Bitcoin’s bull cycle stays firmly intact, with July delivering 5 new all-time excessive (ATH) closes, in response to Constancy Digital Belongings.

The asset’s momentum from Q2 has clearly carried over, with the vast majority of buying and selling days reflecting excessive revenue and excessive volatility circumstances—a trademark of what Constancy phrases the “Acceleration Part.”

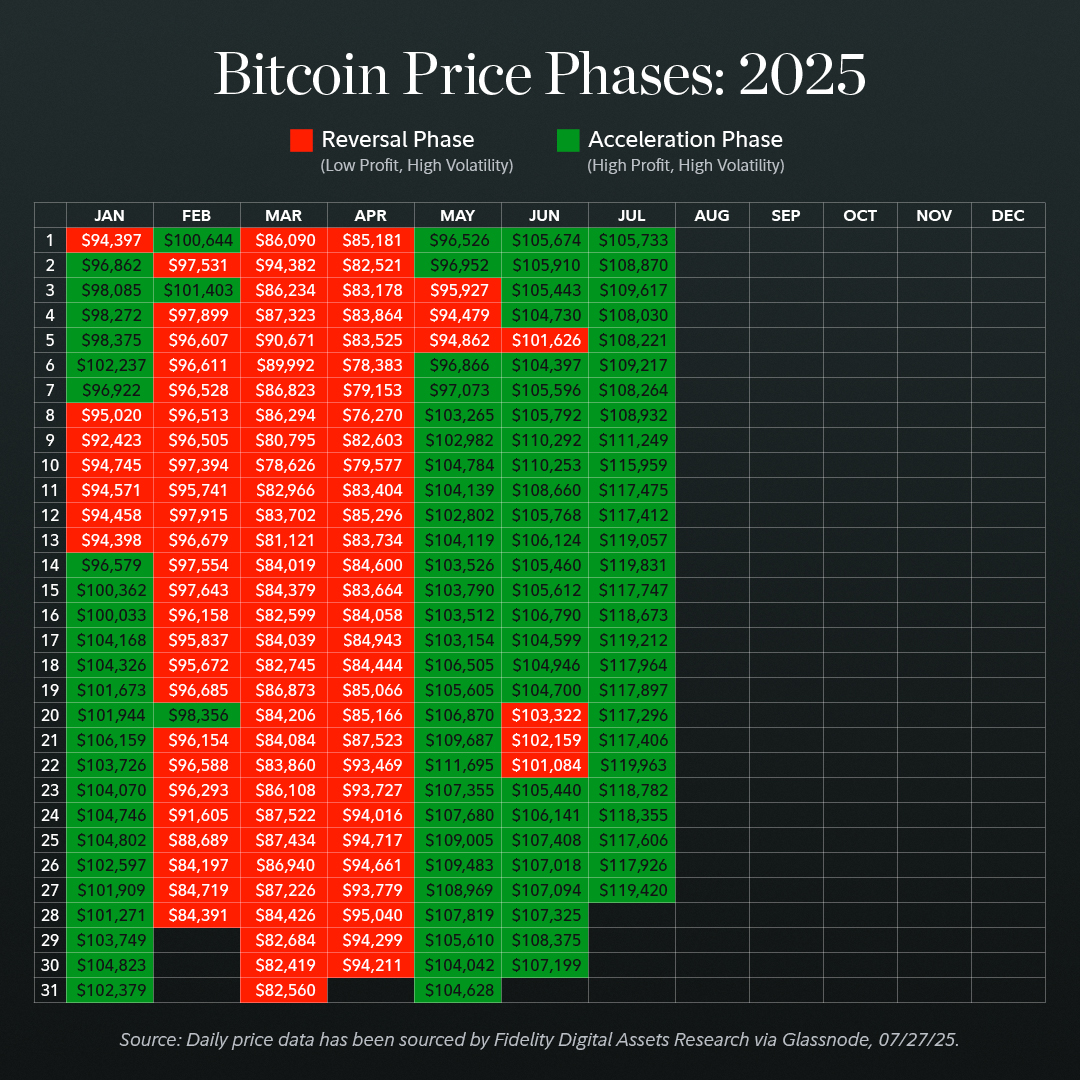

The newly printed chart by Constancy reveals that 54 of the previous 91 days—practically 60%—have fallen inside this green-labeled Acceleration Part. This era is characterised by vital value motion and profit-taking alternatives, usually previous the ultimate leg of a bull market.

July’s shut at $119,420 on the thirtieth displays one of many strongest streaks in current reminiscence. The value motion contrasts sharply with the sooner months of the 12 months, notably February by way of April, which confirmed extended intervals of consolidation and low revenue amid excessive volatility—Constancy’s so-called “Reversal Part.”

Whereas August has simply begun, all eyes are on whether or not Bitcoin can maintain this rally or if indicators of a “blow-off prime” start to emerge. Constancy’s analysis crew notes that they’ll be expecting any indicators of weakening momentum or overheating as Bitcoin enters probably euphoric territory.

With Bitcoin firmly above $100,000 and volatility rising alongside revenue margins, buyers and analysts alike are bracing for both one other leg up—or the start of the top for this acceleration wave.