US spot crypto exchange-traded funds (ETFs) stumbled into August with practically $1 billion in mixed outflows, ending what had been a robust run in July.

Knowledge from SoSoValue revealed that buyers pulled $812 million from 12 US-listed Bitcoin ETFs on August 1. This marked the most important single-day withdrawal in 5 months and the second-worst for this yr.

Crypto ETFs Shock Outflow Contrasts Historic July Positive aspects And Regulatory Developments

Ethereum ETFs, which had just lately gained momentum, additionally noticed notable redemptions on the day.

In whole, $153 million exited the 9 Ethereum merchandise, marking their third-largest single-day outflow since launch and ending a 20-day streak of inflows. In the course of the influx streak, ETH ETFs pulled in additional than $5 billion in recent capital.

This reversal comes on the heels of a banner month in July, the place the crypto business had scored important features.

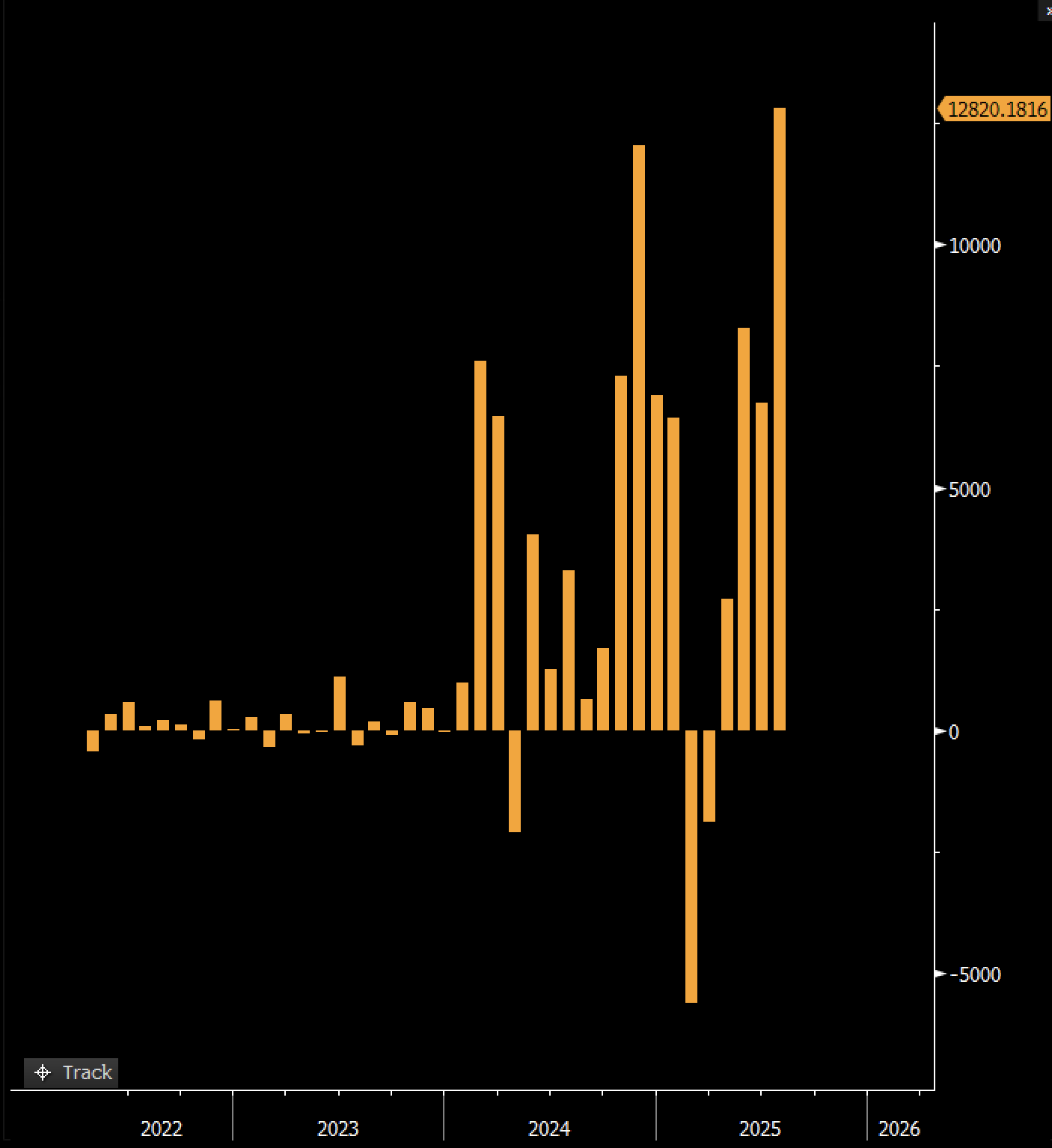

In the course of the interval, Bloomberg senior ETF analyst Eric Balchunas highlighted that US crypto funds attracted $12.8 billion in recent capital. This represented a median every day influx of $600 million.

Notably, the inflows have been broadly distributed, with each Bitcoin and Ethereum merchandise contributing considerably.

Balchunas famous that this tempo outstripped even the efficiency of prime standard ETFs just like the Vanguard S&P 500 ETF (VOO).

So, the timing of the downturn has raised eyebrows throughout the business, particularly as regulatory developments appeared to favor continued progress in crypto markets.

In July, SEC Chair Paul Atkins unveiled “Undertaking Crypto,” a brand new regulatory initiative. The venture goals to modernize US securities legal guidelines to higher align with blockchain-based monetary programs.

“The SEC is not going to stand idly by and watch improvements develop abroad whereas our capital markets stay stagnant. To realize President Trump’s imaginative and prescient of creating America the crypto capital of the world, the SEC should holistically think about the potential advantages and dangers of shifting our markets from an off-chain setting to an on-chain one,” Atkins mentioned.

As a part of this broader push, the SEC authorised in-kind redemptions for crypto ETFs and accelerated the evaluate of functions for exchange-sponsored merchandise.

Contemplating these developments, NovaDius Wealth President Nate Geraci opined that the ETF outflows have been shocking.

In keeping with him, they stood in sharp distinction to the broader momentum seen throughout the crypto market. He additionally described the sudden pullback as a surprisingly muted finish to probably the most pivotal weeks for the digital asset house.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.