Bitcoin worth has corrected by round 2.4% within the final 24 hours, holding simply above $115,000. Whereas merchants stay cautious, one bullish sample might determine whether or not Bitcoin makes a giant push towards $150,000 or dangers shedding its upward momentum.

Let’s break down the important thing indicators shaping this pivotal second.

Fund Move Ratio Factors to Decrease Promoting Strain

The Fund Move Ratio measures what number of cash are being moved to and from exchanges in comparison with whole on-chain transfers. The next ratio often means elevated alternate exercise, typically linked to promoting. A drop within the ratio means fewer cash are heading towards exchanges, signaling decreased rapid promote strain.

Over the previous two weeks, this ratio has shifted notably:

- Earlier in July, it reached 0.15, matching Bitcoin’s current peak close to $120,000, indicating heightened promoting potential.

- By July 28, it had dropped to 0.11, making a decrease excessive. (First decrease excessive since early July, the purpose the place costs surged)

At press time, it has dropped to 0.07. This downtrend within the Fund Move Ratio means that fewer large gamers wish to promote. Cash are staying in wallets or transferring off exchanges, making a potential provide squeeze that would assist gasoline a breakout if shopping for strain will increase.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

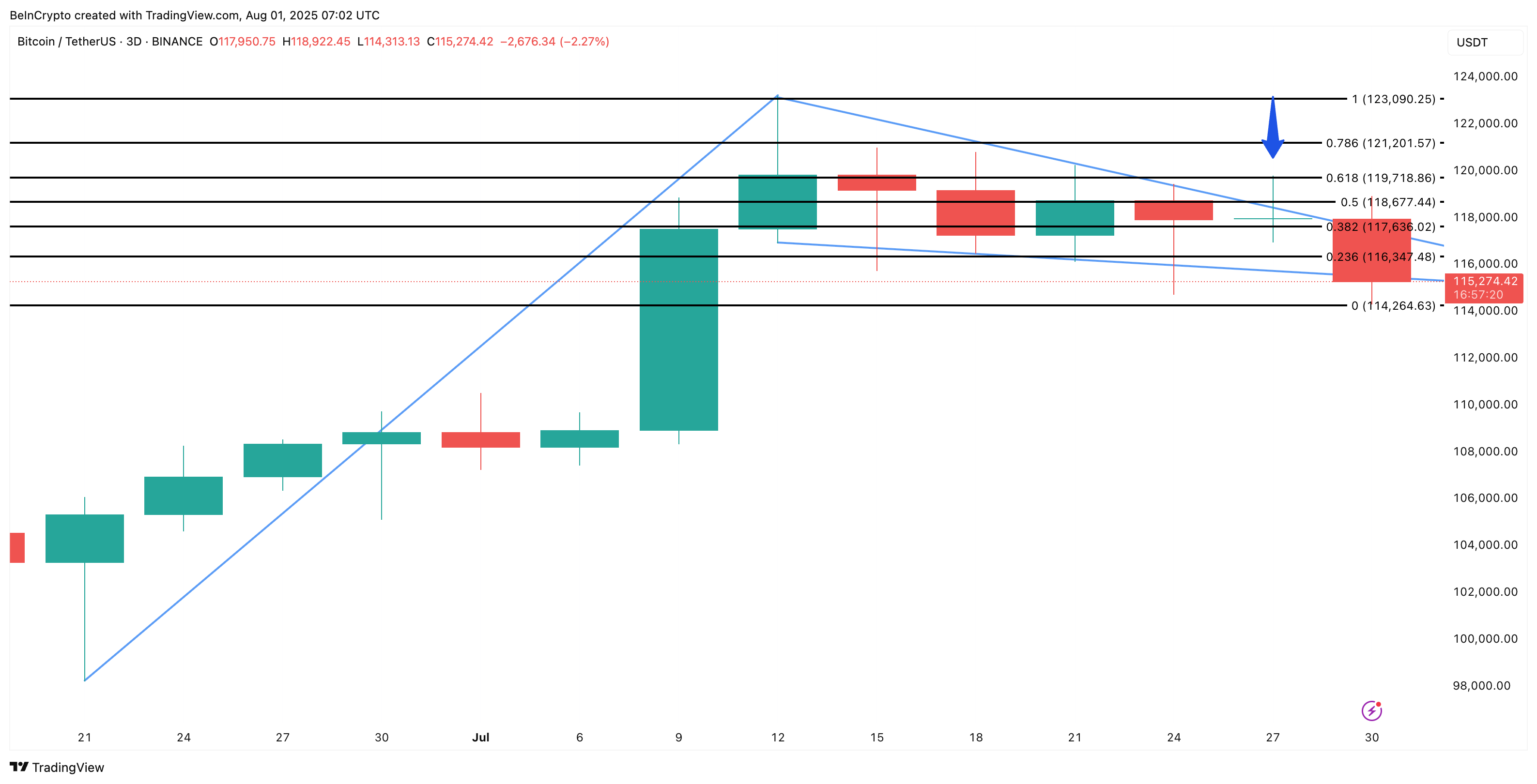

CMF Divergence Reveals Quiet Accumulation

The Chaikin Cash Move (CMF) is a metric that tracks shopping for and promoting strain utilizing each worth and quantity. The next CMF worth signifies sturdy capital inflows, whereas a drop indicators outflows.

On the 3-day chart, a bullish divergence has fashioned:

- Value has been making decrease highs since mid-July.

- On the identical time, CMF has been making greater highs.

This divergence is essential as a result of it suggests that cash is flowing into Bitcoin regardless of the value dips.

The selection of a 3-day chart is deliberate; it smooths out noise from each day volatility and pretend breakouts, giving a clearer view of the place large cash is positioning. Larger timeframe divergences like this typically result in sturdy directional strikes when resistance breaks.

At present, the CMF is across the 0.11 mark, and if it strikes up from right here, forming one other greater excessive, we might get a bullish affirmation for a sample breakout.

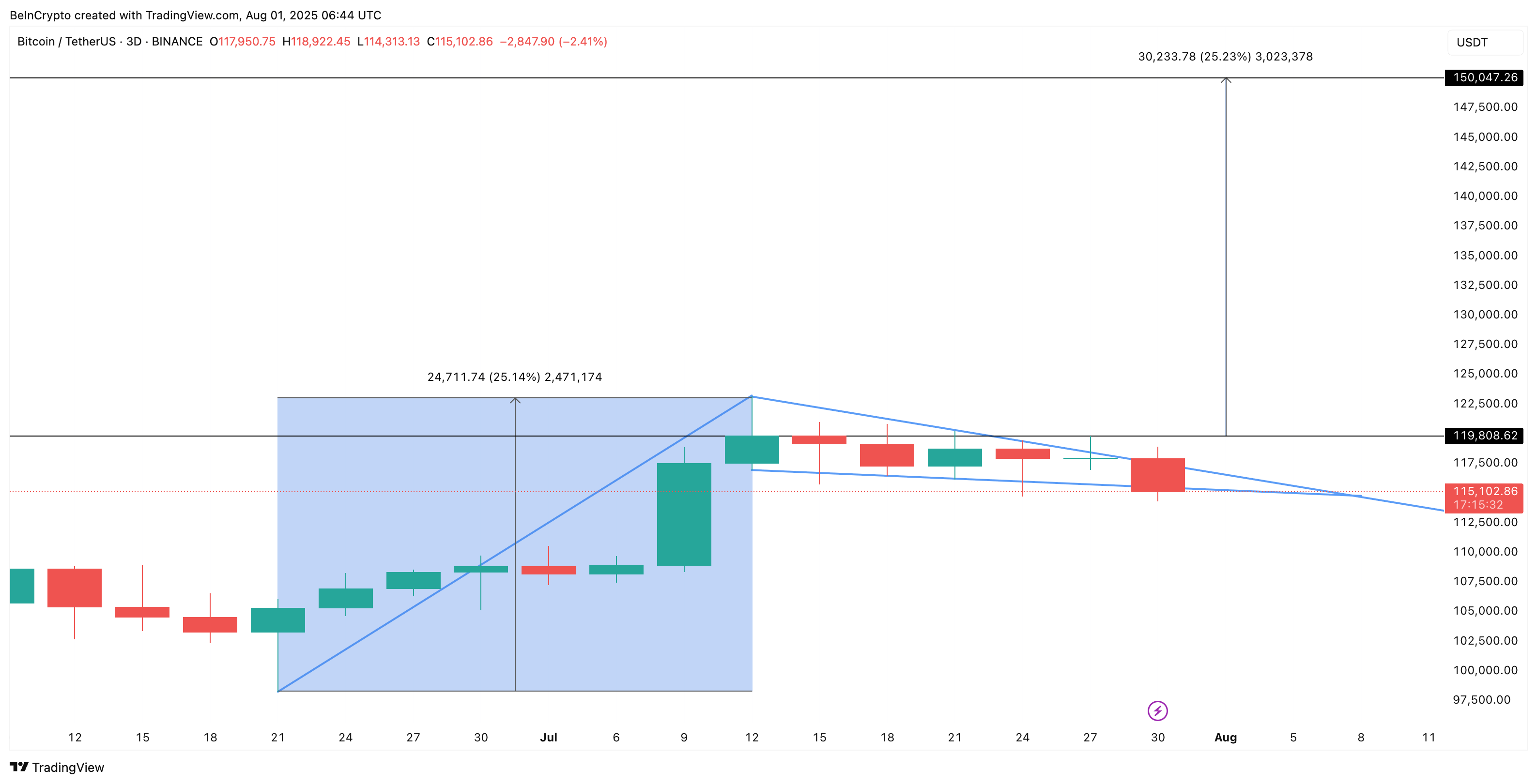

Bullish Pennant Sample Holds the Key $150,000 Bitcoin Value

The three-day chart reveals a basic pole and pennant construction:

- The pole: A pointy 25% rally earlier this month.

- The pennant: A converging consolidation section following the surge.

This setup usually indicators a continuation of the uptrend if resistance breaks. Bitcoin has tried a number of breakouts, with lengthy wicks above and beneath trendlines shortly pulled again on account of excessive volatility.

Notice: Whereas commonplace constructions and patterns can get invalidated after two false breakouts, pole-based constructions have an even bigger rope. Generally, the bullish construction fails if the value drops to shut to 50% of the pole’s peak. Subsequently, the pennant holds for now and stays legitimate so long as $114,000 assist holds.

A confirmed 3-day full candle shut above $119,000 (the very best failed breakout level) would doubtless set off the following leg greater. Based mostly on the measured pole transfer, a 25% breakout from this degree might push Bitcoin to round $150,000, aligning with long-term bullish expectations.

Bitcoin’s subsequent large transfer hinges on a single technical setup. The bullish pennant, backed by decreased alternate outflows and stronger capital inflows on the 3-day CMF, paints a constructive image for bulls. But it surely all comes down to cost motion:

- Above $119,700: Opens the door for a possible surge towards $150,000.

- Beneath $114,000: The bullish setup fails, and draw back danger will increase.

The put up Bitcoin’s $150,000 Dream Hinges on One Bullish Sample: Breakout or Breakdown? appeared first on BeInCrypto.