Bitcoin’s new investor dominance is gaining momentum simply because the asset consolidates in a good vary, setting the stage for a significant breakout. After greater than two weeks of sideways motion between $115,000 and $120,000, BTC continues to commerce inside this well-defined vary—constructing strain that usually precedes a pointy transfer.

Associated Studying

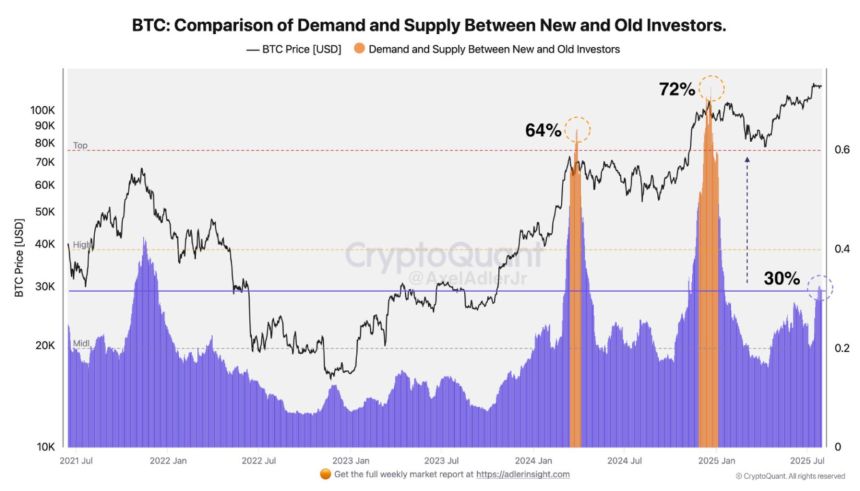

Knowledge from CryptoQuant highlights a vital dynamic: the comparability between demand and provide from new versus outdated traders. The present new investor dominance sits at 30%, solely half of the “overheated” vary of 60–70% seen throughout euphoric phases, however the development is clearly climbing. This implies new liquidity is coming into the market steadily, whereas outdated holders are nonetheless distributing at a manageable tempo. The provision of long-term holders is absorbing this rising younger demand with out disrupting the worth construction.

This wholesome stability means that the market continues to be in a secure late bull section, with no indicators of mass profit-taking or capitulation from seasoned traders. With Bitcoin sustaining a bullish construction and demand from recent entrants rising, the approaching days shall be important.

Bitcoin Enters Wholesome Late Bull Part as New Investor Exercise Grows

High analyst Axel Adler not too long ago shared detailed insights into Bitcoin’s market construction, specializing in the stability between new and outdated investor conduct. In response to Adler, earlier peaks in new investor dominance—64% in March 2024 and 72% in December 2024—aligned exactly with native BTC value tops. At these factors, new liquidity started to wane, and skilled holders ramped up profit-taking.

At present, new investor dominance stands at 30%, which continues to be removed from these overheated extremes. Nevertheless, the development is upward. The purple fill on the chart, which displays cumulative exercise from youthful cash, has been climbing steadily since July 2024. This means {that a} recent wave of patrons continues to enter the market, whereas promoting strain from outdated fingers stays restricted.

This dynamic creates room for additional bullish continuation earlier than the standard euphoria zone—above 60–70% dominance—takes maintain. Previous holders are nonetheless distributing cash, however solely reasonably. A coefficient of 0.3 signifies that three-year-old cash are absorbing demand with out triggering main volatility. This stability means that the market stays structurally sound.

Associated Studying

Bitcoin Varieties A Tight Consolidation Vary

Bitcoin is at the moment buying and selling at $118,413, consolidating in a slender vary between $115,724 and $122,077, as seen within the 8-hour chart. This sideways motion has continued for over two weeks, indicating indecision available in the market. The important thing help sits at $115,724, which has been examined a number of instances however held firmly, whereas the $122,077 stage acts as quick resistance after a robust rejection earlier in July.

The value stays above the 50, 100, and 200-period shifting averages, which now align in bullish order—one other signal that the underlying development continues to be intact regardless of short-term consolidation. Quantity stays comparatively low, suggesting that neither bulls nor bears are aggressively positioning in the mean time. Nevertheless, such tight ranges usually precede massive directional strikes.

Associated Studying

If bulls handle to interrupt above the $122K resistance with robust quantity, it might set off a continuation towards new highs. Alternatively, a breakdown under the $115.7K help would expose draw back threat. Probably resulting in a retest of the 100-period shifting common round $114,490 and even the 200-period common close to $110,188.

Featured picture from Dall-E, chart from TradingView