Bitcoin’s on-chain metrics are sounding an alarm. The Reserve Threat indicator—extensively used to evaluate long-term holder conviction and value valuation—has as soon as once more signaled a possible market high.

Based on analyst Darkfost, this sign comes as a big batch of outdated BTC cash have been just lately moved, a shift that has traditionally preceded intervals of short-term corrections and value consolidation.

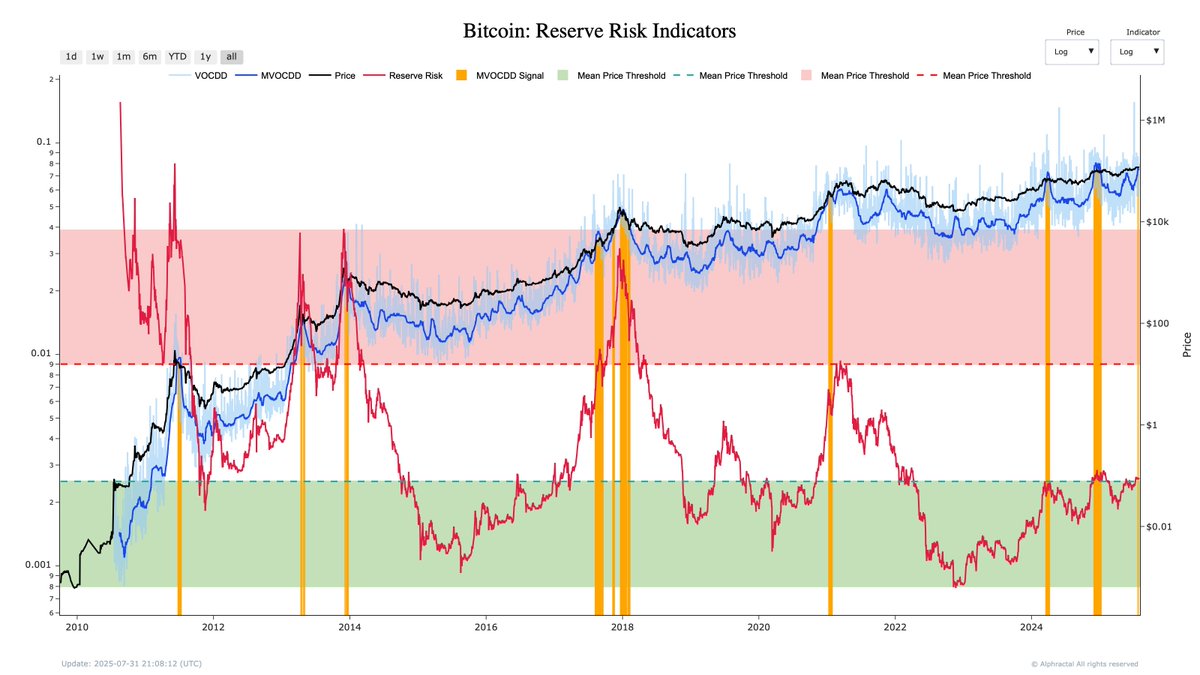

The Reserve Threat mannequin combines metrics like Coin Days Destroyed (CDD) and its momentum (MVOCDD) to guage the boldness of long-term holders (LTH) relative to Bitcoin’s value.

When this metric surges—notably after a considerable amount of aged cash transfer—it typically displays rising investor eagerness to dump into energy, sometimes close to native tops. As proven within the newest chart from LookIntoBitcoin, that is the third time MVOCDD has flashed such a warning since 2017. Every prior occasion led to a notable value cooling-off interval.

What makes this occasion particularly notable is the sharp uptick in MVOCDD at a time when Bitcoin stays close to multi-year highs. The newest transfer suggests long-term holders—who traditionally promote solely throughout robust market euphoria—are beginning to scale back publicity. With Bitcoin nonetheless hovering above $60K, this shift might indicate that institutional or OG wallets are getting ready for turbulence forward.

Whereas not a assure of reversal, Reserve Threat has a powerful observe file of figuring out overheated circumstances. Merchants and buyers might wish to keep alert. An area high might already be in—except new momentum overrides historic conduct.