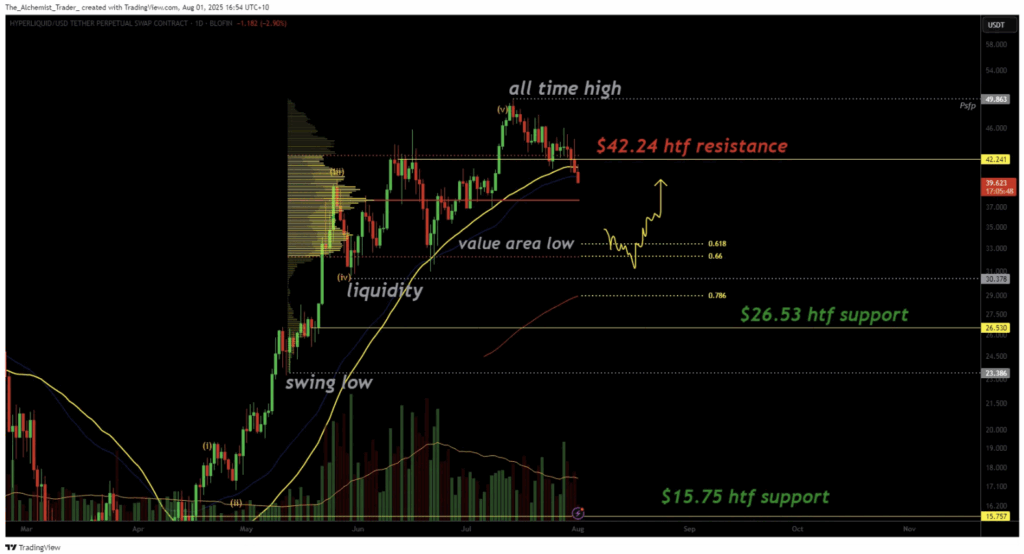

- HYPE misplaced the $42.24 stage after a failed breakout, coming into correction territory.

- Assist ranges to look at: Level of management (present take a look at) and the $30 zone beneath.

- Quantity’s fading, which will increase the danger of deeper draw back until bulls step in quickly.

Effectively… that breakout didn’t final lengthy. HyperLiquid (HYPE) made a daring run above $42.24—setting recent all-time highs—solely to slide proper again beneath it, dropping grip on what many thought of a significant resistance-turned-support stage. And now? The chart’s beginning to appear like a slow-motion retreat.

With quantity drying up and value sliding, HYPE’s momentum is formally in correction mode. All eyes are on that decrease help close to $30. If this retains up, we is likely to be headed there prior to anticipated.

Breakout Rejected, Correction Kicks In

After flirting with the highest, HYPE fumbled the $42.24 breakout and rolled over. What ought to’ve been the bottom for a brand new rally was a fake-out—a textbook deviation that usually alerts extra draw back.

The value is now heading towards the purpose of management (POC), a reasonably essential space that hasn’t been stress-tested on this present pullback. If it doesn’t maintain right here, the worth space low round $30 is the following doubtless cease. And yeah, that stage’s nonetheless acquired a giant ol’ batch of untapped liquidity.

Quantity’s Drying Up — That’s Not Nice

Since hitting that all-time excessive, buying and selling quantity has been fading. That’s… not precisely what you wanna see in case you’re hoping for a restoration bounce. With out sturdy purchase curiosity, each help stage turns into a perhaps relatively than a must-hold.

If $30 doesn’t catch this fall, the following stage to look at is down round $26.53. A drop that low would mainly carve out a wider vary between $42.24 and $26.53—a uneven zone that might stick round until patrons present up with actual conviction.

Nonetheless Bullish… Type Of?

Now, let’s not hit the panic button simply but. Technically, the macro bullish construction isn’t damaged—but. So long as HYPE holds above that worth space low on the day by day shut, this might nonetheless form up as only a basic dip inside a bigger uptrend.

But when that ground provides approach? Then we’re speaking about one thing greater. A deeper consolidation, perhaps even the beginning of a broader development shift.