Solana reasserted its dominance as one of many resilient large-cap altcoins, driving on the wave of July’s broader market rally. Intently monitoring Bitcoin’s upward momentum, SOL surged previous the $200 mark to hit a cycle excessive of $206.19 on July 22.

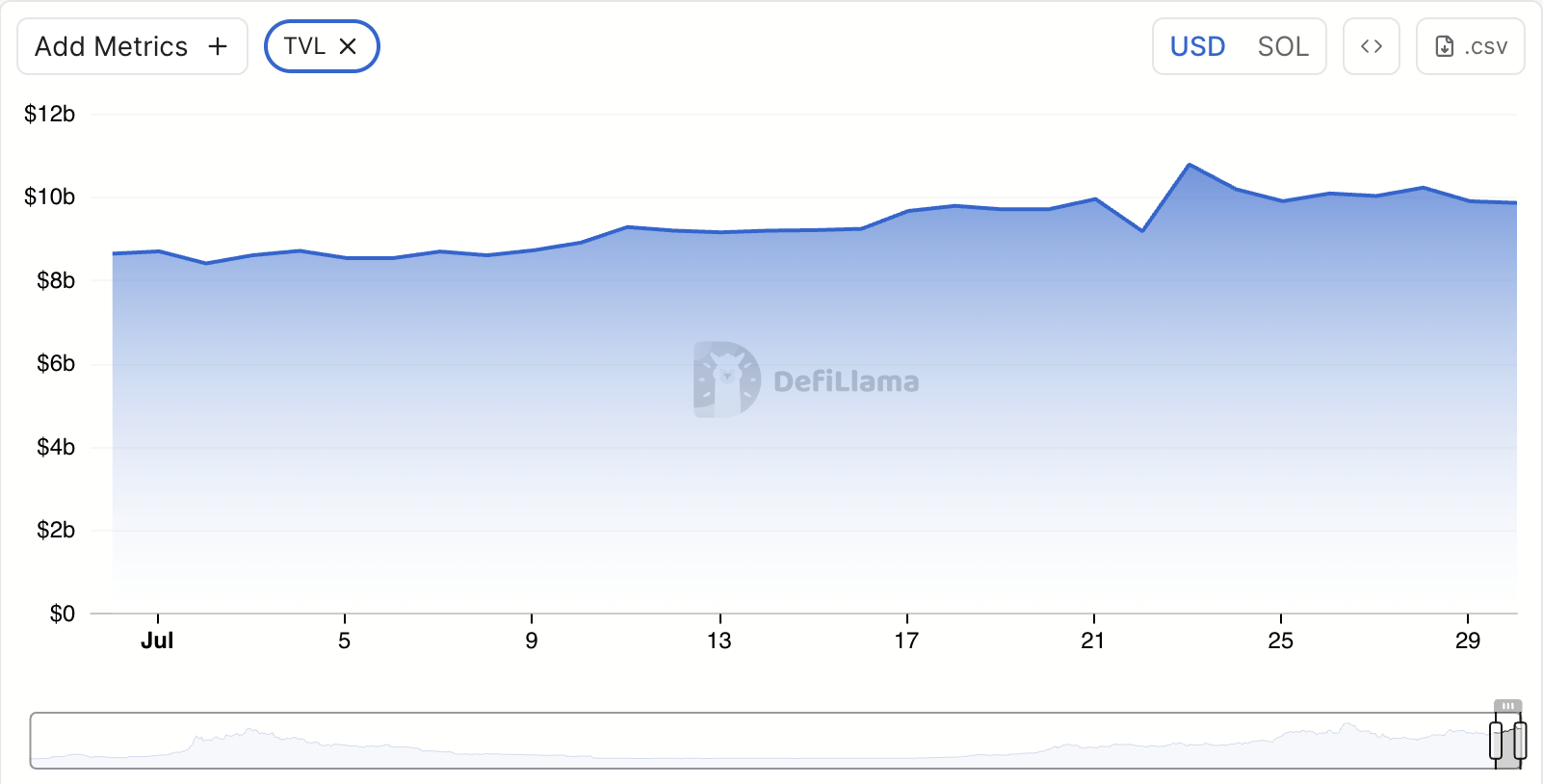

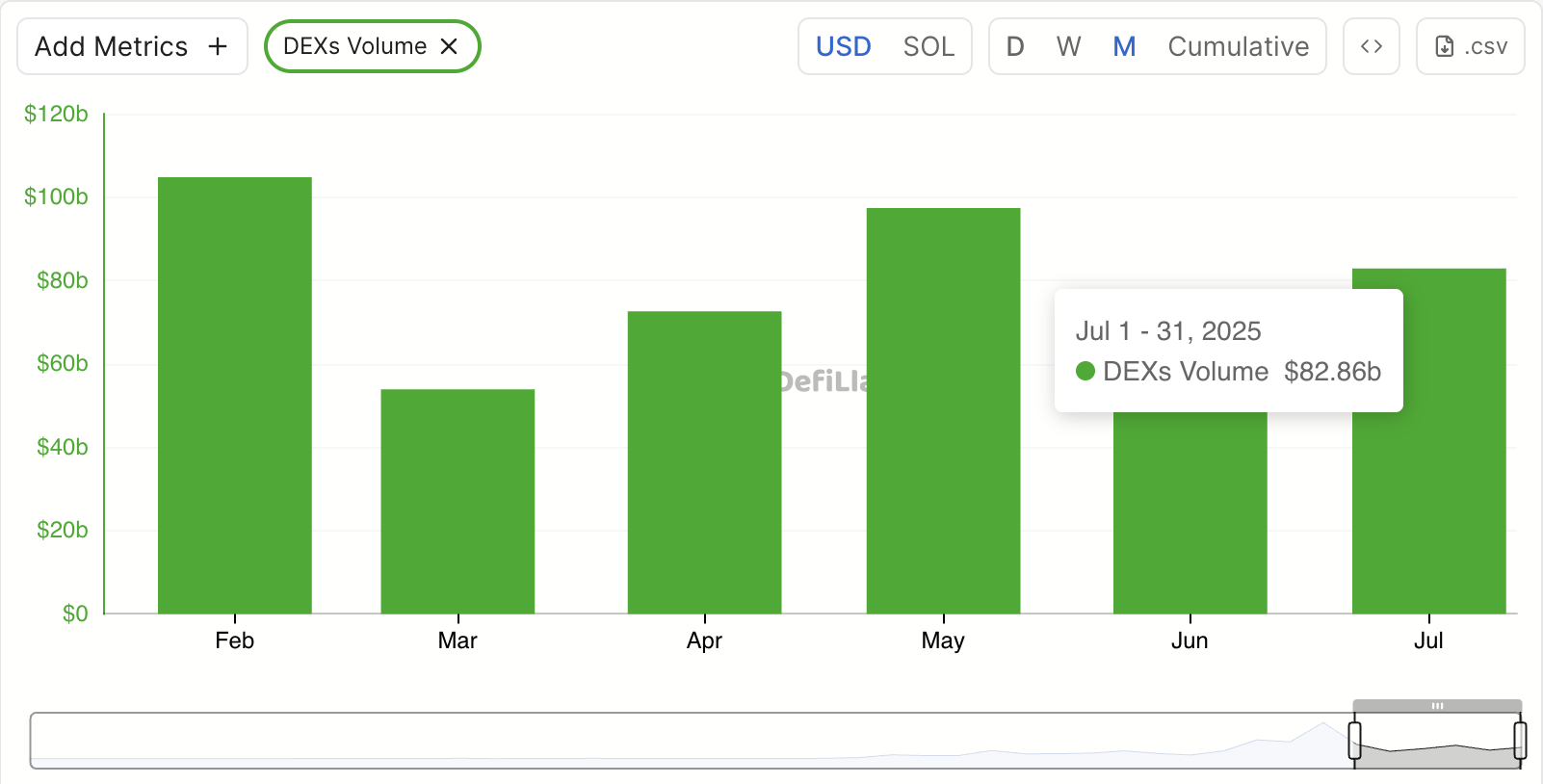

This value rally triggered a spike in on-chain exercise throughout the Solana ecosystem, pushing up its DeFi complete worth locked (TVL), DEX buying and selling volumes, and total chain income. Nonetheless, indicators of exhaustion are beginning to present. SOL has slipped again beneath the $190 threshold, dealing with promoting stress that means buyers could also be rotating out after locking in July’s positive factors.

SOL’s Rally Powers Community Surge—However Can the Momentum Maintain in August?

Between July 1 and July 22, SOL maintained a gradual rally, pushing its worth up by 40%. As SOL’s value surged, the on-chain worth of tokens locked in lending swimming pools and vaults throughout the Solana community rose, boosting the community’s TVL.

At press time, Solana’s TVL sits at $9.85 billion, a 14% enhance over the previous month.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

As demand for SOL climbed throughout that interval, buying and selling exercise throughout DEXes on the community additionally climbed. During the last 30 days, DEX quantity has jumped by 30%, with commerce volumes price greater than $82 billion recorded thus far this month alone.

This spike in exercise translated into greater community income. In accordance with DefiLlama, Solana has generated $4.3 million in income for the reason that starting of July, marking a 13% enhance from the $3.81 million recorded in June.

Solana’s Ecosystem Cools as Value Dips and Consumer Exercise Shrinks

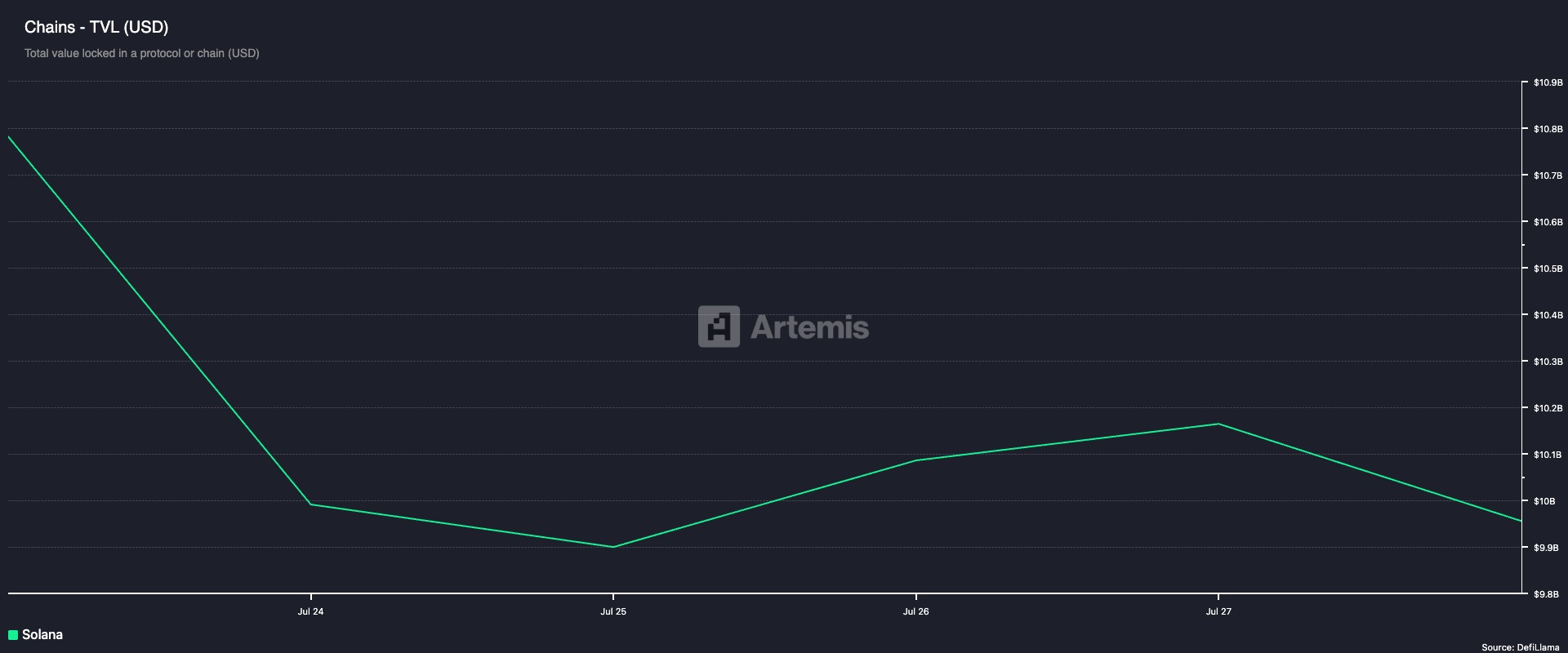

Nonetheless, as we method August, momentum is fading on the Solana community. At press time, SOL has dipped to round $180, and indicators of weakening demand throughout the community are rising.

For instance, the each day lively deal with rely on Solana has plummeted prior to now seven days. In accordance with Artemis, it has declined by 16% throughout that interval.

A drop in a community’s each day lively deal with rely indicators decreased consumer engagement and on-chain exercise. Fewer lively addresses replicate a slowdown in transactions, dApp utilization, and total demand for the community’s providers.

In Solana’s case, the 16% decline suggests waning participation, which hints at a broader cooldown in community progress as the brand new buying and selling month commences.

As exercise throughout the community dips, Solana’s DeFi TVL has additionally begun to tug again. Over the previous week, TVL has fallen by 8%.

This indicators that customers are both withdrawing belongings from the DeFi protocols on the community or the worth of these belongings is declining on account of market actions.

Solana Bears Circle as Value Nears Breakdown Level

SOL’s decline over the previous few days has pushed its value dangerously near its 20-day exponential shifting common (EMA), which kinds a vital dynamic assist line at $178.25. For context, SOL presently trades at $180.51.

The 20-day EMA measures an asset’s common buying and selling value over the previous 20 buying and selling days, giving extra weight to latest costs. A decisive break beneath this stage may probably open the door for additional draw back, particularly if accompanied by falling quantity and community exercise.

On this case, SOL’s value may fall to $171.78.

Alternatively, if market sentiment improves, this bearish outlook shall be invalidated. In that state of affairs, the coin’s value may rally to $186.40. A profitable breach of this stage may propel the coin towards $190.47.

The publish What to Anticipate From Solana (SOL) in August? appeared first on BeInCrypto.