As soon as a little-known participant in 2023, Hyperliquid is now reshaping the DeFi business in 2025, outpacing Robinhood in buying and selling quantity and difficult the dominance of centralized exchanges.

With an aggressive progress technique and distinctive strategy to liquidity, this decentralized alternate (DEX) is not flying beneath the radar.

Centralized Exchanges Beware: Hyperliquid Is Catching Up Quick

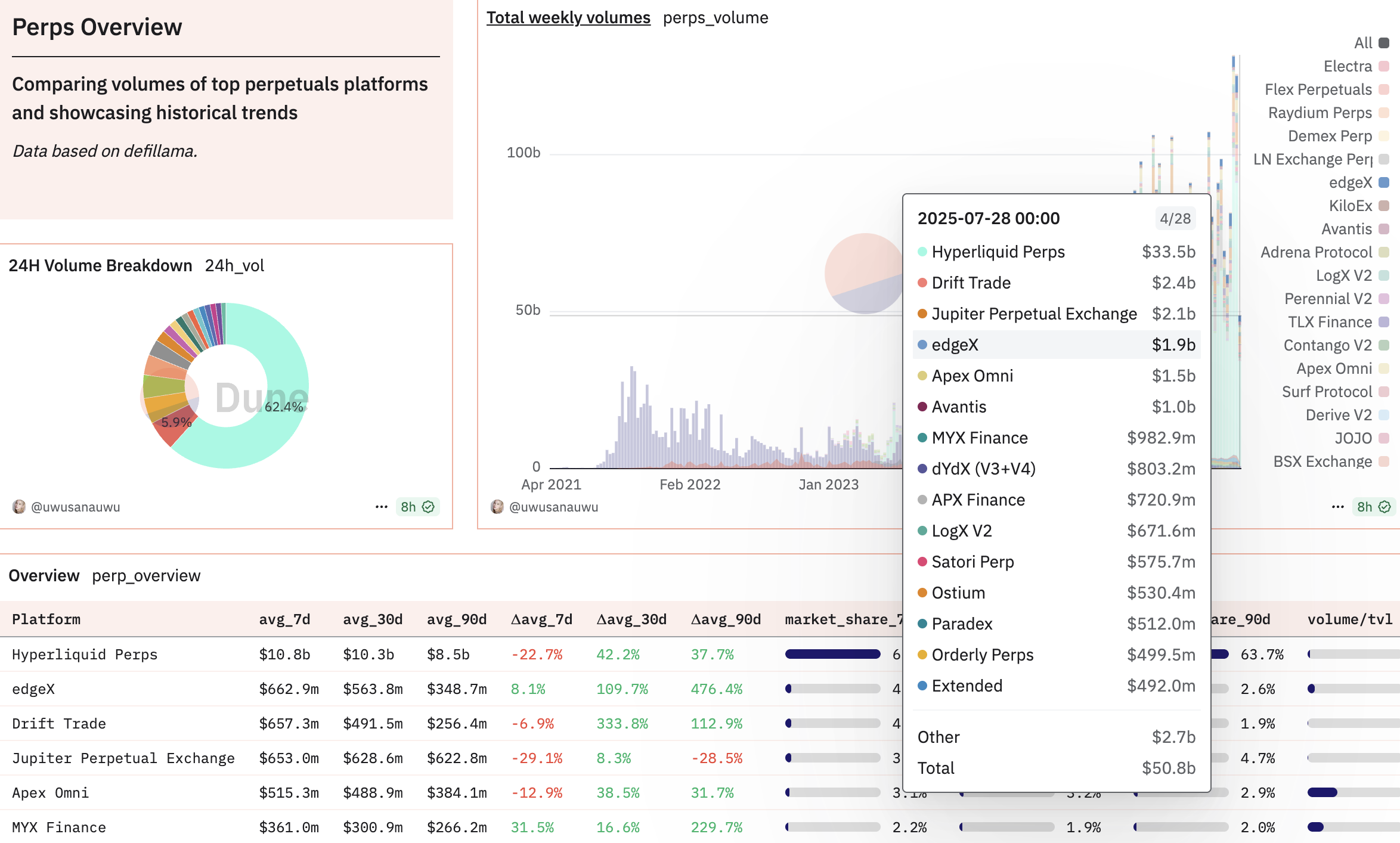

Whereas many nonetheless consider that decentralized exchanges (DEXs) can’t scale like centralized exchanges (CEXs), Hyperliquid (HYPE) is forcing your entire business to rethink. This DEX now leads the perpetual futures buying and selling phase, outperforming many large names.

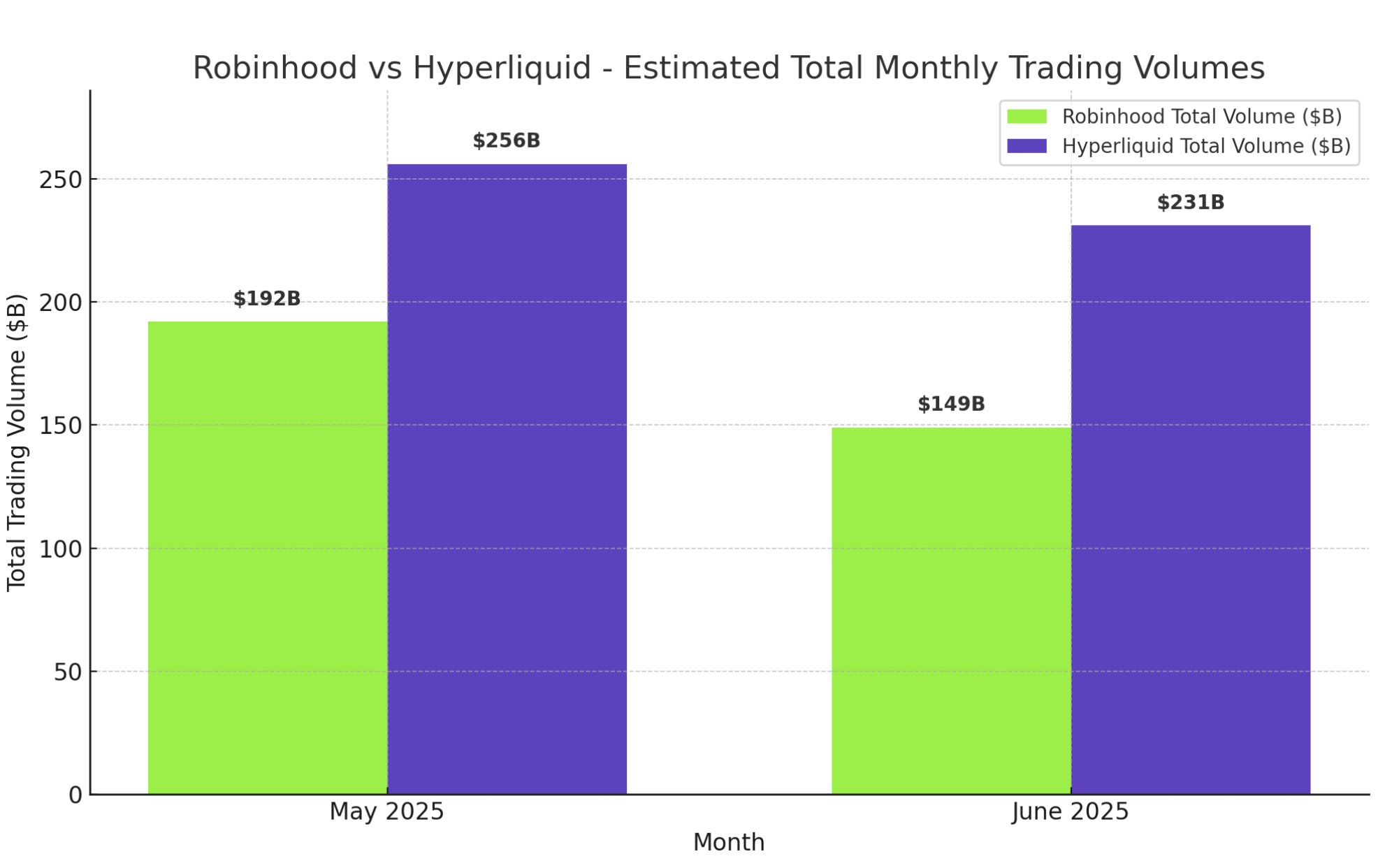

Based on June 2025 information, Hyperliquid’s buying and selling quantity reached $231 billion, barely down from $256 billion in Could.

In the meantime, Robinhood noticed a sharper decline, from $192 billion to $150 billion in the identical interval. These figures present that the hole between a younger DEX like Hyperliquid and the CEX giants is narrowing.

“Coinbase, Robinhood, Binance want to concentrate. Bear in mind when individuals stated DEXs couldn’t scale? Hyperliquid proves them mistaken,” investor Lex Sokolin shared on X.

Based on an in-depth evaluation by Artemis Analytics, Hyperliquid is seen as a “rising star” of the brand new progress cycle. This highlights its speedy improvement and its potential menace to the dominance of conventional centralized exchanges.

“In simply 2 years, Hyperliquid is shortly rising to turn out to be a equally sized enterprise as Robinhood,” famous Steven from Yunt Capital.

One of many standout options that units Hyperliquid aside is its “Liquidity-as-a-Service” strategy. Based on an investor and DeFi skilled, this technique “will increase its valuation and might be the most effective trades one can absorb dimension for the subsequent few years.”

Nonetheless, presumably because of its speedy progress, Hyperliquid just lately skilled a quick person interface outage. This prevented customers from putting, closing, or withdrawing orders, though front-end operations operated usually. Following the incident, Hyperliquid pledged to refund customers affected by the short-lived API problem, which impacted trades and positions.

Whereas it’s nonetheless too early to say that DEXs will utterly change CEXs, Hyperliquid’s progress is more and more blurring the strains between the 2 fashions. Its stability and steadily rising buying and selling quantity have made Hyperliquid a vivid instance of the true potential of decentralized exchanges.

The submit How Hyperliquid Is Quietly Beating Robinhood at Its Personal Recreation appeared first on BeInCrypto.