Discuss of TRON [TRX] token hitting one greenback units off a debate about whether or not the maths even works. The mission’s future is a tug-of-war between its huge token provide and its makes an attempt to shrink it.

To achieve that bold $1 milestone, TRON would want to beat some critical tokenomic hurdles.

How TRON works

TRON began with a colossal provide of over 100 billion TRX tokens. An enormous chunk, practically half, was saved by founder Justin Solar and the TRON Basis, a undeniable fact that has at all times drawn criticism.

Right now, with about 95 billion TRX floating round, a $1 worth would demand a $95 billion market capitalization.

Such a valuation would launch TRON into the identical league as crypto titans like Bitcoin [BTC] and Ethereum [ETH], an enormous leap from its present place.

To battle in opposition to its personal huge provide, TRON makes use of a token-burning system.

Each transaction on the community makes use of up assets, and if a person hasn’t staked sufficient TRX to cowl the associated fee, a small quantity of TRX is destroyed ceaselessly.

This direct hyperlink between community use and token destruction makes TRON deflationary. In actual fact, TRON has not too long ago been burning extra tokens than even Ethereum, exhibiting the system is working extra time.

The every day burn price typically outpaces the creation of latest tokens, which is a robust argument for a future worth enhance.

The burn system

However for each token burned, new ones are created. TRON’s community is secured by 27 “Tremendous Representatives” who produce the blocks and hold issues working.

For his or her work, these representatives and the individuals who vote for them receives a commission in freshly minted TRX.

This fixed creation of latest tokens works straight in opposition to the burning mechanism, making a dynamic stability that retains the overall provide in a state of flux.

What Tron must hit $1

Hitting a $1 worth, and the $95 billion market cap that comes with it, isn’t only a basic math drawback. It requires a number of issues to go completely proper –

- The community wants an enormous surge in new customers and apps to speed up the token burn price.

- Investor confidence, closely influenced by market traits and perceptions of Justin Solar’s management, should skyrocket to draw the required capital.

- All this should occur whereas TRON fights for air in opposition to highly effective opponents like Solana [SOL] and Ethereum, who’re all battling for a similar pool of builders and customers.

The numbers present a path to $1 may exist, however the market’s religion within the TRON ecosystem would be the final decider.

For Tron’s TRX to be price $1, its market worth would want to swell to an infinite $95 billion. This calculation is easy: multiply the 95 billion tokens in circulation by a $1 price ticket.

Placing that $95 billion determine in context reveals simply how large of a bounce it might be. Bitcoin’s market cap hovers round a staggering $2.36 trillion, with Ethereum a distant second at $464 billion.

A $95 billion valuation would squeeze TRON in slightly below Solana ($99 billion) and Binance Coin [BNB] ($115 billion), pushing it previous established names like Cardano [ADA] and Dogecoin [DOGE].

In a nutshell, TRON would want to turn out to be one of many high six most beneficial crypto tasks on the earth.

Historical past reveals us that reaching such heights isn’t unattainable. A number of cryptocurrencies have blown previous the $95 billion mark throughout earlier market frenzies.

This proves that with the suitable momentum and market-wide pleasure, tasks can obtain valuations that after appeared like fantasy. The query isn’t whether or not it can be executed, however whether or not TRON can do it.

Can it occur?

A number of key parts will determine if TRX can pull it off. Its core power is its utility for stablecoin transfers, particularly Tether [USDT], due to its quick, low cost transactions.

If that use case continues to develop alongside its ecosystem of apps, demand may comply with. The mission’s deflationary design, which slowly reduces the overall provide of TRX, provides one other potential catalyst for worth progress.

The truth that the TRON community is already worthwhile provides a layer of monetary stability that would entice critical buyers.

In fact, all the pieces is determined by a pleasant regulatory local weather and the general well being of the crypto market, which nonetheless largely follows Bitcoin’s lead.

Whereas a $95 billion market cap is a big ask, it’s not an unprecedented one within the wild world of crypto.

The numbers sport

The TRON community has carved out a distinct segment for itself as a high-speed, low-cost blockchain because it first appeared in 2017.

Initially geared toward disrupting internet content material, it has since turn out to be a serious hub for decentralized apps and, extra importantly, a titan on the earth of stablecoin transactions.

A have a look at its current efficiency reveals a community buzzing with exercise, whilst its devoted finance sector appears to be shedding some steam.

The uncooked numbers from the primary half of 2025 inform a narrative of unbelievable engagement.

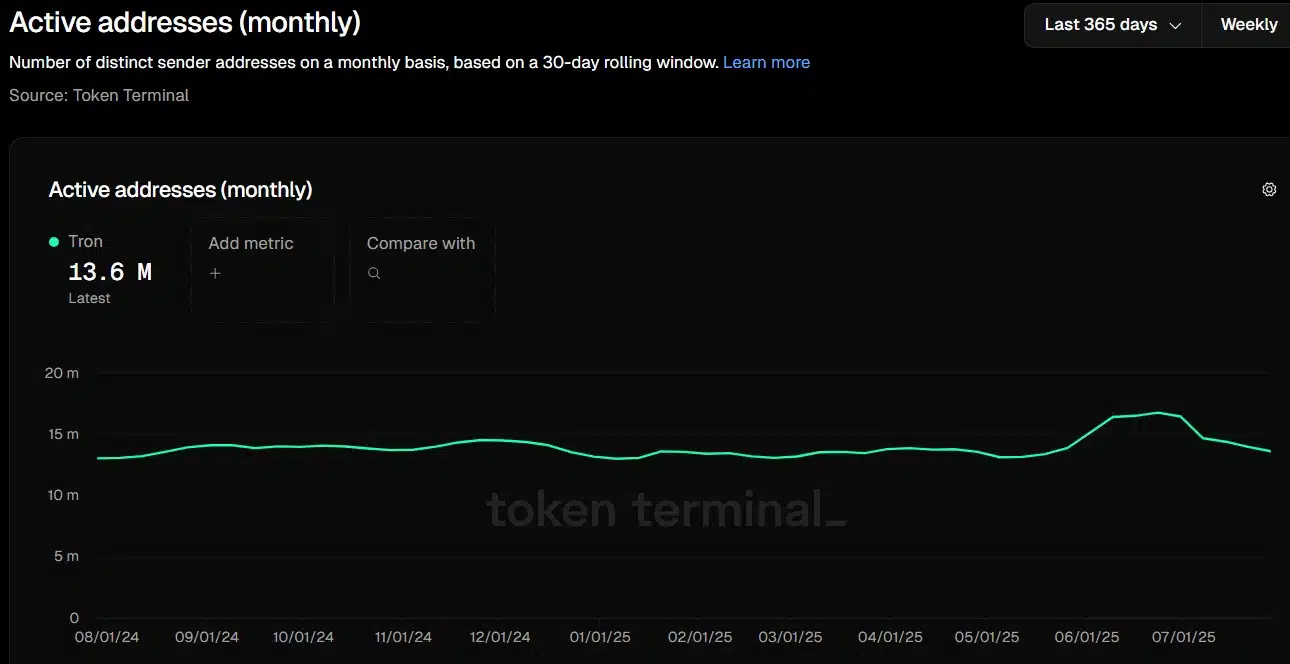

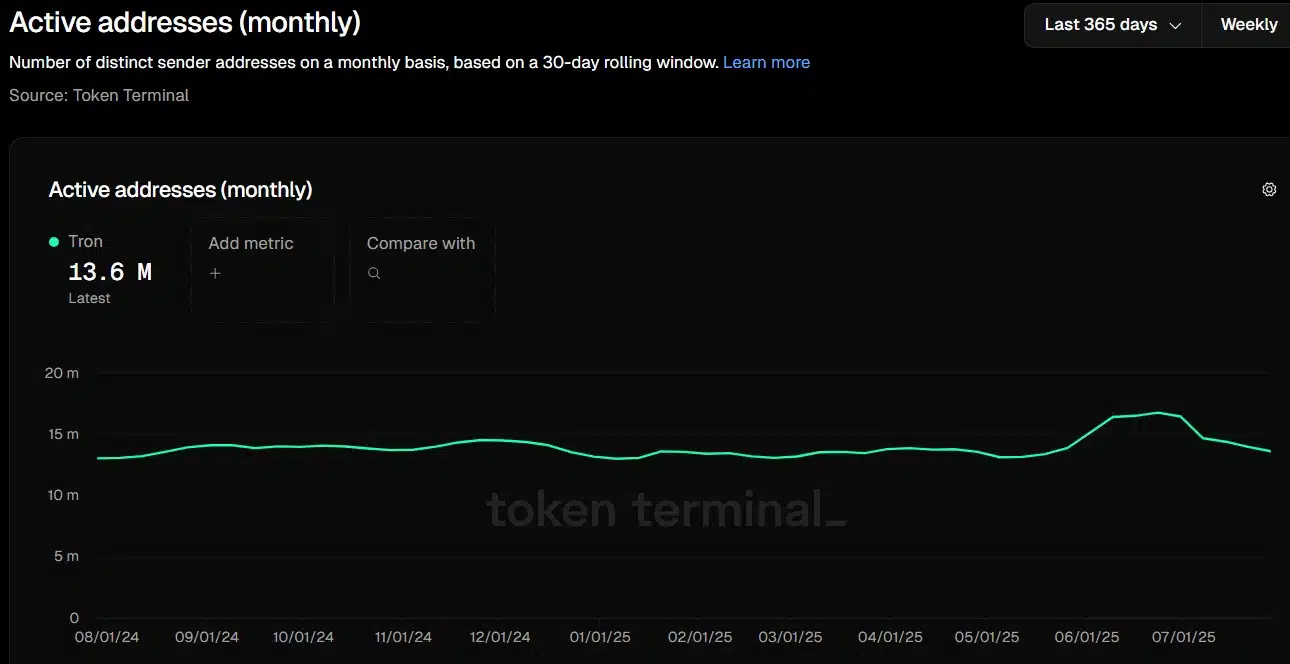

Over the previous 12 months, Tron has seen a mean of two.5 million energetic customers each single day, inserting it third amongst all blockchains and properly forward of rivals like BNB Chain.

Supply: Token Terminal

In the identical 365-day time interval, the community has boasted of dealing with a complete of two.9 billion transactions, averaging 8 to 9 million transactions every day, a quantity made attainable by transaction charges which can be virtually free at about three-hundredths of a cent.

Within the second quarter of 2025 alone, TRON processed practically 800 million transactions, bringing its lifetime complete previous 11 billion.

Supply: Token Terminal

But, this explosion in exercise hasn’t absolutely translated into its decentralized finance (DeFi) scene.

The entire worth locked (TVL) in TRON’s DeFi protocols really fell from $7.5 billion to $5 billion within the first half of the yr, a 33% drop that value it its rank because the third-largest DeFi chain.

Supply: Token Terminal

The ecosystem is closely reliant on just some platforms, just like the lending protocol JustLend and the trade SunSwap.

To breathe new life into this space, TRON not too long ago revamped its USDD stablecoin, making it extra decentralized by permitting customers to mint it straight with TRX and USDT by means of sensible contracts.

Stablecoins enter the sector!

The actual engine behind TRON’s huge transaction numbers is its full and utter dominance within the stablecoin market. The community is the undisputed king of Tether [USDT].

As of July 2025, over $80 billion price of USDT lives on TRON, accounting for greater than half of all USDT in existence.

The provision of USDT on TRON grew by an unbelievable 41% in simply the primary six months of 2025. Day by day, the community processes over $20 billion in USDT transfers, simply surpassing Ethereum’s quantity.

Supply: CryptoRank

This has made TRON the go-to railroad for transferring stablecoins across the globe, a robust place that fuels its progress whilst different components of its ecosystem play catch-up.

Is Justin Solar good for TRON?

Justin Solar, TRON’s energetic and infrequently polarizing founder, nonetheless casts a protracted shadow over the mission he created.

Even with the TRON DAO in place to steer the ship, Solar’s presence is a significant component that shapes how buyers view the community. His affect is each a blessing and a curse.

Solar’s aggressive advertising and marketing and deal-making have been essential to TRON’s visibility and progress.

However his profession can be marked by controversy, from accusations of plagiarizing TRON’s unique whitepaper to ongoing authorized battles.

He formally stepped down as CEO of the TRON Basis in 2021 to let the community-governed DAO take over, however nobody doubts he’s nonetheless essentially the most highly effective voice within the room.

The DAO itself, the place TRX holders vote for 27 “Tremendous Representatives” to run the community, raises its personal questions on how decentralized TRON actually is.

Critics level out that with Solar’s large private holdings of TRX, the system may simply be swayed, concentrating energy within the arms of some.

This creates a break up character for TRON within the eyes of buyers.

On one facet, you might have a community with spectacular achievements, like turning into the principle freeway for USDT stablecoin transactions resulting from its velocity and low charges.

The community boasts large person numbers and billions of {dollars} locked inside its ecosystem.

On the opposite facet, the controversies persist with Solar like glue.

In March 2023, the U.S. Securities and Trade Fee (SEC) hit Solar and his firms with expenses of fraud and market manipulation, alleging they faked buying and selling quantity and paid celebrities for undisclosed promotions.

Solar denied all the pieces, however the lawsuit created a cloud of danger that’s onerous for buyers to disregard.

TRON’s strategic selections replicate this actuality. The laser give attention to stablecoins has been a transparent win. Extra not too long ago, an organization tied to Solar pulled off a reverse merger to get listed on the Nasdaq as Tron Inc.

The plan is for this publicly traded firm to purchase and maintain giant quantities of TRX, very similar to MicroStrategy does with Bitcoin, making a regulated manner for conventional buyers to get entangled.

It’s a daring play to construct legitimacy and investor confidence, however its success will hinge on whether or not Solar and the DAO can lastly shake the lingering doubts about transparency and centralization which have adopted the mission for years.

Trying into USDD

TRON’s stablecoin, USDD, is a narrative of huge ambitions shadowed by large dangers.

Though the mission claims USDD is closely over-collateralized, questions on its true stability, centralized management, and transparency stay, creating a possible legal responsibility for the complete TRON community and its TRX token.

USDD launched in Might 2022 as an algorithmic stablecoin, instantly drawing nervous comparisons to the failed TerraUSD.

To counter this, TRON shifted its narrative, insisting the coin was over-collateralized with a reserve of property like Bitcoin, TRX, and different stablecoins, supposedly guaranteeing its stability.

Regardless of these guarantees, USDD hasn’t at all times held its $1 peg. It wobbled in the course of the market chaos of June 2022 and once more after the FTX collapse later that yr, at one level dipping under $0.97.

The TRON DAO has tried to downplay these occasions, saying a 3% fluctuation is suitable in unstable occasions.

Belief was additional shaken when studies revealed that the collateral backing the stablecoin had been considerably modified with none group vote, reinforcing fears in regards to the mission’s lack of real decentralization.

Nonetheless, USDD has discovered a foothold, particularly inside TRON’s personal DeFi world. A lot of its provide is used on platforms just like the lending protocol JustLend, making a self-contained loop of utility.

It even gained a sliver of real-world legitimacy when the Commonwealth of Dominica acknowledged it as a licensed digital foreign money.

The core risks, nevertheless, haven’t gone away. The focus of energy throughout the TRON DAO and round its founder, Justin Solar, is a continuing fear.

The stablecoin’s design, which entails burning TRX to create new USDD, additionally ties its destiny on to TRON’s native token.

A pointy crash within the worth of TRX may spark a loss of life spiral, because the collateral backing USDD would plummet in worth, triggering a disaster of confidence.

This deep connection makes USDD a double-edged sword for TRX. If USDD adoption grows, it ought to create extra demand for TRX, pushing up its worth.

However any critical de-pegging occasion or lack of religion in USDD would virtually definitely drag TRX down with it. The stablecoin’s future is due to this fact one of many largest query marks hanging over the complete TRON ecosystem.

How the worldwide financial system performs an element

Whether or not TRON’s TRX token can ever attain the $1 mark relies upon closely on the whims of the worldwide financial system.

The monetary currents that elevate or sink markets, from rate of interest selections to basic investor temper, will play an enormous position in any potential crypto bull run that would carry TRX to such heights.

International rates of interest, particularly these from the U.S. Federal Reserve, are a key issue. When charges are low, cash seeks riskier, higher-return investments like crypto.

When charges are excessive, the protection of bonds turns into extra enticing, pulling capital out of speculative markets. For TRX to have a shot at an enormous rally, it wants an atmosphere the place low cost cash is flowing freely.

Inflation provides one other layer to the story. Whereas Bitcoin’s fame as “digital gold” has been examined, durations of excessive inflation can nonetheless push buyers towards property with a hard and fast provide.

This might probably profit cryptocurrencies like TRX which have deflationary mechanics.

In the end, it comes all the way down to market psychology. A widespread “risk-on” angle, the place buyers are desirous to gamble on progress, is crucial for the type of explosive rally that would propel an altcoin like TRX to $1.

Indicators that measure market sentiment, just like the Concern & Greed Index, should be firmly within the “greed” territory.

There are some highly effective crypto-specific forces at play as properly. The current Bitcoin halving, which cuts the creation of latest bitcoin in half, has traditionally kicked off main bull markets.

A rising Bitcoin worth tends to elevate all different crypto boats.

The flood of cash into new Bitcoin ETFs is one other sturdy tailwind, lending legitimacy to the complete asset class and bringing in waves of latest institutional and retail money.

So, what occurs now?

Even with an ideal financial backdrop, TRX nonetheless has to face by itself deserves. The well being of its DeFi platforms like SunSwap and JustStable, together with the continued innovation from its developer group, is essential.

However the crypto area is extremely crowded. To seize a significant slice of any new capital, TRON wants to supply one thing extra compelling than the hundreds of different tasks all combating for a similar consideration.

The journey to $1 is an advanced dance between international financial traits and TRON’s personal capability to show its price.

TRON’s worth historical past is a wild trip, marked by dizzying highs and gut-wrenching lows because it first launched in 2017.

Taking a look at its previous efficiency provides us clues about whether or not an enormous 10x or 15x worth surge from at present’s ranges is even within the realm of risk.

TRX began its life with an ICO worth of simply $0.0019. Through the crypto mania that adopted, it exploded to an all-time excessive of round $0.44, delivering life-changing returns for its earliest backers.

That peak stays a key psychological barrier for the token.

Through the years, the value has established a number of battlegrounds, with a powerful help ground typically forming across the $0.30 to $0.32 space and resistance ceilings showing at ranges like $0.35, $0.38, and $0.51.

The token has a confirmed historical past of spectacular rallies. One notable bull run in its previous delivered a mind-boggling 2,450% acquire.

Whereas previous efficiency is not any assure of future outcomes, it does present that TRX is able to explosive strikes when the market circumstances are proper.

These rallies have at all times been a mixture of broader crypto market hype and particular information or developments from the TRON ecosystem.

The thought of one other large run isn’t simply primarily based on chart patterns.

TRON has solidified its place as the first community for USDT stablecoins, and its current debut on the Nasdaq through the Tron Inc. reverse merger has introduced it a brand new degree of mainstream consideration.

So, may TRX actually pull off a 10x to 15x enhance? From its present worth of about $0.33, that might imply a goal of $3.30 to $4.95 per token—a brand new all-time excessive by a rustic mile.

The argument for it rests on historical past; if it has rallied over 2,400% earlier than, a 1,500% acquire isn’t unthinkable throughout an enormous market-wide bull run.

The argument in opposition to it factors to a way more crowded and aggressive crypto market than in TRON’s early days, together with the ever-present menace of regulatory crackdowns.

For a rally of this magnitude to occur, TRX would want to decisively smash by means of its previous all-time excessive. If it could possibly clear that hurdle, the trail to a a lot increased valuation can be large open.

TRON is attempting to reinvent itself. By means of a strategic rebranding, an enormous push into synthetic intelligence, and main tech upgrades, the mission is attempting to set the stage for a brand new section of progress.

The query is whether or not these bold plans can really create actual worth and drive demand for the community.

A key a part of this new technique is the trouble to win over mainstream and institutional buyers. The debut of Tron Inc. on the Nasdaq was an enormous step, giving the mission a degree of credibility it by no means had earlier than.

Tron Inc. has even filed with the SEC to lift as much as $1 billion, with the said aim of utilizing that capital to purchase TRX tokens.

This might create a proxy funding car for individuals who need publicity to TRON with out holding the crypto straight.

Behind the scenes, TRON can be upgrading its core expertise to be quicker and extra steady. The 2025 roadmap contains help for brand new {hardware} architectures and optimizations to enhance speeds for app builders.

In the long run, they’re exploring methods to course of transactions in parallel to dramatically enhance throughput.

Maybe essentially the most forward-looking a part of the plan is the combination of AI into the blockchain. TRON has launched an AI Growth Fund to encourage builders to construct smarter, extra automated dApps on the community.

This transfer goals to enhance all the pieces from person expertise to operational effectivity.

In fact, TRON’s current strengths in DeFi and its dominance within the stablecoin market stay essential.

The community handles an enormous quantity of USDT transactions, creating a continuing, underlying demand for TRX to pay for charges. The plan appears to be to construct on this stable basis with new, progressive layers.

This roadmap is bold and stuffed with potential. The Nasdaq itemizing may usher in a flood of latest cash. The tech upgrades are important to remain aggressive. And the AI pivot may open up completely new use instances.

However the dangers are simply as actual. The crypto market is notoriously unstable, and regulatory threats loom giant. Whereas the plan to have a public firm purchase TRX may help the value, it additionally provides a layer of centralization.

TRON has laid out a compelling imaginative and prescient, however the coming years will present if it could possibly really ship on its guarantees.

An in depth have a look at TRON’s on-chain knowledge reveals that a number of giant holders, or “whales,” management a big quantity of the TRX provide.

This focus, mixed with current actions of tokens to and from exchanges, presents clues about what is perhaps coming subsequent for the TRX market.

Knowledge reveals that addresses holding over 1% of the overall TRX provide have not too long ago elevated their holdings, suggesting that large gamers could also be positioning themselves for a future worth transfer.

TRONSCAN’s public listing of high accounts confirms this, with wallets linked to the Binance trade holding huge quantities of TRX.

This gives deep liquidity but in addition carries the danger that a number of entities may dump numerous tokens available on the market at any time.

Regardless of this focus on the high, there’s additionally a constructive development amongst smaller holders. The variety of addresses holding TRX for the long run has been rising, an indication of accelerating grassroots confidence within the community.

Supply: Token Terminal

As of mid-2025, a overwhelming majority of TRX holders have been in revenue. It is a wholesome signal, nevertheless it may additionally tempt some to promote and take these earnings, creating downward strain.

The on-chain image for TRX is due to this fact a blended bag. The heavy focus of tokens amongst whales is a transparent danger.

Nevertheless, the expansion in long-term holders and the community’s highly effective fundamentals, pushed by its position because the world’s stablecoin freeway, counsel an underlying power.

Observers ought to hold a detailed eye on whale exercise and trade flows, as these can be key indicators of the place the value is perhaps headed subsequent.