August has begun on a tough footing for the crypto market, particularly for ‘made in USA’ cash. Buying and selling exercise has fallen as buyers rush to lock in earnings from July’s sturdy rally. Over the previous week, the worldwide crypto market capitalization has slipped by 5%, signaling a drop in demand and a broader market cooldown.

But amid this lull, just a few ‘Made in USA’ tokens are drawing consideration for his or her potential to buck the pattern. Listed below are three altcoins buyers ought to carry on their radar this month.

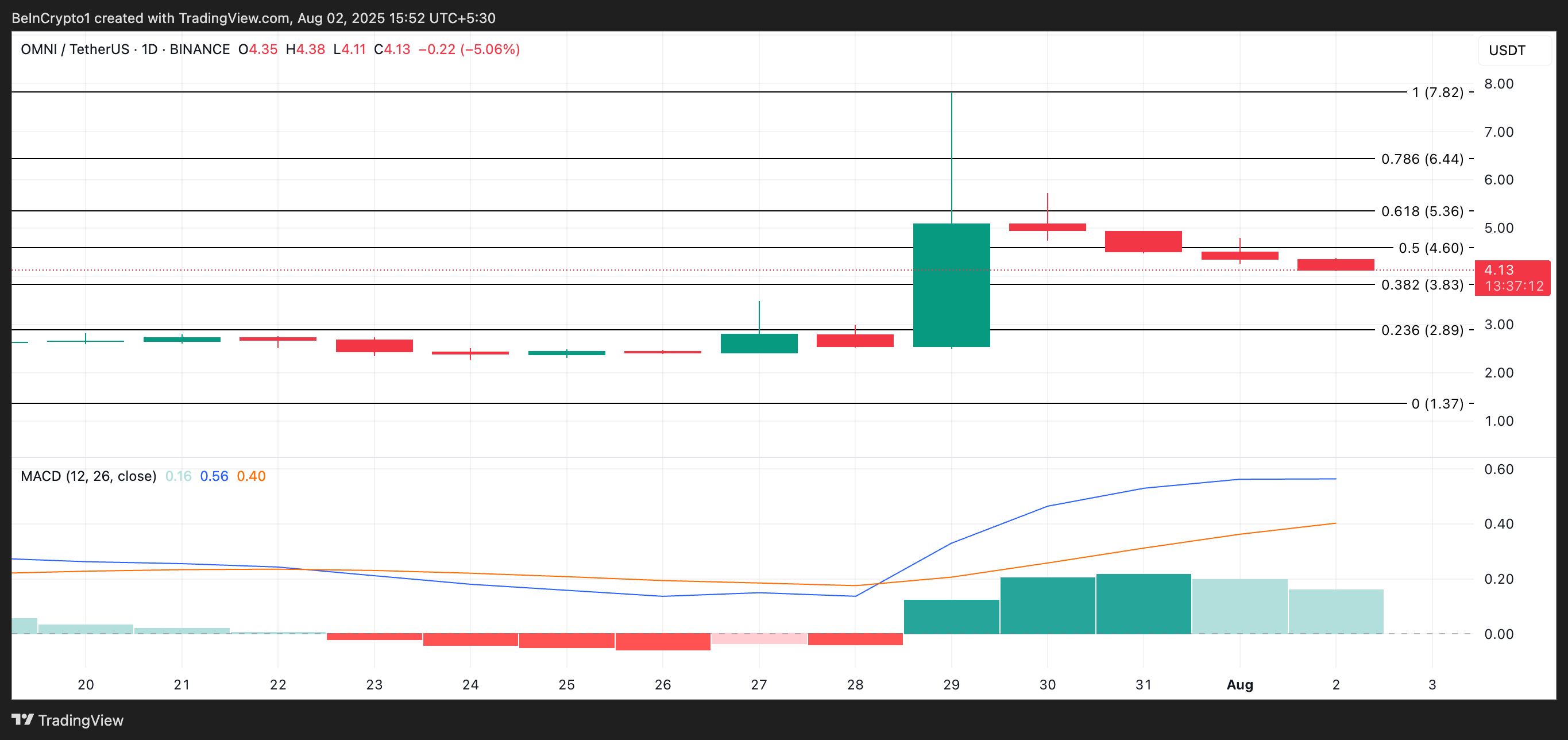

Omni Community (OMNI)

OMNI is up 72% over the previous week. It has bucked the broader market decline recorded up to now seven days to report positive factors. This makes it one of many made-in-USA cash to observe as the primary buying and selling week of August runs its course.

The setup of the token’s Transferring Common Convergence Divergence (MACD) indicator on the day by day chart confirms the bullish bias towards the altcoin. At press time, OMNI’s MACD line (blue) rests above the sign line (orange).

The MACD indicator identifies traits and momentum in its value motion. It helps merchants spot potential purchase or promote alerts by means of crossovers between the MACD and sign strains.

As with OMNI, when the MACD line rests atop the sign line, it signifies bullish momentum. Merchants see this setup as a purchase sign.

If accumulation persists, the token might break above $4.60.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Then again, if demand falls, the token’s value might drop to $3.83.

Story (IP)

At present priced at $5.71, IP has climbed 24% over the previous three weeks — positioning it as one other made-in-USA coin to observe in early August.

Readings from the IP/USD one-day chart reveal that the altcoin has been buying and selling inside an ascending parallel channel since July 11. This chart sample, shaped by drawing two upward-sloping trendlines connecting the asset’s increased highs and better lows, signifies a sustained bullish pattern.

At press time, IP hovers close to the decrease line of the ascending channel. If this help degree holds and accumulation will increase, the altcoin might rally, probably reaching $6.46 within the brief time period.

Nonetheless, a decisive break under the channel’s help line could invalidate the bullish setup. This might set off a steeper decline towards the $4.92 zone.

Zebec Community (ZBCN)

ZBCN is up practically 30% up to now seven days, making it one of many altcoins to observe within the first week of August.

On the day by day chart, the token’s Sensible Cash Index has seen a gradual uptick, highlighting the sustained backing of key token holders. On the time of writing, it’s at 1.

An asset’s SMI tracks the exercise of skilled or institutional buyers by analyzing market habits through the first and final hours of buying and selling. When it drops, it suggests promoting exercise from these holders, pointing to expectations of value declines.

Conversely, as with ZBCN, when the indicator rises, it signifies elevated shopping for exercise. If demand continues to extend, the token’s value might break above $0.0053.

Then again, if shopping for stress flattens, the token’s value might drop towards $0.0047.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.