Ethereum might face downward stress in August, because the institutional and whale help that fueled its rally to a July peak of $3,800 seems to be retreating.

With bearish sentiment silently mounting throughout the broader crypto market, the main altcoin now faces a harder climb again towards the $4,000 mark.

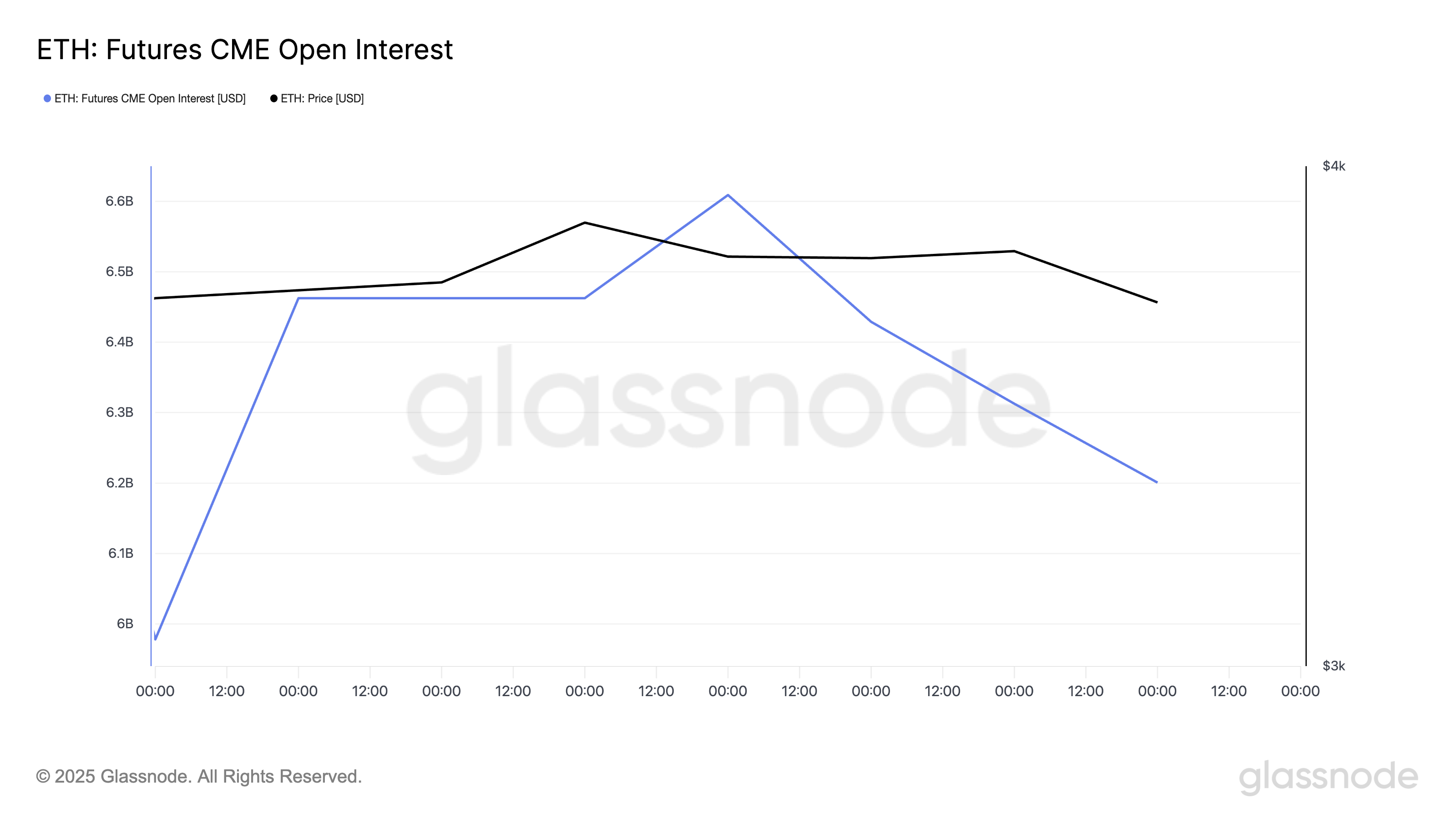

ETH Futures Sink to $6.2 Billion: Institutional Confidence Shedding Steam?

On-chain and derivatives information present a current pattern of decline in exercise among the many market’s largest gamers. For instance, open curiosity in ETH futures contracts on the Chicago Mercantile Change (CME) has fallen sharply, closing yesterday at a five-day low of $6.2 billion.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

This drop is notable, as CME’s ETH futures market is primarily utilized by institutional gamers in search of regulated publicity to the asset. Due to this fact, decrease open curiosity alerts these buyers could also be scaling again their ETH positions.

With out continued institutional engagement, the upward stress on ETH’s worth might weaken, rising the probability of short-term corrections.

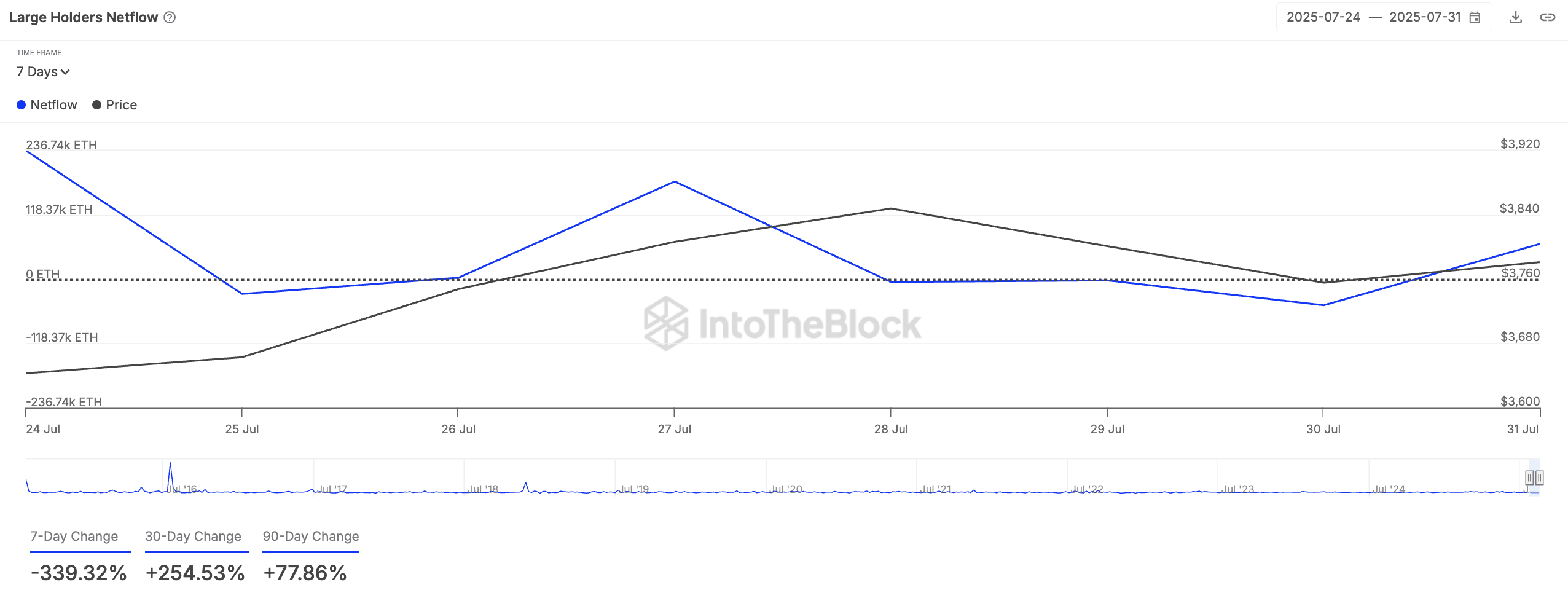

As well as, whale exercise can also be truly fizzling out. A overview of the coin’s on-chain exercise reveals a 339% dip in its giant holders’ netflow over the previous seven days.

Giant holders are whale addresses that maintain greater than 1% of an asset’s circulating provide. Their netflow tracks the distinction between the cash they purchase and the quantity they promote over a selected interval.

When an asset’s giant holders’ netflow will increase, extra tokens or cash stream into main buyers’ wallets than are flowing out. This pattern signifies that these holders are accumulating the asset, signaling confidence in its future worth.

Conversely, when it plunges, it marks a cooling in high-conviction accumulation, weakening short-term worth help.

Ethereum Tanks 10% as Promoting Strain Surges—Is $3,314 Subsequent?

At press time, ETH trades at $3,620, down practically 10% over the previous day. Throughout that interval, its buying and selling quantity rocketed by 17%, making a destructive divergence. This divergence emerges when rising buying and selling exercise coincides with falling costs, signaling intensified promoting stress.

If this continues, ETH’s worth may fall to $3,524. A breach under this key help ground may result in a deeper decline to $3,314.

Nonetheless, if demand resumes, ETH may regain and climb to $3,859.

The submit Ethereum’s Transfer to $4,000 Stalls as Whales and Establishments Pull Again appeared first on BeInCrypto.