America (US) Federal Reserve (Fed) will announce its rate of interest choice and publish the coverage assertion following the July coverage assembly on Wednesday.

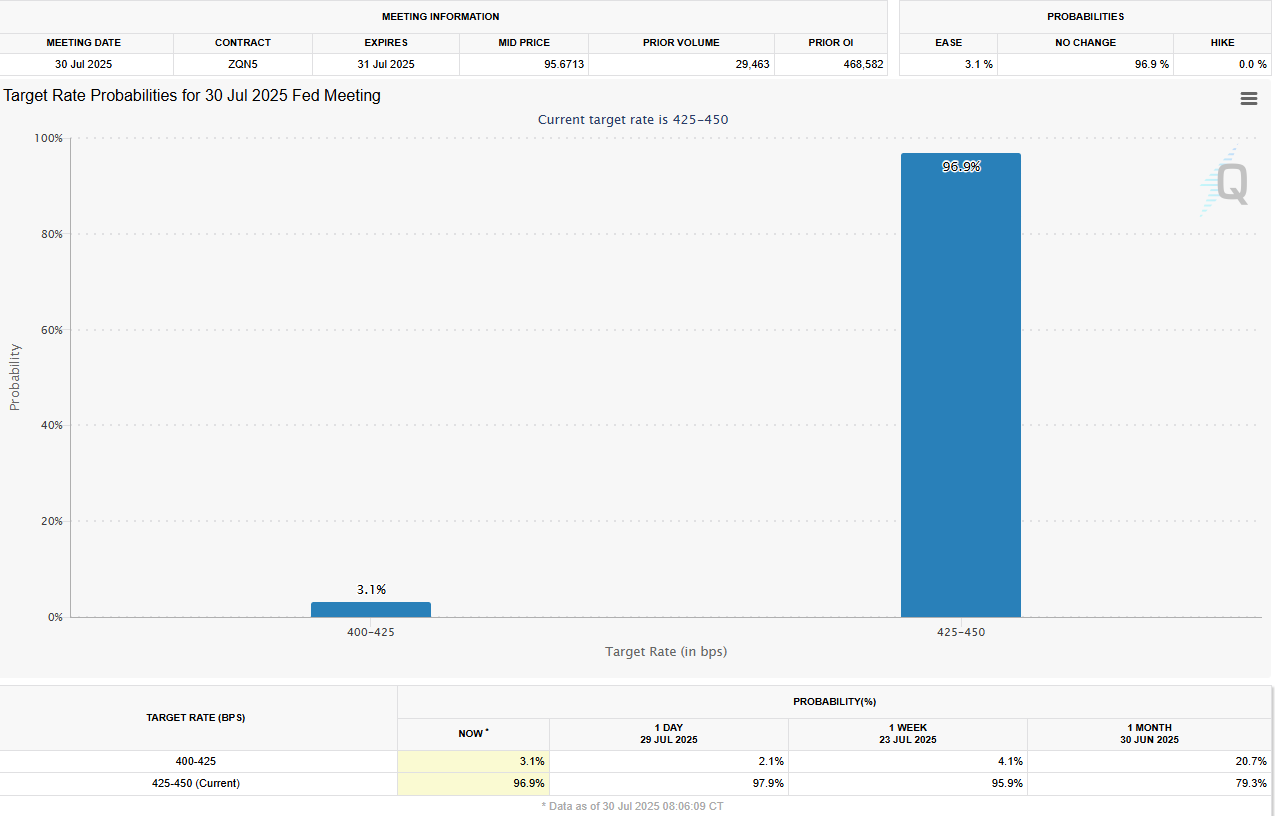

Market individuals extensively anticipate the US central financial institution will depart coverage settings unchanged for the fifth consecutive assembly after reducing the rate of interest by 25 foundation factors (bps) to the 4.25%-4.50% vary final December.

No Price Reduce in Sight from the Feds?

The CME FedWatch Device exhibits that traders nearly see no probability of a charge reduce in July, whereas pricing in a few 64% chance of a 25 bps discount in September. This market positioning means that the US Greenback faces a two-way danger heading into the occasion.

The revised Abstract of Financial Projections (SEP), printed in June, confirmed that policymakers’ projections implied 50 bps of charge cuts in 2025, adopted by a 25 bps discount in each 2026 and 2027.

Seven of 19 Fed officers pencilled in no cuts in 2025, two noticed one reduce, eight projected two, and two forecast three cuts this yr.

Following the June assembly, Fed Governor Christopher Waller voiced his help for a July charge reduce in his public appearances, arguing that they need to not wait till the labor market is in hassle earlier than easing the coverage.

Equally, Fed Governor Michelle Bowman mentioned that she is open to reducing charges as quickly as July since inflation pressures stay contained.

In the meantime, President Donald Trump prolonged his makes an attempt to stress the US central financial institution into reducing rates of interest in July.

Whereas addressing reporters alongside British Prime Minister Keir Starmer on Monday, Trump reiterated that the US financial system could possibly be doing higher if the Fed have been to chop charges.

“The FOMC is once more extensively anticipated to maintain its coverage stance unchanged subsequent week, with the Committee sustaining charges at 4.25%-4.50%,” famous analysts at TD Securities. “We anticipate Powell to repeat his affected person, data-dependent coverage stance whereas sustaining flexibility across the Committee’s subsequent transfer in September. We consider two dissents, from Governors Bowman and Waller, are doubtless at this assembly.”

When will the Fed announce its rate of interest choice and the way might it have an effect on EUR/USD?

The Fed is scheduled to announce its rate of interest choice and publish the financial coverage assertion on Wednesday at 18:00 GMT. This will probably be adopted by Fed Chair Jerome Powell’s press convention beginning at 18:30 GMT.

In case Powell leaves the door open for a charge reduce in September, citing alleviated uncertainty after the US reached commerce offers with some main companions, such because the European Union and Japan, the USD might come beneath renewed promoting stress with the quick response.

Eren Sengezer, European Session Lead Analyst at FXStreet, supplies a short-term technical outlook for EUR/USD.

“The near-term technical outlook factors to a buildup of bearish momentum. The Relative Energy Index (RSI) indicator on the every day chart stays under 50 and EUR/USD trades under the 50-day Easy Transferring Common (SMA) for the primary time since late February.”

Conversely, the USD might collect power towards its rivals if Powell repeats the necessity for a affected person method to policy-easing, highlighting sticky June inflation readings and comparatively wholesome labor market circumstances.

On this state of affairs, traders might chorus from pricing in a charge reduce in September and wait for brand new inflation and employment information.

“On the draw back, 1.1440 (Fibonacci 23.6% retracement stage of the February-July uptrend) aligns as the subsequent help stage forward of 1.1340 (100-day SMA) and 1.1200 (Fibonacci 38.2% retracement). Wanting north, resistance ranges could possibly be noticed at 1.1700 (20-day SMA), 1.1830 (end-point of the uptrend) and 1.1900 (static stage, spherical stage),” mentioned Sengezer.

The publish Federal Reserve Set to Go away Curiosity Charges Unchanged Amid Financial Uncertainty appeared first on BeInCrypto.