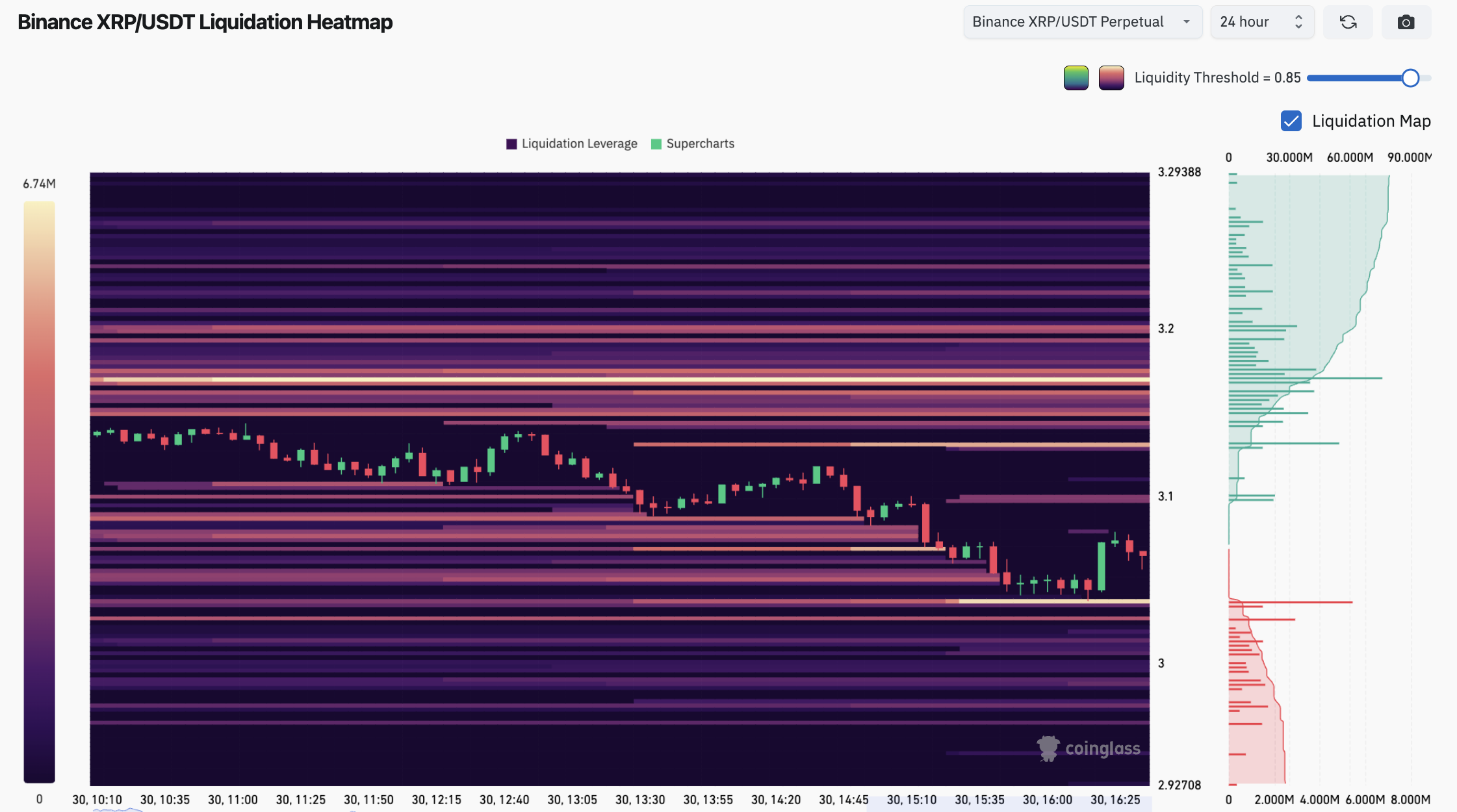

For XRP, the battleground will not be some distant resistance or far-off help; it’s proper right here, within the tight $3-$3.10 pocket, the place almost $30 million in leveraged bets are ready to be liquidated, per CoinGlass. The market calls this the “max ache” zone, and XRP has simply walked straight into it.

Within the final month or so, there have been a great deal of lengthy and quick liquidations on this space. On the one hand, quick positions begin to unravel round $3.13.

Alternatively, quick liquidations kick in at slightly below $3.03. That’s lower than a 3% distinction between the 2 stress factors, which is principally a lure. When the worth goes up or down in such a slim vary, somebody is sure to lose out.

Liquidation heatmaps for Binance’s XRP/USDT pair again this up. Some thick yellow bands displaying high-leverage density stacked round $3.05 to $3.10.

It’s a traditional setup — the type of high-stakes compression that always ends not with a blow however with a pressured transfer triggered by cascading stop-outs. The XRP value has been caught right here for over 48 hours, which means that the stress is constructing, not easing off.

XRP might effectively be subsequent domino to fall

Zoom out to the one-month view and see much more focus. There’s a $3.67 quick liquidation cluster hanging over us, and under $3.00, one other batch of longs begins to look a bit susceptible. This creates a center floor that may be a bit in every single place; there isn’t any clear security, simply dangers that overlap.

The ethical of the story? This isn’t a spread to commerce in casually. With the liquidation thresholds being so tight and the leveraged quantity so excessive, any respectable push from market makers or a sudden inflow of spot quantity might set off a sequence response.

It isn’t about being optimistic or pessimistic anymore. It’s about who can maintain their head above water when issues go unsuitable.