- ADA dropped 7.6% in 24 hours, nevertheless it’s nonetheless up practically 29% on the month.

- Whales are promoting, retail is shopping for, and shorts are constructing—making a three-way battle.

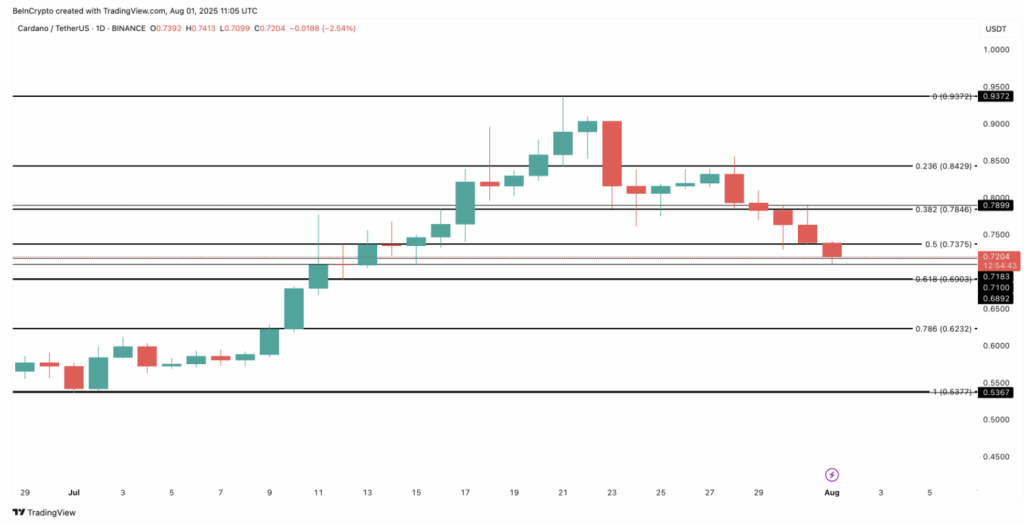

- Break beneath $0.68 = hassle. Break above $0.78 = quick squeeze potential.

Cardano’s had higher days. After operating up nearly 30% up to now month, it simply gave again a giant chunk—down 7.6% within the final 24 hours. So now, merchants are sitting in that bizarre in-between house: a mixture of hope and uh-oh, not once more.

Behind the value drop, there’s a deeper battle occurring. The most important whales are quietly trimming their luggage. Retail of us? Nonetheless HODLing. In the meantime, short-sellers in derivatives markets are beginning to odor blood. With all this push and pull, one spark could possibly be all it takes to tip the scales.

Whales Again Off Whereas Community Exercise Cools

In line with on-chain information, Cardano’s “tremendous whales”—these holding over a billion ADA—have diminished their holdings from 5.43% to five.02% since late June. Sounds small, however in whale territory, even a 0.4% shift is a fairly large deal.

On prime of that, exercise on the community is down. Means down. Energetic addresses have fallen greater than 40% since mid-July, dropping from 42,000 to underneath 25,000. That slowdown began proper after ADA hit $0.92, which now appears to be like like a neighborhood prime. Could possibly be why the whales are cooling off too—they’re watching the identical numbers we’re.

Retail Isn’t Flinching—However Derivatives Merchants Guess In opposition to Them

At the same time as whales again off, retail merchants aren’t letting go. In actual fact, they’ve been pulling ADA off exchanges for months, an indication they’re extra all in favour of stacking than promoting. That’s often bullish—it exhibits conviction.

However not everybody’s shopping for the dip. Over on Bitget, quick sellers are stacking up. There’s $141.7 million in brief positions proper now in comparison with simply $74 million in longs. That’s practically double. It paints a transparent image: leveraged merchants predict extra ache.

So now we’ve bought a three-sided combat: whales trimming, retailers holding, and shorts betting on a breakdown. That blend doesn’t final eternally. Somebody’s gonna blink.

Key Worth Ranges Might Determine the Combat

ADA’s sitting close to some make-or-break ranges proper now. Assist at $0.71 and $0.68 is holding—for now. But when value breaks beneath, we could possibly be a drop to $0.62. And that might most likely set off one other wave of liquidations, wiping out a piece of the remaining longs.

On the flip aspect, if bulls handle to push it again above $0.73 and even $0.78, issues may flip quick. That will put the stress on the shorts as an alternative, particularly if it sparks a mini quick squeeze. From there, the trail towards $0.84 and even $0.93 isn’t that far-fetched.

Who’s Gonna Win This One?

In the meanwhile, it’s a stand-off. Whales are offloading, smallholders are holding agency, and leveraged shorts are circling like sharks. The following huge transfer would possibly come all the way down to only one factor: whether or not this pile of shorts will get squeezed—or retains dragging the value down.