Bitcoin stays trapped in a good consolidation vary that started over two weeks in the past, fueling expectations of an imminent breakout or breakdown. The dearth of decisive motion has created a state of market indecision, with neither bulls nor bears taking full management. Value continues to hover between key help and resistance ranges, displaying no sturdy indicators of accumulation or distribution.

Associated Studying

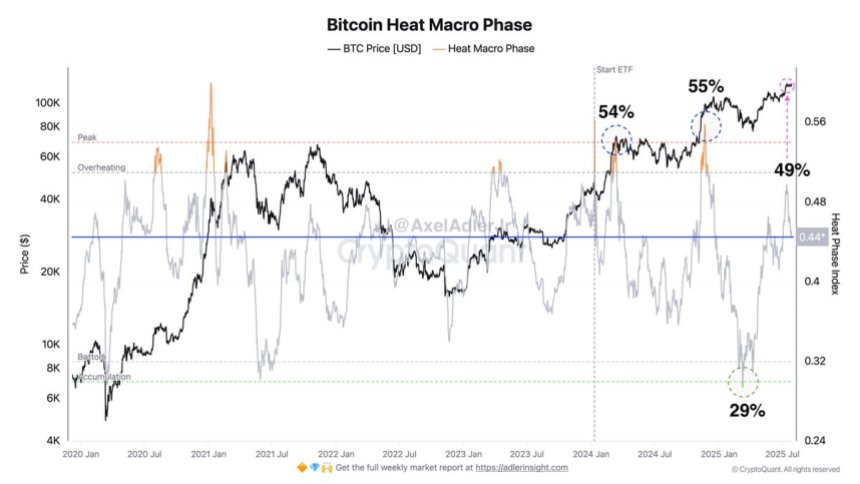

In line with new information from CryptoQuant, the Bitcoin Warmth Macro Part—a metric that displays the general temperature of the market—presently sits at a impartial degree. This means that market situations are balanced, with no clear dominance from patrons or sellers. Revenue-taking stays reasonable, ETF inflows have slowed, and long-term holder exercise is secure, all of which help the view that the market is in a wait-and-see mode.

The present construction suggests {that a} main transfer is probably going approaching. With volatility compressed and the market treading water, merchants and traders are carefully looking forward to a sign that may outline the subsequent leg. Whether or not Bitcoin breaks out towards new highs or rolls over right into a correction, the approaching days can be essential in shaping the short-term development and broader sentiment throughout the crypto panorama.

Bitcoin Warmth Macro Part Indicators Impartial Market

High analyst Axel Adler just lately shared insights into the Bitcoin Warmth Macro Part—a metric that condenses a number of key market indicators right into a single scalar worth, providing a simplified but highly effective view of the place Bitcoin stands in its broader macro cycle. The metric combines information factors similar to overvaluation assessments, profit-taking exercise, long-term holder (LTH) promoting strain, and ETF inflows to gauge whether or not the market is overheated or coming into a good accumulation zone.

When the Warmth Macro Part reaches excessive values close to 50%, it sometimes alerts that these elements are at their higher historic bounds—suggesting an overheated market that could be nearing a distribution section or a correction. Conversely, readings nearer to 30% mirror cooler market situations: decrease profit-taking, modest ETF exercise, and minimal LTH promoting. These situations typically point out that the market is undervalued and ripe for accumulation.

At present, the Bitcoin Warmth Macro Part sits at 44%, placing it squarely within the impartial zone. Adler explains that this degree displays a balanced market surroundings—neither overbought nor undervalued. There’s no clear dominance by bulls or bears. Revenue-taking is starting to speed up, nevertheless it hasn’t reached a degree that will recommend a broader exit is underway.

This mid-range studying aligns with Bitcoin’s current worth motion, which has remained in a good consolidation for over two weeks. Because the metric hovers in impartial territory, it reinforces the concept that the subsequent vital transfer—whether or not upward towards new highs or downward in a correction—will rely totally on upcoming worth conduct. For now, the Bitcoin Warmth Macro Part acts as a market barometer, signaling endurance as traders watch for the subsequent breakout or breakdown to substantiate route.

Associated Studying

BTC Value Motion Particulars: Tight Consolidation

Bitcoin continues to consolidate between well-defined help and resistance ranges, presently buying and selling at $118,269.81 on the 12-hour chart. The worth motion has remained confined inside a horizontal vary, with higher resistance at $122,077 and robust help at $115,724. This vary has continued for over two weeks, reflecting a section of indecision the place neither bulls nor bears have asserted dominance.

The 50, 100, and 200 SMAs—situated at $116,342, $111,334, and $106,668, respectively—are all trending upward, suggesting that the broader construction stays bullish. BTC is presently buying and selling above all key shifting averages, that are appearing as dynamic help. Nonetheless, quantity has decreased considerably, indicating a scarcity of conviction from either side of the market.

Associated Studying

The tightening construction suggests {that a} breakout is approaching. If patrons handle to push BTC above $122K with sturdy quantity, the subsequent leg greater towards new all-time highs might observe. Then again, a breakdown under $115K would invalidate the present setup and open the door to a deeper correction.

Featured picture from Dall-E, chart from TradingView