- Twenty One Capital upped its Bitcoin holdings to 43,500 BTC—price about $5.1B.

- The agency’s backed by Tether, Bitfinex, SoftBank, and Cantor Fitzgerald.

- It’s launching via a SPAC merger and can commerce below ticker “XXI”.

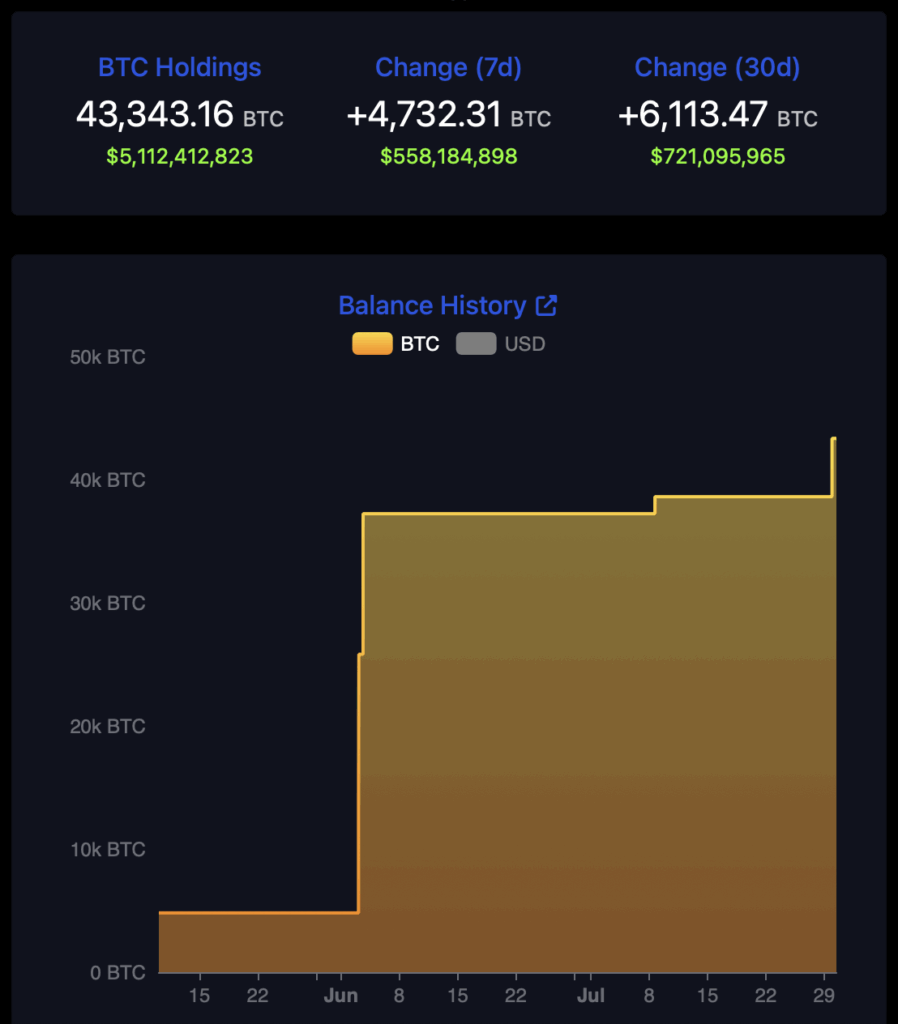

In a transfer that might rattle the company crypto panorama, Twenty One Capital simply beefed up its Bitcoin stash—by so much. The brand new treasury agency stated Tuesday it added roughly 5,800 BTC from Tether, pushing its complete holdings to 43,500 BTC. That’s… nicely, round $5.1 billion primarily based on Bitcoin’s present worth close to $117,500.

That haul makes Twenty One probably the third-largest company Bitcoin holder on the planet. Not dangerous for an organization that hasn’t even began buying and selling but.

The agency’s a joint effort powered by a curious mixture of outdated cash and new: Tether, Bitfinex, Cantor Fitzgerald, and SoftBank are all behind it. It’s aiming to be greater than only a treasury—it’s a Bitcoin-first public firm. “With the companions, capital, staff, and construction we’ve assembled, we really feel like we are able to do something,” stated CEO Jack Mallers. “And we’re simply getting began.”

Buying and selling Quickly, and Buying and selling Huge

Based mostly outta Austin, Texas, Twenty One plans to hit the general public market by way of a SPAC merger with Cantor Fairness Companions. As soon as that goes via, they’ll record below the ticker “XXI.” Till then, Cantor’s placeholder inventory—CEP—has been on a wild journey. It closed down 4.5% Tuesday, however nonetheless sits up 134% over the previous week after phrase of the merger bought out.

When it launches, Twenty One will solely path two company whales in Bitcoin: Technique and MARA Holdings. That’s some heavy firm. The concept is easy: maintain a ton of BTC, let buyers purchase in via the inventory market, and perhaps—simply perhaps—rebuild the worldwide monetary system on prime of it.

As Mallers put it, “We’re not right here to beat the prevailing system, we’re right here to construct a brand new one.” Huge phrases. Huge Bitcoin pockets to again it up.

Wall Avenue Meets Web3

So who’s behind this complete factor, anyway? It’s an fascinating cocktail.

Tether, the issuer of the most-used stablecoin on Earth, clearly brings a large crypto footprint. Bitfinex provides crypto alternate muscle. On the TradFi facet, there’s SoftBank—Japan’s mega investor—and Cantor Fitzgerald, the Wall Avenue powerhouse as soon as helmed by Howard Lutnick, a reputation that pops up in each finance and politics.

Put all of it collectively and also you’ve bought a $3.9 billion Bitcoin machine that’s half hedge fund, half disruptor. It’s another signal that conventional finance isn’t simply flirting with Bitcoin anymore—they’re locking it into their stability sheets and betting on it long run.