Bitcoin’s restoration to five-figure territory had already set a transparent tone for the brand new quarter. Ethereum additionally adopted go well with, and prime altcoins are actually starting to mirror related momentum. However the value motion is just a part of the story. Underneath the floor, deeper indicators are pointing to renewed urge for food. Alternate exercise is selecting up, transaction volumes are rising, and retail flows are turning aggressive once more.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise, or different supplies on this web page.

One of many clearest indicators got here from Robinhood’s newest earnings name. As one of the broadly used platforms globally, its financials function a helpful barometer of retail conduct. The corporate confirmed that crypto was a key think about its year-over-year income progress. The sign is straightforward: curiosity isn’t just coming again, it’s already shaping outcomes.

Exchanges Document Surging Consumer Exercise, Buying and selling Demand Jumps

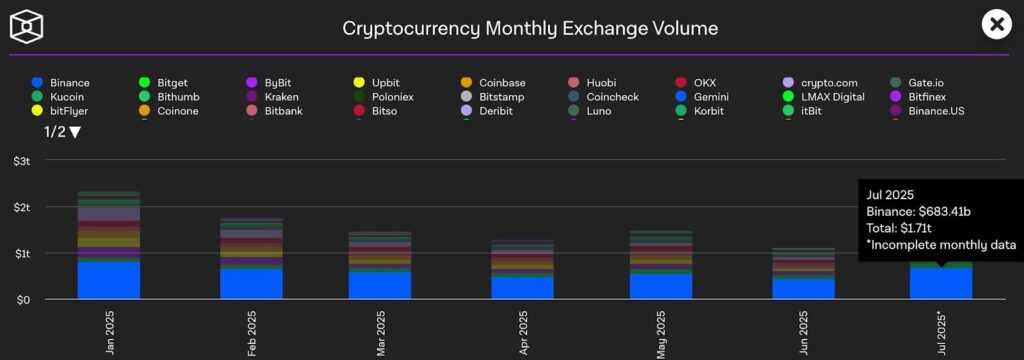

Over the previous few weeks, exchanges have began reporting a wave of recent curiosity. On-chain indicators and platform-specific information each recommend that customers are returning in giant numbers, not simply to carry however to commerce. The Block reported that month-to-month spot market quantity throughout main exchanges was roughly $1.1 trillion in June.

By July, that determine had surged to greater than $1.7 trillion. This isn’t only a statistical bump. It displays heightened engagement, extra capital shifting via the system, and an increase in customers keen to take directional bets on value.

Robinhood’s newest monetary replace helps this sample. The corporate posted whole web revenues of $989 million for Q2, up 45% from the earlier 12 months. Out of that, $160 million got here from crypto-related buying and selling exercise. Transaction-based revenues rose 65%, and customers deposited almost $6 billion in July alone. In accordance with the agency’s CFO, the third quarter has already seen an acceleration in buying and selling throughout classes, crypto included.

These will not be remoted occasions. What’s unfolding here’s a clear uptick in each confidence and exercise. For buyers paying consideration, this surroundings affords a perfect window to enter high-potential crypto initiatives early, particularly as value and participation start to maneuver collectively once more.

Greatest Crypto to Purchase Now As Indicators Level to A Bullish Quarter

Maxi Doge

With the present market situations driving renewed curiosity and investments in low-cap meme cash, a brand new contender Maxi Doge is gaining traction, elevating roughly $150k inside 24 hours of its presale debut.

Maxi Doge’s robust early begin is not any shock, contemplating its distinctive branding as the ultimate type of the Shiba Inu household tree poised to ship six-digit returns to early buyers.

Recall how its predecessors, ranging from Dogecoin, Shiba Inu, and Bonk to Dogwifhat, Floki Inu, and extra have all efficiently leveraged the identical branding to construct hype, develop huge communities, and extra importantly, drive explosive long-term positive factors.

Nevertheless, whereas embodying the long-lasting ethos of the Shiba Inu lineage, Maxi Doge units itself aside by bringing a way of life rooted in inexperienced candles, fitness center reps, and relentless hustle to the meme coin scene. It carries a robust message: “elevate, commerce, and repeat” – a method crafted to outperform even the unique Dogecoin and ship outsized returns to group members.

Essentially, it’s constructing a community-centric ecosystem that thrives on rekindling the 1000x power, sharing leveraged insights, and organizing gamified occasions, probably positioning itself for fast progress.

The subsequent engaging characteristic is staking, permitting early patrons to complement their early positive factors with passive earnings. Regardless of being a recent launch, main names within the trade corresponding to 99Bitcoins have already featured it, explaining why it might outperform Dogecoin.

Wall Road Pepe

Wall Road Pepe has managed to construct one thing completely different from the remainder of the meme coin crowd. It doesn’t chase nostalgia or depend on low-effort virality. The challenge is intentionally structured round dealer tradition, market consciousness, and a type of irony that mirrors how the crypto area truly works. From its branding to its mechanics, every thing is designed to mirror the day-to-day mindset of energetic market individuals.

The token operates with a robust emphasis on consumer exercise. Engagement is rewarded not simply via holding, however via interplay with the platform’s social and marketing campaign layers. It runs frequent updates, drops, and buying and selling occasions that require customers to remain knowledgeable and concerned. This strategy matches completely with the broader uptick in crypto participation.

As volumes rise and change exercise strengthens, tokens like this could profit from the wave of recent customers who’re re-entering the area on the lookout for each group and market-driven upside.

What makes Wall Road Pepe related on this cycle is the way it connects the meme identification with precise market dynamics. The challenge maintains energetic presence throughout each quiet and unstable phases, reinforcing its visibility amongst merchants who transfer shortly and observe early-stage alternatives.

In an surroundings the place sentiment is as soon as once more enhancing and retail is returning to exchanges, it is smart to regulate tokens that perceive how consideration and liquidity function collectively. Wall Road Pepe doesn’t simply reply to that rhythm. It’s constructed round it.

Greatest Pockets Token

As extra capital flows again into crypto markets and buying and selling platforms report stronger exercise, infrastructure as soon as once more turns into central to the dialog. Greatest Pockets Token performs immediately into that layer.

It isn’t a meme or trend-driven asset, however a utility token that helps one of the user-focused wallets within the area. Designed to operate as each a cost mechanism and an entry instrument, it connects holders with options that transcend easy storage.

Greatest Pockets has centered on making crypto interplay seamless for retail individuals. The interface strips away friction whereas preserving management. Token integration performs a key function right here. Holders of Greatest Pockets Token obtain advantages tied to transaction charge reductions, staking rewards, and early entry to new companion launches. These will not be static options. They’re formed by how customers behave and what they demand from their major app.

With change exercise rising and retail flows returning, the relevance of useful, user-owned infrastructure will increase. The pockets acts as a entrance door for the subsequent wave of customers, and the token anchors that relationship. What makes this challenge really spectacular is the way it locations the asset immediately on the middle of consumer expertise.

Builders declare that the challenge is all about enhancing engagement via significant entry. In a cycle the place sensible instruments are being rediscovered by customers who need management with out complication, Greatest Pockets Token matches into the ecosystem as one thing obligatory fairly than elective.

Snorter

Snorter is a Telegram-native crypto challenge constructed for pace, automation, and visibility. Whereas most initiatives attempt to drive visitors towards static apps or dashboards, Snorter turns the messenger platform itself into the operational core.

Each operate, whether or not it’s inserting a commerce, checking a value, or monitoring a trending pair, occurs inside Telegram, with no redirect or login required. For merchants who worth simplicity, it cuts out pointless steps and delivers what they want in actual time.

What separates Snorter from related bot initiatives is just not the format or the instructions. It’s the system of incentives that surrounds the instrument. Snorter features a dwell referral construction, staking capabilities, and ongoing token rewards which might be tied to platform interplay.

The token is just not a passive asset. It’s used as gasoline for particular duties, together with premium options and marketing campaign entry. That connection between exercise and worth retains the ecosystem engaged even when the market is quiet. Creators like ClayBro and plenty of others have already endorsed it as a prime choice to contemplate for glorious positive factors within the present market setting.

Now, as buying and selling volumes climb and customers develop into extra energetic throughout exchanges, Snorter stands to learn. Bots that sit inside real-time channels have a tendency to select up momentum in high-volume phases. They supply entry that matches the tempo of the market. Snorter’s progress is just not tied to cost hypothesis alone. It comes from utilization, automation, and the power to satisfy merchants the place they’re, which is contained in the chats, the watchlists, and the heatmap conversations that transfer quicker than most web sites can load.

Bitcoin Hyper

Bitcoin Hyper is likely one of the few new initiatives that builds immediately on Bitcoin’s base presence whereas making an attempt to reimagine how pace and scalability can work with out altering the ethos of the unique asset. Bitcoin Hyper operates as a secondary execution layer, in contrast to wrapped derivatives or mirror tokens, providing quicker confirmations and decrease charges whereas nonetheless anchoring to the broader Bitcoin narrative.

What units the challenge aside is its strategy to engagement. It was not constructed for passive holding. Each a part of its system is tied to participation. Customers can be a part of validator campaigns, earn rewards based mostly on transaction relay, and profit from scheduled token unlock occasions that reward continued involvement. The token itself is just not positioned as a easy proxy for Bitcoin’s value. It’s an energetic asset inside a self-contained surroundings that encourages exercise every day.

As change volumes rise and crypto visitors returns to main platforms, scalable infrastructure turns into extra necessary. Initiatives that provide quicker throughput with out compromising on compatibility will appeal to builders, merchants, and liquidity seekers. Bitcoin Hyper matches into that section.

It isn’t a general-purpose platform, however it’s a very particular resolution for customers who wish to retain Bitcoin publicity whereas accessing instruments that transfer on the tempo of present market situations. In a second the place customers are once more looking for sensible options to high-fee environments, Bitcoin Hyper presents a case constructed on utility, consistency, and precise transaction throughput.

TOKEN6900

TOKEN6900 makes no try to seem polished and doesn’t include a proper whitepaper, investor displays, or a roadmap crammed with imprecise future deliverables. However that’s precisely the purpose. The token was created as a direct channel for degen individuals who are not looking for construction, however as an alternative choose velocity, liquidity, and uncooked publicity to speculative power.

There isn’t any misplaced branding right here. The challenge has constructed a presence completely via real-time motion. Telegram calls, group raids, and meme propagation have pushed most of its progress. It makes use of social exercise as its major engine. This technique works greatest in cycles the place customers are actively rotating capital throughout newer tokens. And with buying and selling volumes throughout exchanges rising once more, that kind of sample is starting to return.

What provides TOKEN6900 its present relevance is just not what it has promised, however the way it has carried out in early phases. The liquidity swimming pools have remained energetic even with out a central change itemizing. The group continues to drive order circulation and visibility, making a system that thrives on pace. For buyers watching the market heat up, tokens like this usually develop into first movers in short-term cycles. They act as signalers of retail power and as early exams for broader sentiment shifts.

It isn’t a long-term asset. It isn’t pretending to be one. However in an surroundings the place fast exercise and social coordination can create actual short-term outcomes, TOKEN6900 matches the present second higher than most.

Conclusion

With costs climbing, volumes rising, and participation ranges spiking throughout main platforms, that is the type of market section that usually rewards early positioning. The restoration isn’t just seen on charts. It’s displaying up in income experiences, consumer exercise, and liquidity throughout the board.

For buyers trying to construct publicity forward of a stronger quarter, now’s a logical time to begin stocking up. The initiatives outlined above mirror a mixture of utility, momentum, and adaptableness that fits the present cycle. Whereas timing stays key, these are choices price critical consideration earlier than the subsequent leg of progress begins.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to use of or reliance on any content material, items or companies talked about.