ZORA’s worth efficiency has taken a bearish flip previously 24 hours, slipping farther from its new all-time excessive of $0.105.

The downturn follows a discount in whale exercise and a modest rise in alternate inflows, signaling the beginning of a profit-taking cycle.

ZORA Whales Exit as Token Nears Peak — Is a Correction Coming?

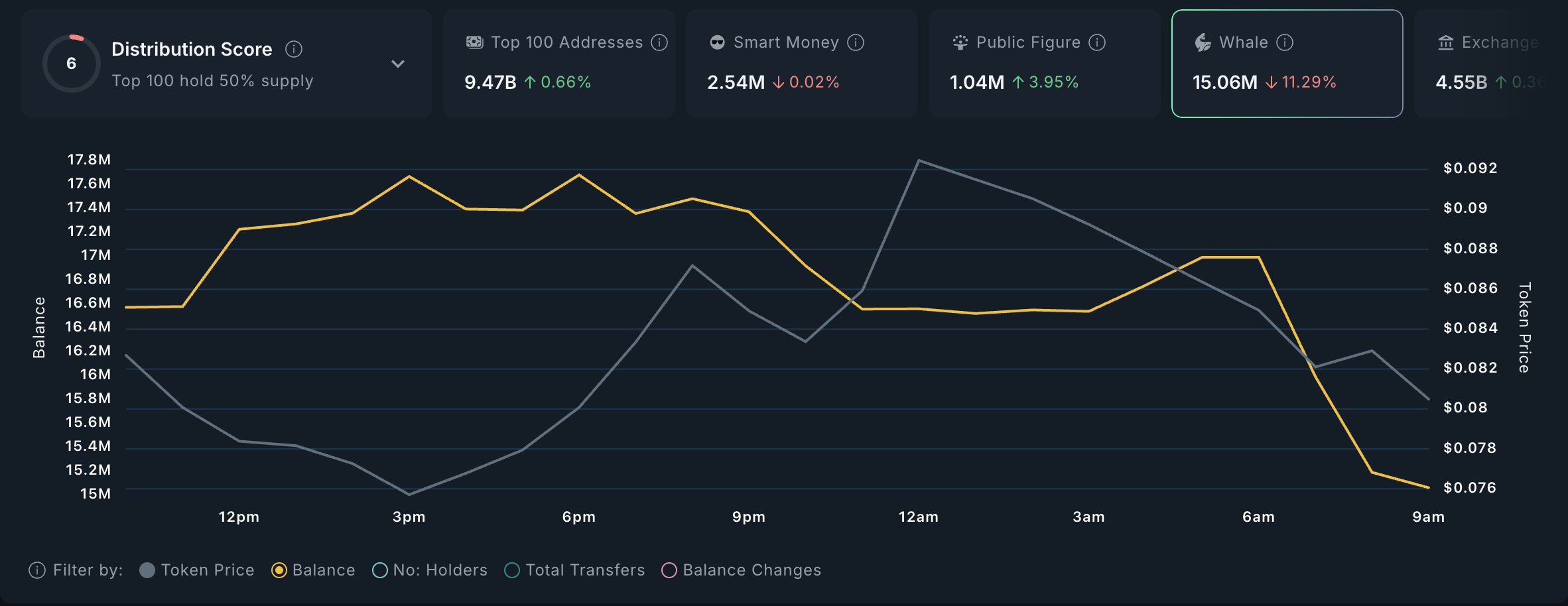

Information from Nansen reveals a pointy decline in ZORA’s massive holder exercise over the previous 24 hours.

Based on the on-chain information supplier, the steadiness held by high-value wallets—these holding over $1 million price of ZORA—has dropped by practically 11% in a single day, signaling a notable shift amongst key stakeholders.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

The sudden pullback comes after ZORA’s rally to its all-time excessive of $0.105. With rising market volatility and uncertainty creeping into the broader altcoin house, whales look like trimming their publicity whereas the token’s worth stays excessive.

This wave of profit-taking from whales may additionally set off a domino impact amongst retail merchants. With confidence within the short-term pattern weakening, smaller holders could also be inclined to observe go well with, worsening the downward strain on ZORA’s worth.

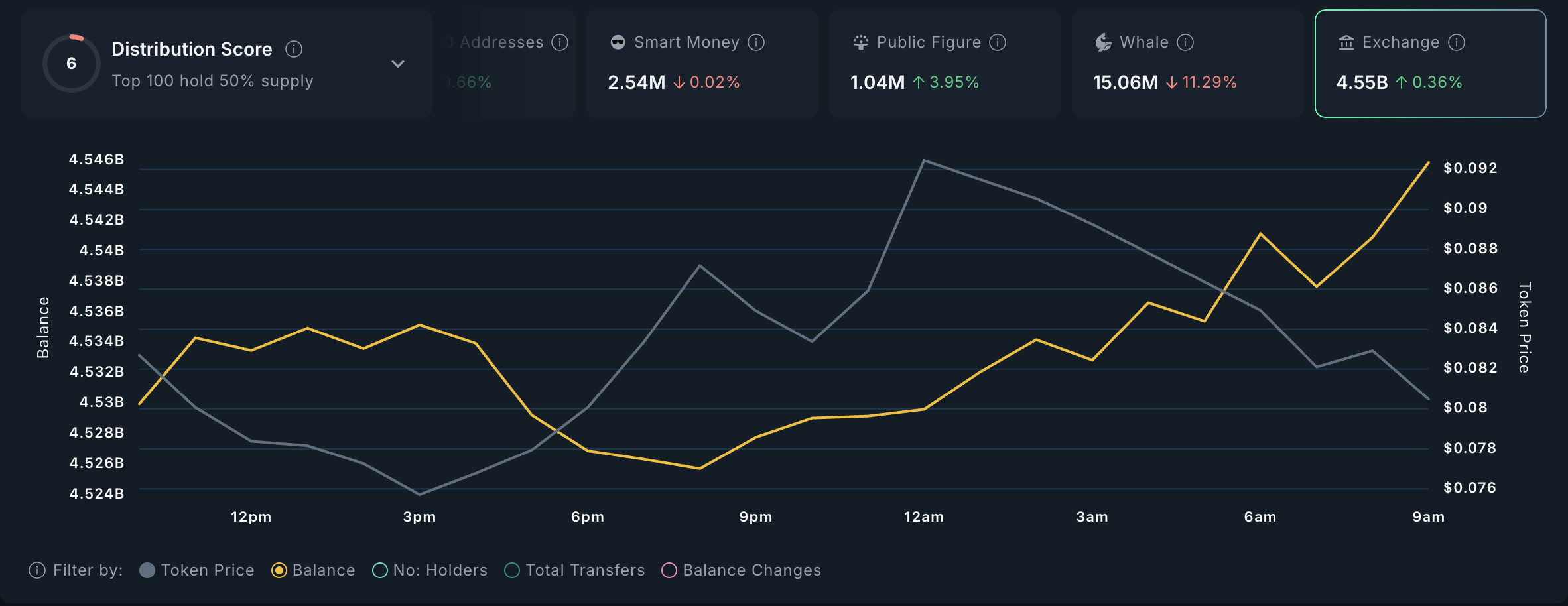

Moreover, ZORA has famous a modest 0.36% uptick in its holdings throughout exchanges over the previous day. This implies an increase within the variety of tokens despatched to buying and selling platforms since ZORA recorded an all-time excessive.

When an asset’s alternate influx spikes, it’s usually an indication that holders are making ready to promote. The rising influx mixed with the dip in whale exercise and declining buy-side momentum provides to bearish strain, growing the probability of a ZORA worth correction within the quick time period.

ZORA Weakens as Sellers Take the Lead

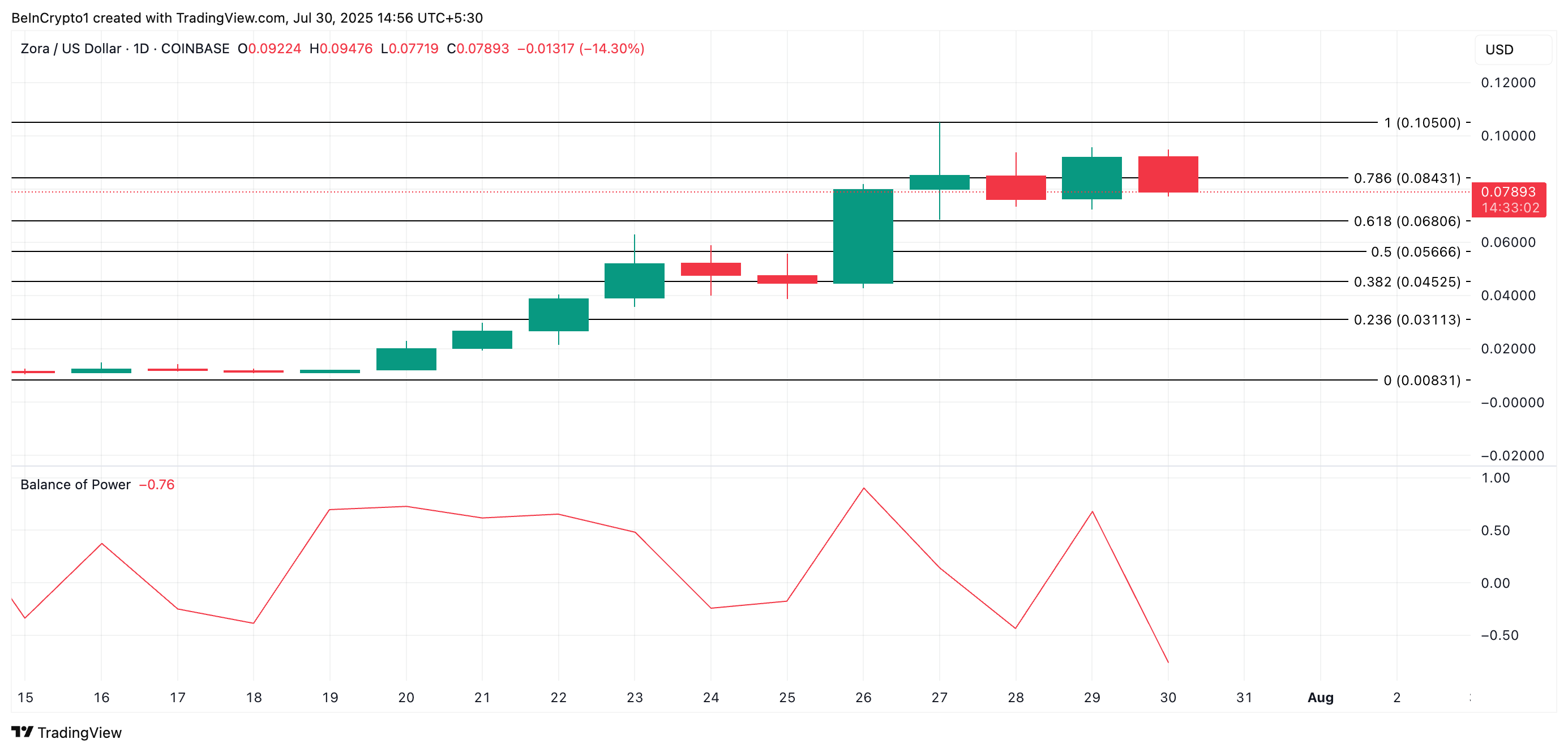

From a technical perspective, ZORA’s Steadiness of Energy (BoP) indicator is adverse at press time, highlighting the clear decline in shopping for strain. At press time, the momentum indicator, which measures shopping for and promoting pressures, is at -0.76

This implies that the bulls are shedding management, and sellers are starting to dictate market path.

If this continues, ZORA’s worth may plummet to $0.068.

Then again, an increase in buy-side energy may set off a breach of the resistance at $0.084 and a rally again to $0.105.

The publish ZORA Exhibits Indicators of Exhaustion After All-Time Excessive as Bears Eye a Reversal appeared first on BeInCrypto.