A big quantity of Bitcoin (BTC) and Ethereum (ETH) choices expires on August 1, 2025, positioning the crypto marketplace for volatility.

Like month-to-month choices expiry, weekly ones can affect value course or trigger value to pin close to key strike ranges as merchants hedge or unwind positions.

Bitcoin, Ethereum Choices Expiry Looms With Over $7 Billion at Stake

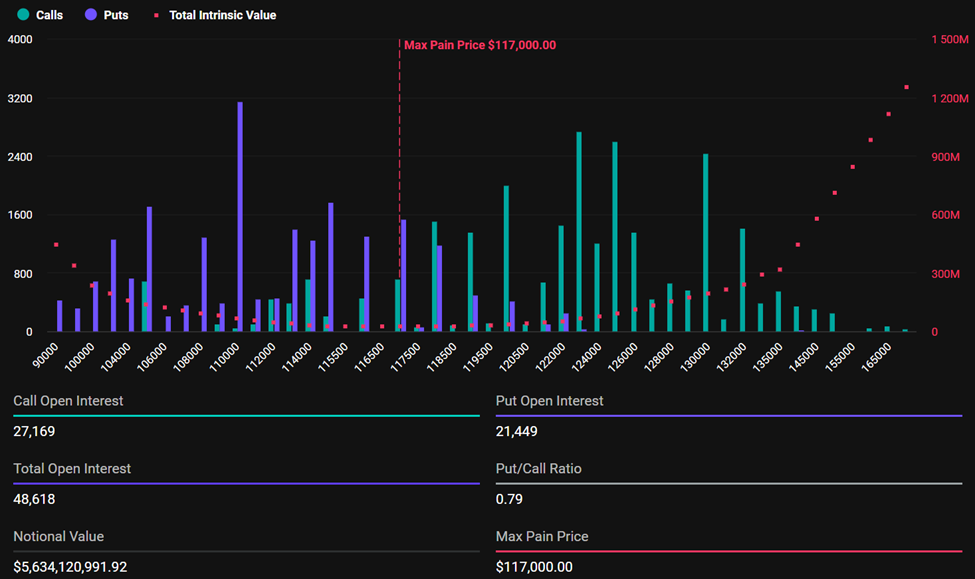

Knowledge on Deribit exhibits as we speak’s expiring Bitcoin choices have a most ache degree or strike value of $117,000, which is effectively above its present value of $116,003.

In the meantime, complete open curiosity, the sum of all Put (Sale) and Name (Buy) choices, is 46,618. Expiring Bitcoin choices as we speak have a notional worth of $5.6 billion.

Based mostly on the present value, choices merchants maintain Bitcoin choices for round 48,568.75 BTC tokens.

With a Put-to-Name ratio (PCR) of 0.79, Deribit information exhibits a prevalence of Name choices, suggesting a common bullish sentiment.

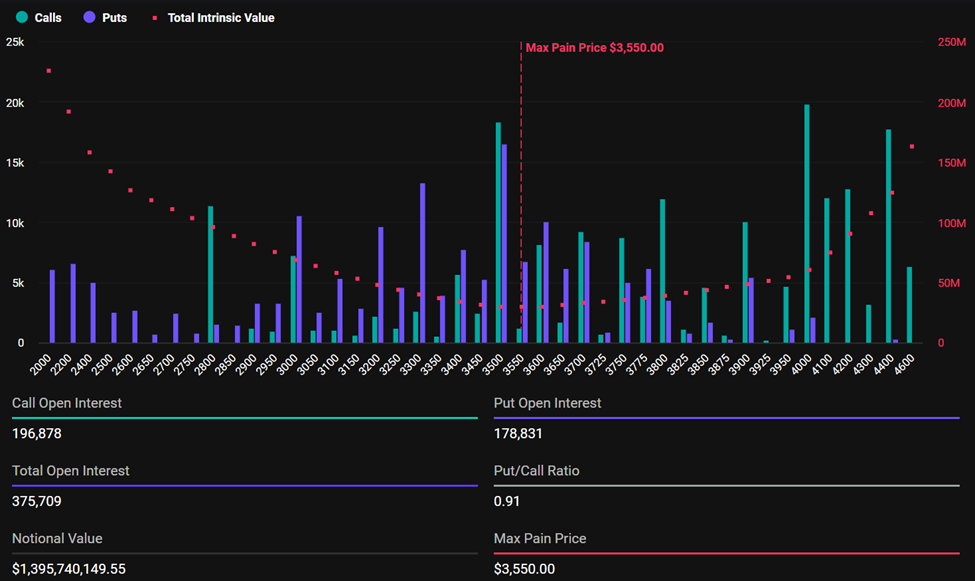

Elsewhere, Ethereum expiring choices have a PCR of 0.91. This factors to a cautious however optimistic outlook available in the market, as buy orders exceed sale orders.

Most merchants will really feel essentially the most monetary ache on the $3,550 most ache degree in as we speak’s Ethereum expiring choices. In contrast to Bitcoin, Ethereum’s value is effectively above its strike value.

In the meantime, complete open curiosity for expiring ETH choices is 375,709, indicating that extra capital is deployed on ETH choices contracts than in BTC ones. This may occasionally additionally counsel that merchants present higher curiosity in Ethereum’s near-term volatility.

Different causes for extra ETH open curiosity than Bitcoin are that Ethereum is turning into extra dominant in derivatives markets amid an abounding Ether narrative. Knowledge on Deribit exhibits the notional worth for as we speak’s expiring ETH choices is $1.39 billion.

As choices close to expiration, costs are likely to gravitate towards their respective max ache ranges, suggesting a modest correction for ETH and a slight restoration for BTC. That is because of the actions of sensible cash, who promote choices to retail merchants, wanting them to run out nugatory.

Their actions reduce payouts on each calls and places by pinning costs close to most ache ranges.

Notably, this manipulation will not be all the time intentional. Typically, simply hedging conduct causes pure gravitation towards max ache.

Nevertheless, when liquidity is skinny and positioning is lopsided, it will probably seem like the value is being steered there.

“BTC positions are huge, however value is holding proper above max ache. ETH’s additionally pinned simply above $3.5K. Will expiry act as a magnet or a springboard?” analysts at Deribit posed.

Company Purchases Present Fragile Assist

Elsewhere, analysts at Greeks.dwell level to a divided market sentiment, highlighting $116,000 as a vital assist for Bitcoin. To the upside, the pioneer crypto faces potential resistance round $118,000.

“…[there’s] disagreement on whether or not the latest dip represents a shopping for alternative or the beginning of a deeper correction,” wrote Greeks.dwell.

Notably, the Bitcoin value and the broader crypto market pulled again, a correction probably ascribed to the latest FOMC determination to maintain rates of interest unchanged.

Regardless of the draw back strain in the marketplace, Michael Saylor’s Technique cushions the Bitcoin market from a chronic spiral.

“Technique Corp closed $2.52B IPO and instantly bought 21,021 bitcoins at $117,256, offering important institutional shopping for strain,” analysts at Greeks.dwell added.

On the one hand, analysts level to the provision shock translating to elevated shopping for strain, which might catalyze an upside for the BTC value.

However, some see Technique’s latest buy as provisional assist positioned round $114,000.

“Merchants famous this buy was probably the first purchase assist on the 114 degree, explaining why open curiosity remained flat through the bounce. Neighborhood expressed concern that with out this institutional stream, value might have simply dropped to 115 or decrease, highlighting the market’s present dependence on company treasury flows,” Greeks.dwell famous.

As as we speak’s choices close to expiry, merchants ought to brace for volatility, which might affect value actions into the weekend.

Nevertheless, the market might stabilize quickly after choices expire at 8:00 UTC on Deribit, with merchants adjusting to new market situations.

The submit Over $7 Billion Bitcoin and Ethereum Choices Expire At this time: What Merchants Ought to Anticipate appeared first on BeInCrypto.