The broader crypto market is going through heightened volatility, and Bitcoin, the biggest digital asset, has skilled a pullback to the $116,000 threshold. With the market beneath bearish strain, a number of key Bitcoin metrics are starting to maneuver into unfavourable territory, sparking issues out there.

Waning Bitcoin Coinbase Premium Index

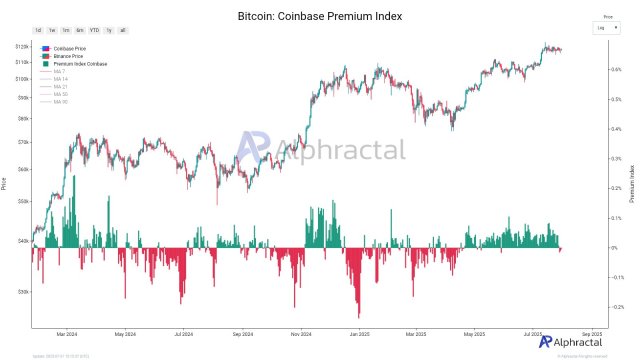

Bitcoin’s worth has retested the $116,000 mark as soon as once more after a earlier run towards $120,000, reflecting rising volatility. Within the meantime, one among BTC’s key metrics, notably the Coinbase Premium Index, has flipped into unfavourable territory.

The unfavourable improvement was disclosed by Alphractal, a sophisticated on-chain information and funding platform, which indicators a possible shift in market sentiment and conduct. Moreover, the unfavourable studying comes within the midst of heightened volatility rattling investor confidence, elevating issues in regards to the ongoing pattern.

Particularly, the Bitcoin Coinbase Premium Index is an important metric that measures the worth distinction of BTC between the Coinbase change and different world exchanges similar to Binance. Wanting on the chart shared by Alphractal, the index has now fallen beneath zero for the primary time since Might. A drop beneath zero is taken into account to be in a unfavourable space, whereas an increase above zero is regarded as a constructive zone.

The index transferring right into a unfavourable zone usually means that American consumers are stepping again or offloading their BTC holdings. On condition that the index usually measures the US demand for BTC, the unfavourable studying sparks questions in regards to the resilience of US-driven momentum and the short-term institutional urge for food.

In keeping with Alphractal, the occasion signifies promoting strain within the US market as Bitcoin is now buying and selling at a reduction on Coinbase. “Traditionally, unfavourable values could replicate an absence of curiosity from US buyers or profit-taking moments,” the platform added.

Consequently, the on-chain platform has urged buyers to stay vigilant as buyers within the US offload their holdings. That is due to the way it usually impacts the Bitcoin market within the brief time period.

A Large Accumulation In The Final Few Months

Many essential Bitcoin metrics could have turned bearish or are struggling to keep up a constructive pattern, however bullish sentiment amongst sure buyers continues to stay steadfast. A report from Santiment, a number one on-chain platform and market intelligence, highlights sturdy curiosity amongst BTC buyers, particularly pockets addresses holding between 10 and 10,000 BTC.

Within the report, Santiment famous that the cohorts have been steadily shopping for BTC within the final 18 weeks, or since late March 2025. Throughout this era, these buyers have amassed about 218,570 extra BTC. The 218,570 BTC gathered throughout the interval represents round 0.9% of the entire provide.

Despite the fact that BTC’s worth has briefly misplaced its upside momentum, the group will not be exhibiting indicators of stopping, reflecting sturdy optimism within the asset’s prospects. Following the huge accumulation of BTC, Santiment information reveals that these key stakeholders now collectively maintain 68.44% of all Bitcoin’s provide.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.