In a publish shared on TradingView, crypto analyst Xanrox argues that the present bullish cycle is sort of over, pointing to a possible downtrend that may see the Bitcoin value crash to $60,000. This evaluation comes as Bitcoin is buying and selling inside a really quiet part, prompting many crypto merchants and crypto analysts to start out reassessing its subsequent course.

Xanrox Predicts Bitcoin High At $122,000 And Crash To $60,000

The world’s largest cryptocurrency has been hovering simply above the $118,000 value degree for a number of days now, struggling to interrupt decisively above this zone but in addition exhibiting no main indicators of a breakdown. Regardless of this consolidation, market sentiment stays upbeat.

Associated Studying

The crypto worry and greed index continues to flash “greed,” and most analysts nonetheless argue that Bitcoin is establishing for one more leg upward. Nonetheless, an attention-grabbing technical outlook challenges this bullish consensus and points a crash warning.

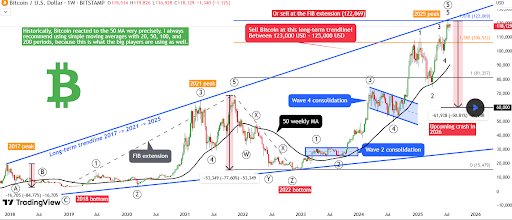

Notably, crypto analyst Xanrox recognized a promote sign on the weekly candlestick timeframe chart after Bitcoin reached the 1.618 Fibonacci extension and touched the long-term 2017–2021–2025 trendline, with the newest contact of the trendline aligning to Bitcoin’s current all-time excessive at $122,800.

In line with him, the latest contact of this trendline may be the highest of the present cycle. Moreover, he famous that the Elliott Wave construction has now accomplished Wave 5 of a rising wedge and a bigger Wave 5 impulse transfer. As such, a corrective part is about to start out.

What’s Subsequent For Bitcoin?

As proven within the chart beneath, the subsequent main transfer could possibly be not less than a 50% decline, with Bitcoin dropping to round $60,000 by 2026. This projection relies on earlier value motion, the place Bitcoin launched into 84% and 77% value crashes after touching the trendline in 2017 and 2021, respectively.

The technical setup additionally aligns with statistical knowledge that exhibits August and September traditionally deliver elevated promoting stress. Xanrox famous that whereas merchants can watch for additional affirmation, reminiscent of a break beneath the 50-week transferring common, he personally believes the highest is already in. Giant establishments {and professional} traders pay shut consideration to the 20, 50, 100, and 200-period transferring averages.

Associated Studying: Bitcoin Brief Squeeze Incoming As Market Makers Set Lure To Go Above $123,000

Xanrox’s outlook is a pointy distinction to the prevailing sentiment amongst crypto traders. Bitcoin’s present construction remains to be exhibiting power on increased timeframes, and a number of other different analysts see the current consolidation between $117,000 and $119,000 as a base for continuation towards $130,000 and past.

The shortage of main sell-side quantity, the agency maintain above the $118,000 value degree and the 50-week transferring common, and bullish indicators throughout altcoins like Ethereum are on-chain indicators that the Bitcoin value nonetheless has extra room to run earlier than it reaches a peak value this cycle.

Featured picture from Pixabay, chart from Tradingview.com