Solana’s rally appears to have cooled off. Regardless of posting over 22% beneficial properties prior to now month, the final seven days have been sluggish. The token has dropped almost 6%, now buying and selling across the $184 mark, properly beneath the latest excessive.

Whereas this may appear to be only a wholesome cooldown, some on-chain and sentiment metrics counsel that the correction may drag on longer than anticipated.

SOPR and Liquidations Trace at Bearish Stress

One of many key indicators of potential additional correction comes from the SOPR, or Spent Output Revenue Ratio. This metric tracks whether or not holders are promoting their tokens at a revenue or loss.

Solana’s SOPR has dropped from 1.04 to almost 1.00 over the previous week, which means wallets which are promoting now are barely breaking even.

In easy phrases, fewer individuals are cashing out in revenue, which normally occurs when confidence begins dipping. This usually indicators market hesitation or early indicators of panic, extra so when the metric drops together with the worth.

Validating this weak point is the liquidation knowledge. Within the 7-day window, quick positions on Solana whole $1.28 billion, in comparison with $924 million in lengthy positions.

Which means merchants are inserting larger bets on Solana’s value falling additional. This quick bias strains up with the SOPR reset and reveals that merchants are now not positioning for upside, at the least within the quick time period.

Bullish Momentum is Shedding Steam

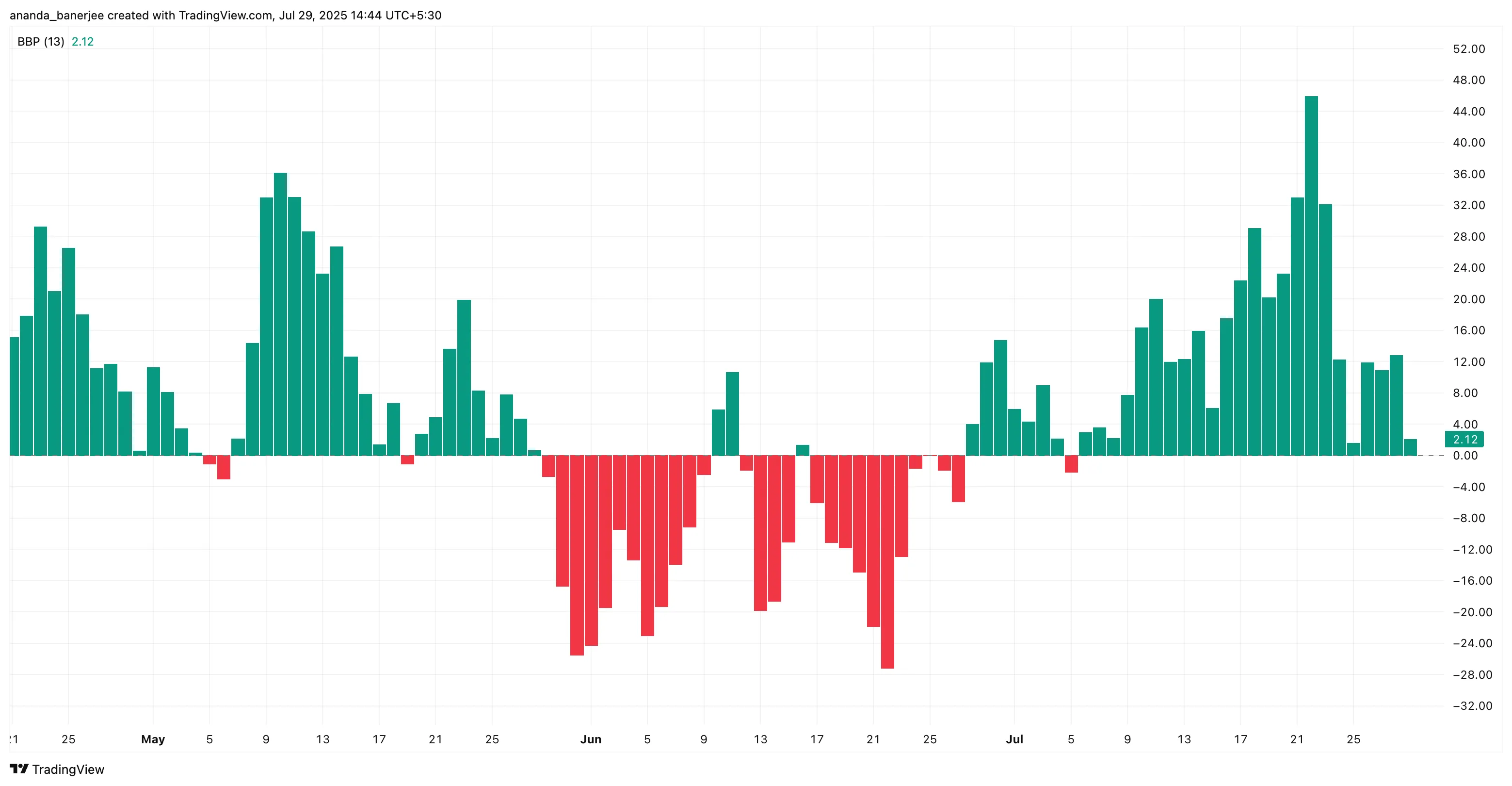

One other crimson flag comes from the Bull-Bear Energy Index. This indicator, which measures the power of consumers versus sellers, has been trending downward. It reveals that consumers are slowly shedding management because the correction deepens.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

A fading bull energy studying means fewer aggressive buys are taking place throughout dips, lowering the prospect of a fast bounce-back.

This sort of cooling off doesn’t essentially imply Solana’s long-term pattern is damaged, but it surely does indicate that bulls are taking a breather.

With no contemporary wave of shopping for curiosity, the worth may keep tender or grind decrease earlier than any significant restoration.

Key Solana Value Ranges to Watch: $175 as Make-or-Break Help

From a value motion standpoint, Solana has pulled again from its native high at $206 and is now hovering round $184. Primarily based on a Fibonacci retracement from the latest $125 low to the $206 excessive, the important thing assist degree to look at is $175. This can be a traditional 38.2% retracement zone, usually seen as the primary “severe” assist in a wholesome uptrend.

If Solana holds this degree, it’d commerce in a spread earlier than attempting one other leg up. Nonetheless, a break previous $187, a key resistance ( a degree the place the SOL costs have been rejected earlier), can shortly flip the short-term bearish narrative bullish.

But when $175 breaks, it may open the door for a deeper correction. That might affirm the bearish indicators flashing from SOPR, liquidations, and weakening bull energy.

Disclaimer

In step with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.