree may drive the worth towards $1, whereas dropping assist at $0.67 might result in a drop towards $0.60 and even $0.50.

Solana (SOL)

Solana’s current worth actions seem strongly influenced by institutional curiosity and key technical indicators. A sustained breakout above the $200 resistance degree, lengthy watched by merchants, may open the door for a transfer towards $300.

Recent inflows following the ETF launch have added momentum, with BlockchainReporter highlighting that the REX-Osprey ETF’s rising publicity might assist Solana regain the $200 mark and push to new highs within the coming months.

Including to the bullish sentiment, analyst Ali Martinez identified that the Tom DeMark Sequential indicator suggests now could also be a great time to “purchase the dip” in $SOL.

Broader market indicators are additionally favorable. The entire worth locked (TVL) in Solana’s DeFi ecosystem not too long ago exceeded $10 billion, a milestone some analysts hyperlink to stronger worth stability.

Nevertheless, volatility persists. If Solana fails to decisively clear the $190 degree, a retracement towards $170 or decrease stays attainable. Nonetheless, with sturdy technical alignment, institutional momentum, and rising ETF publicity, the general outlook stays constructive.

Finest Pockets (BEST)

Finest Pockets is rising as a standout possibility amongst altcoin-related investments, significantly as curiosity in crypto wallets surges alongside rising altcoin search volumes.

Positioned as greater than only a storage resolution, Finest Pockets is being actively amassed forward of the anticipated bull run as a consequence of its user-friendly interface, accessibility, and utility.

As retail buyers more and more look to enter the crypto house, wallets like this are anticipated to see increased adoption, particularly as newcomers understand the need of safe, practical platforms for token administration.

This pockets permits customers to buy tokens immediately utilizing both crypto or a financial institution card, providing comfort for each seasoned buyers and first-time patrons. The setup course of is simple: join the pockets, scan a QR code, choose the funding quantity, and the tokens are allotted for launch day.

Customers are inspired to discover the app by searching its options, interface, and value to see how properly it aligns with their preferences and targets. With altcoin curiosity rising quickly, wallets with sturdy infrastructure and sensible options stand to profit.

Finest Pockets’s early traction displays this dynamic, providing not simply speculative alternative, but in addition real-world performance. Those that act earlier than the broader market catches on could also be higher positioned to capitalize on the features anticipated within the last months of the yr.

As previous crypto cycles have proven, ready till momentum peaks typically means lacking out – making early accumulation of instruments like Finest Pockets a strategic transfer in immediately’s evolving market.

Go to Finest Pockets

This text has been offered by considered one of our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please remember our industrial companions might use affiliate applications to generate revenues by means of the hyperlinks on this text.