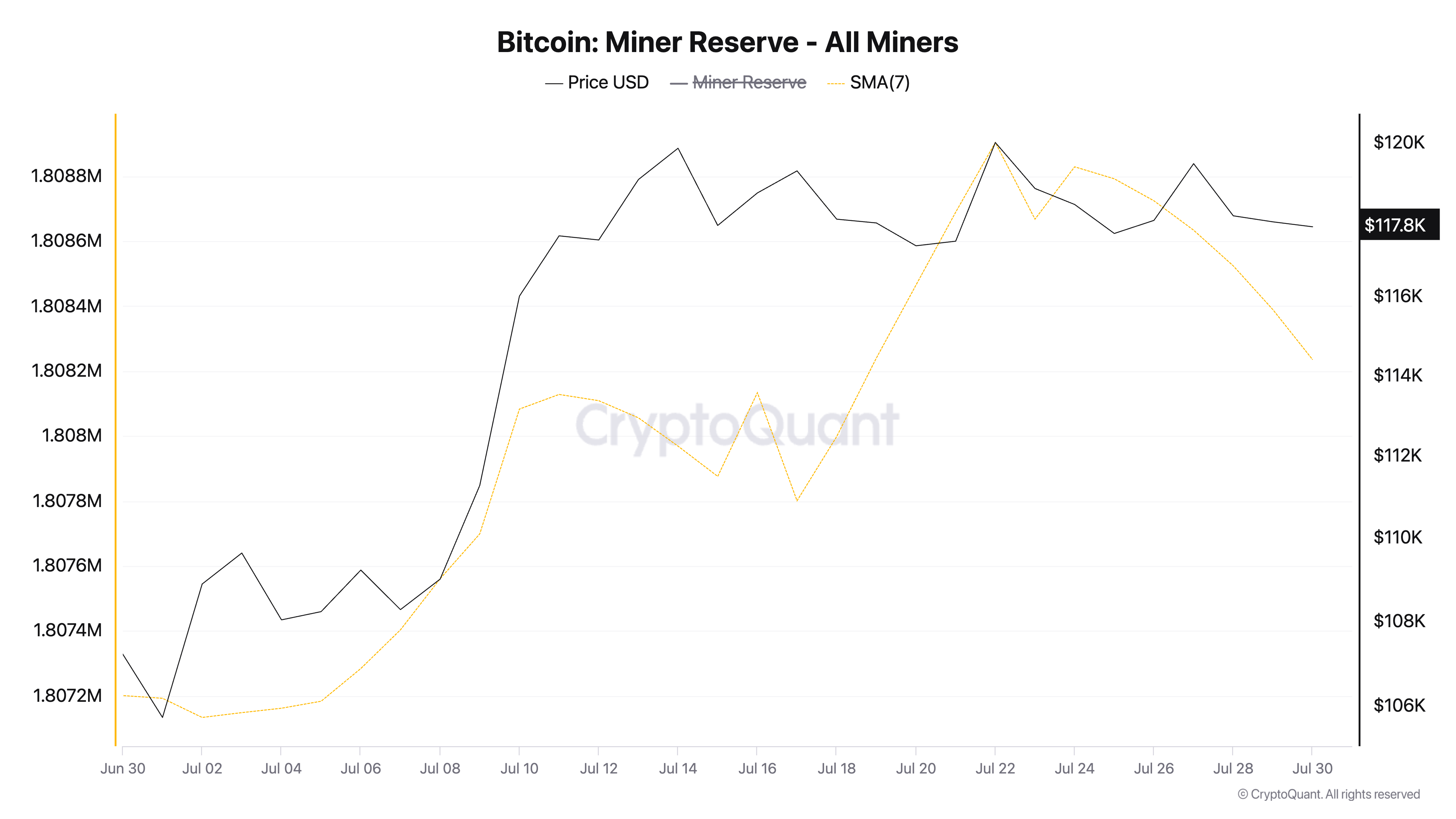

Bitcoin’s miner reserve climbed steadily between July 2 and July 22, reflecting accumulation because the coin soared to a brand new all-time excessive of $122,054 on July 14.

On the time, miners appeared assured within the coin’s bullish momentum, holding onto their rewards in anticipation of upper costs. Nevertheless, BTC has struggled to take care of upward momentum since hitting that peak. In response, miners have begun offloading their holdings to lock in earnings. This shift introduces new headwinds for BTC in August.

Bitcoin’s Bullish Run Pauses as Miners Shift From Holding to Promoting

As BTC’s worth started to climb at the beginning of the month, miners on the Bitcoin community additionally ramped up accumulation, mirrored within the uptick within the coin’s Miner Reserve.

In response to CryptoQuant information, this metric—noticed utilizing a seven-day transferring common (7-day SMA)—rose by 0.05% between July 1 and July 22, peaking at 1.808 million cash.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

The Miner Reserve metric tracks the entire quantity of BTC held in wallets related to mining entities. When the reserve climbs, it indicators that miners are holding onto their cash slightly than promoting, reflecting bullish sentiment or expectations of continued value development.

Nevertheless, following BTC’s rally to its July 14 peak and the following consolidation part—inside which it continues to commerce—bullish sentiment amongst miners has begun to wane. In response to CryptoQuant, the Miner Reserve has trended downward since July 22, indicating elevated profit-taking or diminished confidence in BTC’s short-term value outlook.

On condition that miners management a good portion of BTC’s newly issued provide, modifications of their habits can influence value path. A decline in miner reserves like this will worsen promoting stress, elevating the chance of a BTC value correction in August.

Institutional Inflows Might Offset Miner Promote Strain in August

In an unique interview with Abdul Rafay Gadit, Co-Founder and Chief Monetary Officer at Zignaly, he mentioned that the latest uptick in miner reserves earlier in July was “possible a short-term pause slightly than the beginning of aggressive accumulation.”

“The uptick in miner reserves suggests they’re selecting to carry onto their BTC, possible ready for stronger market indicators or extra favorable value situations. It doesn’t but mirror broad-based accumulation; slightly, it seems to be a strategic slowdown in promoting. If Bitcoin’s value stabilizes or developments upward, we might see accumulation resume steadily, however for now, it’s extra about preserving capital than making daring bets,” he informed BeInCrypto.

When requested concerning the relative affect of miner exercise in comparison with institutional demand on BTC’s present value efficiency and what to anticipate, Gadit famous that:

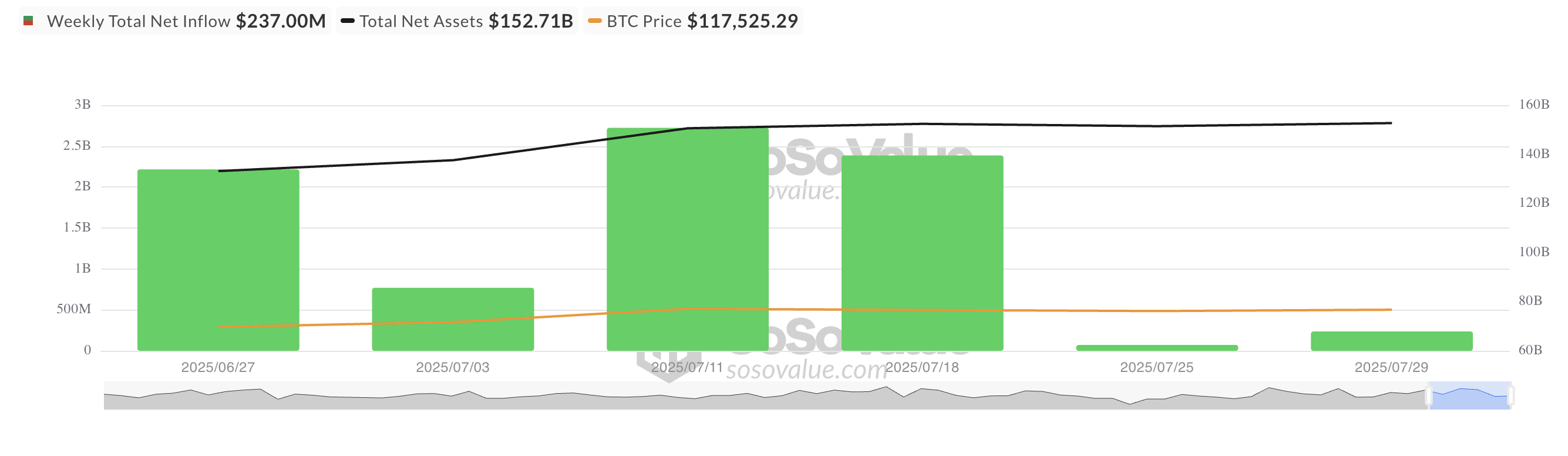

“Institutional demand is the true spine of Bitcoin’s present value construction. Flows from ETFs, significantly these managed by BlackRock, Constancy, and Ark, are making a constant structural bid that’s supporting value ranges extra successfully than diminished miner promoting.”

He added:

“Whereas miner habits does play a task in easing short-term provide stress, the true pressure behind the market’s path is formed by institutional capital, broader participation, and rising expectations of a extra favorable regulatory local weather. The fact is that miners are not setting the tempo; establishments are.”

With rising institutional demand for BTC—mirrored within the regular inflows into BTC-backed ETFs—any potential sell-side stress from miners could possibly be successfully counterbalanced, serving to to maintain the coin’s value secure in August.

In response to information from SoSoValue, BTC ETFs have recorded $237 million in web inflows to this point this week, regardless of the coin buying and selling largely sideways.

This confirms Gadit’s view that institutional capital, slightly than miner exercise, is the first pressure supporting BTC’s value and will assist stabilize it within the coming month.

Can Bitcoin Shake Off the Sideways Development?

At press time, BTC trades at $117,826, hovering between the help flooring fashioned at $116,952 and the resistance at $120,811. If institutional demand will increase and common market sentiment improves, it might push the coin’s value previous the $120,811 resistance and towards its all-time excessive in August.

Alternatively, if bearish stress climbs, the coin might break under $116,925 and fall to $114,354.

The put up What to anticipate from Bitcoin (BTC) in August? appeared first on BeInCrypto.