Bitcoin enters bullish retest zone round $112.5K, whereas 96% of provide stays in revenue—Glassnode information reveals elevated strain for subsequent transfer.

Bitcoin has entered a crucial retest section after finishing a breakout above $112,000, in accordance with dealer Merlijn. In a chart shared on August 1, he pointed to the $112.5K degree because the “reload zone” for bulls, figuring out it as a structurally robust assist space. With BTC hovering round $114,000, this zone is shaping as much as be a pivotal launchpad for the following wave towards the $130K degree.

“This isn’t hype—it’s construction,” Merlijn said, emphasizing that the group sometimes arrives at resistance, not earlier than. He added that this vary is the place legends accumulate, marking it as a primary zone for forward-looking consumers to place earlier than the following main transfer unfolds.

In the meantime, market sentiment stays firmly bullish, with technical patterns aligning for a possible continuation to the upside.

Glassnode: Bitcoin holders sit on document earnings—will they promote?

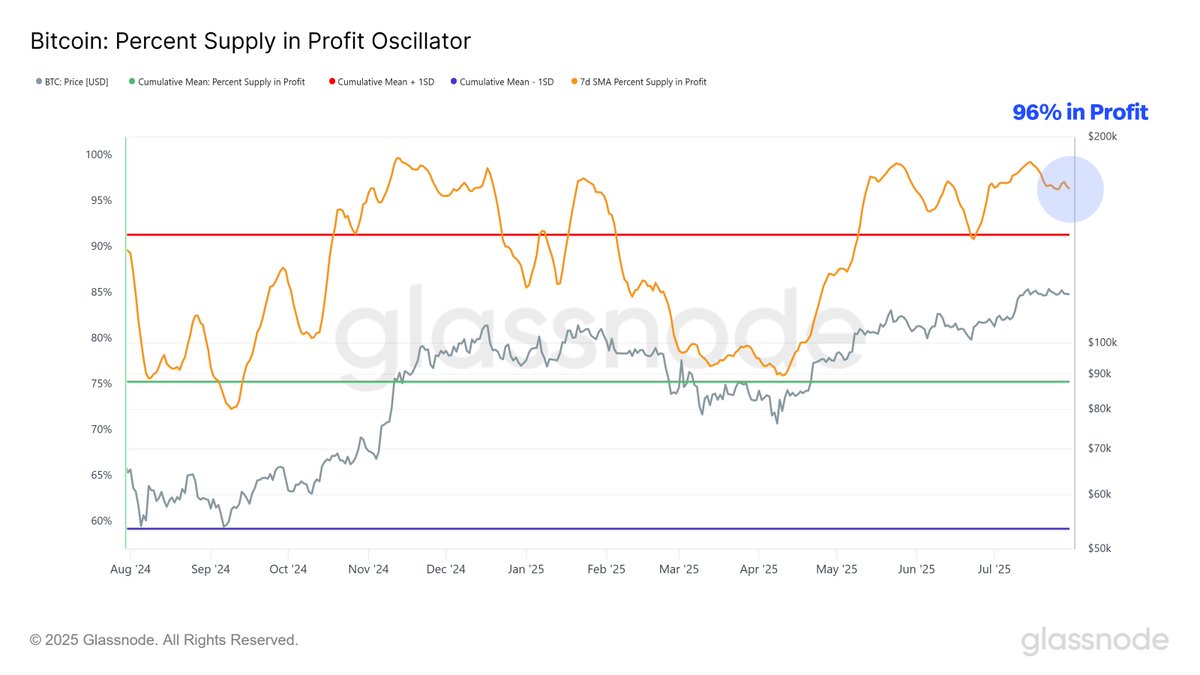

Supporting the case for top market optimism, on-chain analytics agency Glassnode reported that 96% of all Bitcoin provide is presently in revenue. Based on their P.c Provide in Revenue oscillator, the metric has stayed above 90% for over a month—a uncommon sign traditionally seen close to euphoric phases of bull cycles.

The agency cautions, nevertheless, that this elevated degree might finally improve the chance of profit-taking. “When almost all holders sit on positive factors, strain to appreciate earnings builds,” Glassnode wrote. The 91% degree represents a key statistical deviation, and a break beneath it might recommend a deeper reset.

Nonetheless, at present ranges, the market seems resilient. The truth that 96% of provide stays in revenue with out triggering main promoting might sign that long-term holders are in management—and ready for even increased costs.

Conclusion

With Bitcoin’s worth motion aligning with technical retests and on-chain metrics reflecting widespread profitability, the stage could also be set for one more rally. Analysts are watching the $112K–$115K zone intently, with $130K because the psychological goal. So long as the supply-in-profit ratio holds, momentum could proceed to construct.