Welcome to the Asia Pacific Morning Transient—your important digest of in a single day crypto developments shaping regional markets and world sentiment. Seize a inexperienced tea and watch this area.

DeFi TVL hits pre-Terra ranges whereas IMF formally acknowledges crypto in nationwide accounts. Visa expands stablecoin assist throughout a number of blockchains as institutional adoption accelerates amid rising regulatory readability worldwide.

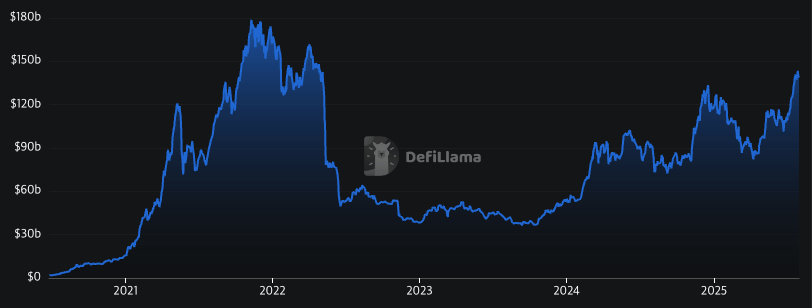

DeFi Summer time Again? TVL Hits Pre-Terra Ranges

DeFi whole worth locked reached $138 billion, matching pre-Terra collapse highs. The sector briefly exceeded $140 billion through the July 28-30 buying and selling periods. This marks the best TVL since Could 2022’s UST-LUNA disaster.

Lending and staking companies drove the restoration throughout main protocols. AAVE leads with $34.405 billion in locked belongings for lending operations. Lido follows intently at $33.619 billion in liquid staking companies.

EigenLayer rounds out high three with $18.029 billion in restaking protocols. Whether or not this indicators a sustained DeFi revival stays unsure. Market observers query if momentum can surpass 2020’s unique summer season.

IMF Embraces Crypto in Nationwide Accounts

The Worldwide Financial Fund softened its stance on digital belongings this week. International regulators up to date nationwide wealth measurement requirements to incorporate Bitcoin and cryptocurrencies. The revised System of Nationwide Accounts now classifies crypto as “non-produced nonfinancial belongings.”

Nations will report crypto holdings on nationwide stability sheets beginning 2029-30. These belongings stay excluded from GDP calculations however achieve formal recognition. The change displays rising adoption and potential monetary stability implications.

El Salvador advantages considerably from this coverage shift amid ongoing IMF negotiations. The nation’s 6,000+ Bitcoin holdings will now seem in official wealth statistics. This improvement marks a realistic flip in institutional acceptance of digital belongings.

The framework modernizes financial knowledge assortment for the digital age. New tips additionally cowl synthetic intelligence, cloud companies, and digital platforms. Regulators goal to stability monetary innovation with systemic stability issues.

Visa Expands Stablecoin Assist Throughout A number of Blockchains

Visa added PayPal’s PYUSD, euro-backed EURC, and International Greenback to its platform. The fee large now helps Stellar and Avalanche blockchain networks. Customers can ship funds or convert stablecoins to fiat forex.

The enlargement builds on present USDC assist throughout Ethereum and Solana. Visa has processed over $225 million in stablecoin quantity since 2023. Institutional curiosity surged following the passage of the GENIUS stablecoin invoice.

Mastercard reviews 30% of transactions are already tokenized by way of crypto partnerships. JPMorgan and Financial institution of America are growing comparable stablecoin infrastructure. Amazon and Walmart discover issuing proprietary stablecoins for cross-border funds.

The $256 billion stablecoin market attracts conventional finance and tech giants. Visa’s Could funding in BVNK indicators deeper crypto infrastructure dedication. Cross-border transactions stay costly by way of legacy fee networks.

The submit DeFi Summer time Returns? IMF Embraces Crypto and Extra appeared first on BeInCrypto.