After a blistering 300% month-to-month surge, the VINE value is now going through its harshest actuality examine but. The token has declined by over 24% within the final 24 hours, dropping to $0.117, regardless of whales persevering with to build up cash through the dip.

The divergence between whale confidence and retail habits, paired with weakening cash circulate and a fragile technical setup, suggests this rally may not have sufficient gas left to push increased anytime quickly.

Whales Hold Accumulating as Retail Heads for the Exit

On-chain knowledge from Nansen exhibits that the highest 100 addresses added 3.27% extra VINE within the final day, with whale wallets alone rising holdings by 2.22%. Usually, that type of shopping for would trace at rising conviction amongst large gamers. However the image isn’t completely bullish.

Change balances jumped 3.03% in the identical interval, which means retail holders have been sending tokens to centralized exchanges, seemingly making ready to promote into power.

This cut up in habits has left VINE’s order books skewed. Whales are offering some buy-side help, however the lack of broader participation is already beginning to eat into momentum. When retail flows out whereas large wallets attempt to catch falling costs, the market’s footing can rapidly turn into unstable.

Cash Circulation Drains as Bullish Momentum Fades

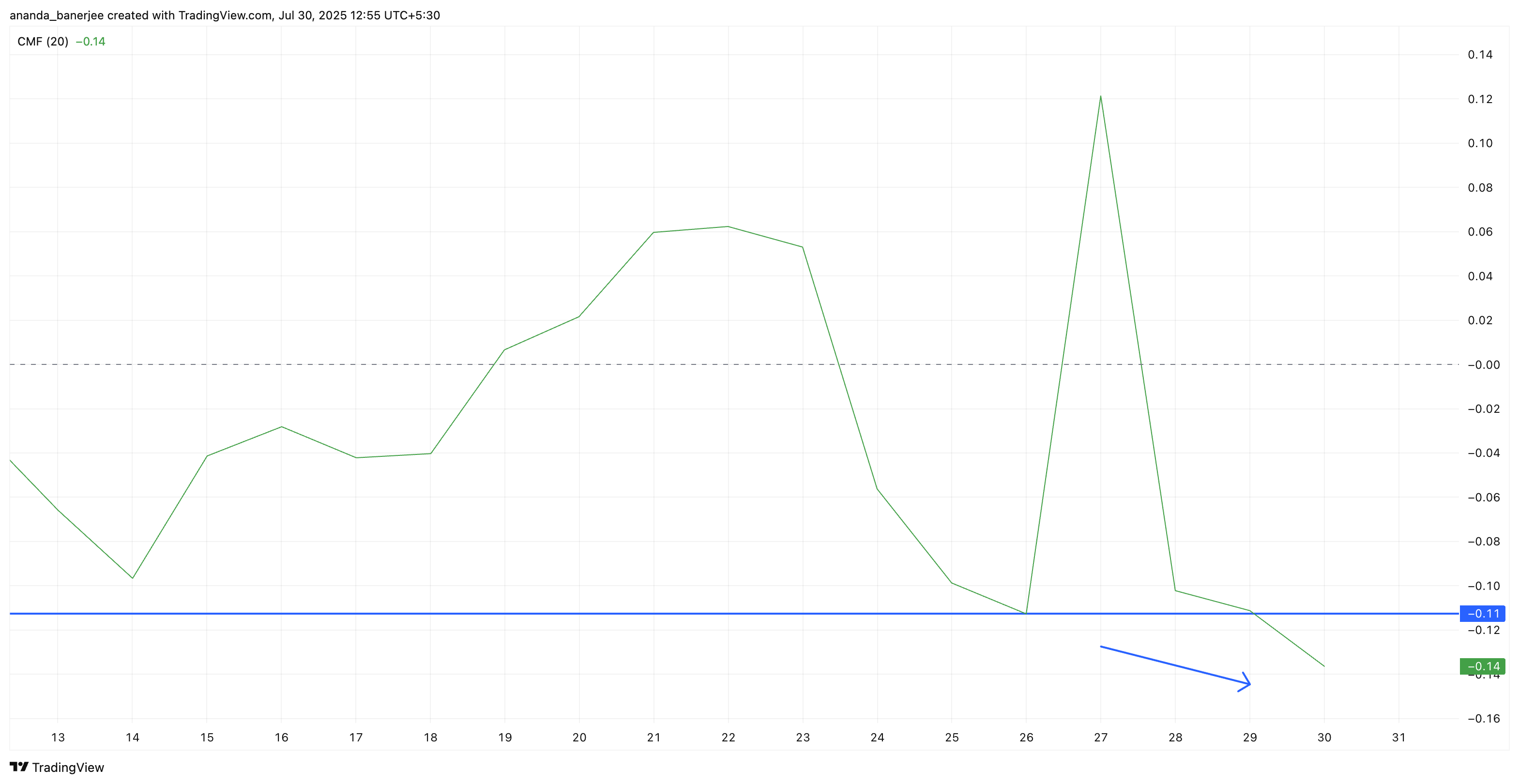

The Chaikin Cash Circulation (CMF), which tracks whether or not capital is getting into or leaving the market, has fallen sharply to -0.14, even decrease than ranges earlier than this month’s VINE value rally started. That alerts a tide of promoting strain outweighing the pockets of whale accumulation.

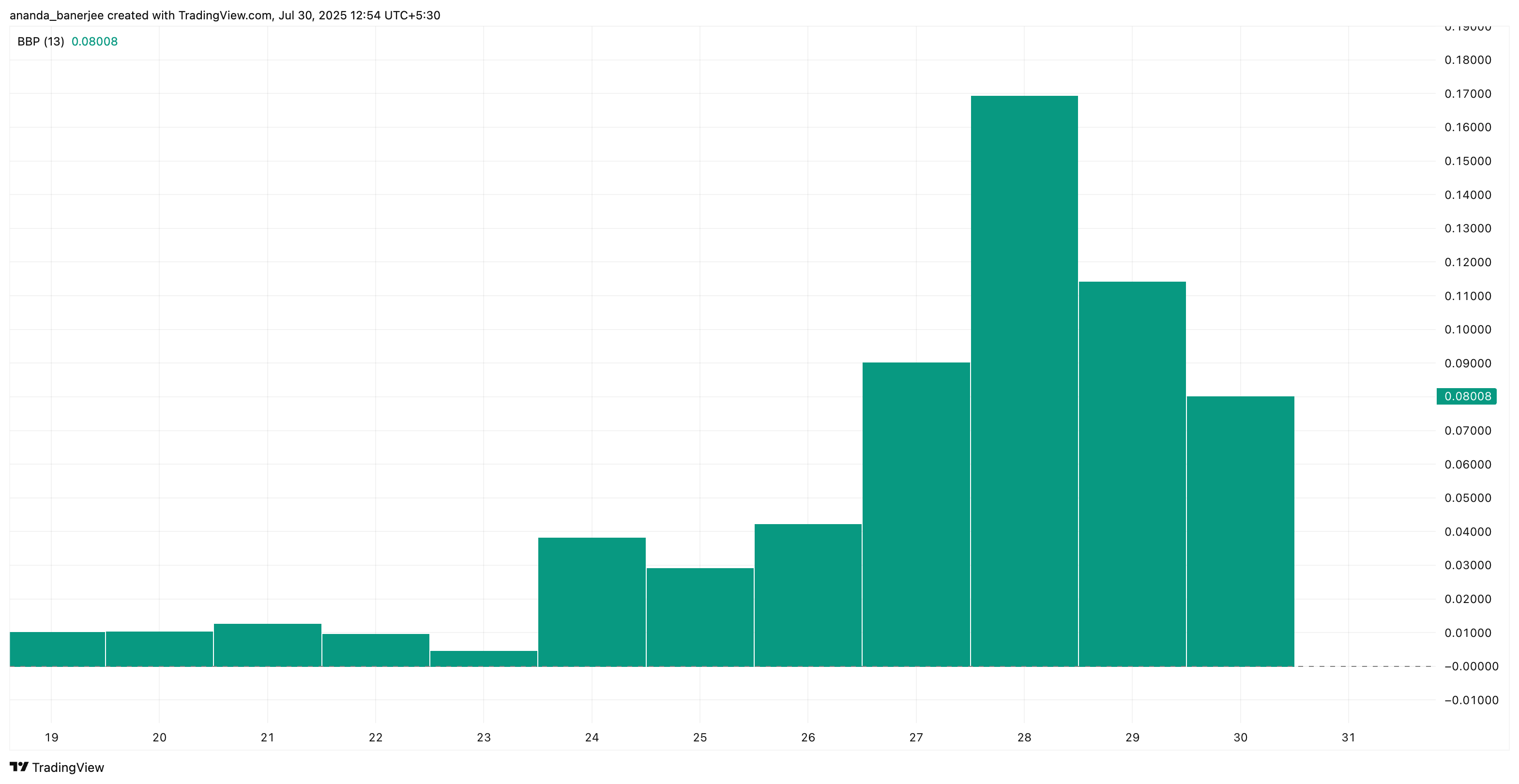

Alongside this, the Bull Bear Energy (BBP) indicator, a measure of shopping for versus promoting power, has cooled off noticeably since July 28, exhibiting that bullish momentum is not constructing because it as soon as was.

These readings trace that VINE’s explosive run might have been extra hype-driven than sustainably supported. With recent cash failing to enter the market and sellers taking management, the token is exhibiting indicators of exhaustion, leaving the VINE value motion weak to sharper strikes down.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

VINE Worth Setup Flags Fragile Help and Steep Draw back Danger

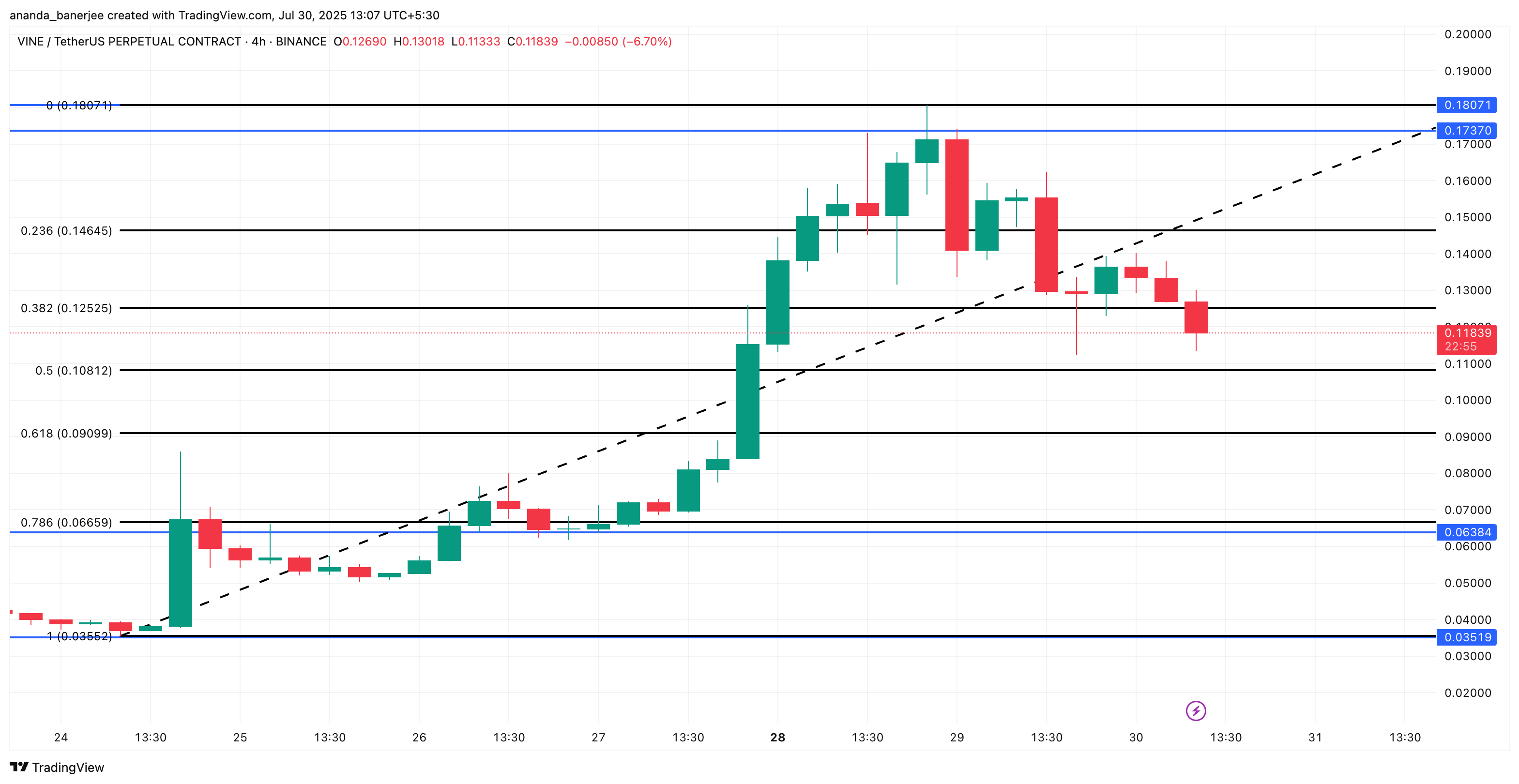

VINE’s 4-hour chart offers a clearer view of short-term volatility, and the image isn’t encouraging. The token value is forming an ascending wedge, a sample that always alerts a bearish reversal.

VINE value is now clinging to help at $0.1129. A breakdown right here opens the trail towards the following main help round $0.063, almost a 50% drop from present ranges.

Fibonacci ranges on the identical timeframe spotlight the place bulls have to step in to vary the story. A transfer again above $0.1465 might invalidate this bearish outlook and revive upward momentum.

Till then, the trail of least resistance seems decrease, with whale shopping for alone unlikely to cease additional corrections.

The submit VINE Dangers a 50% Drop Regardless of Whales Shopping for the Dip appeared first on BeInCrypto.