Bitcoin has dropped to $113,000 at the beginning of August, triggering renewed promoting stress throughout the crypto market. Whereas some merchants concern additional losses, many long-term Bitcoin holders see it as short-term noise and a possible shopping for alternative.

In the meantime, MicroStrategy’s Michael Saylor is doubling down, planning a large $4.2 billion Bitcoin buy. This daring transfer raises the query: will it set off a Bitcoin restoration, or is now the time to shift focus to the very best altcoin to purchase in 2025?

Supply – 99Bitcoins YouTube Channel

Technique Plans $4.2B STRC Providing to Gas Main Bitcoin Buy

Technique, the Bitcoin-focused agency led by Michael Saylor, is pushing ahead with its aggressive BTC accumulation plan. Simply days after elevating over $2.5 billion, the corporate filed with the SEC to safe one other $4.2 billion by promoting its Bitcoin-backed safety, STRC.

The submitting particulars a brand new inventory providing involving main establishments like Morgan Stanley, Barclays, and TD Securities.

These shares, labeled below its Variable Price Collection A Perpetual Stretch Most well-liked Inventory, are listed on Nasdaq and at the moment commerce round $94.50. The corporate has not but introduced when the providing will start.

Technique goals to make use of the proceeds for basic company initiatives, primarily to develop its Bitcoin reserves.

Earlier within the week, it spent almost your entire earlier elevate to amass 21,021 BTC, boosting complete holdings to 628,791 BTC. The present worth of those holdings is $46.8 billion, with a mean buy value of $73,227 per coin.

The corporate additionally reported $14 billion in Q2 working earnings, fueled largely by unrealized positive factors from honest worth changes on its BTC holdings. CEO Phong Le famous that Technique’s capital strikes have elevated its Bitcoin per share (BPS) by greater than 25% this 12 months.

With current choices similar to STRK, STRF, STRD, and now STRC, Technique has introduced in over $10 billion. As investor urge for food for BTC-backed securities continues to develop, the agency raised its full-year targets to a 30% BTC yield and $20 billion in Bitcoin-related positive factors.

Bitcoin Value Prediction

Bitcoin is at the moment going by means of short-term volatility, however its long-term efficiency and market sentiment stay sturdy.

The current value drops, even with main patrons like Michael Saylor actively accumulating, stem from a mixture of macroeconomic elements, leverage-related sell-offs, and seasonal patterns.

A cautious method from the Federal Reserve and the introduction of latest commerce tariffs have triggered a risk-off temper in broader monetary markets, which has weighed on cryptocurrencies.

The preliminary dip in Bitcoin’s value set off a sequence response of leveraged lengthy place liquidations, pushing costs decrease. Throughout this era, figures like Eric Trump have as soon as once more urged traders to “purchase the dip,” reaffirming their assist for Bitcoin through the market pullback.

Traditionally, August has additionally been a difficult month for Bitcoin, with the asset usually going through declines throughout this era. Regardless of these short-term headwinds, Bitcoin’s long-term fundamentals stay strong.

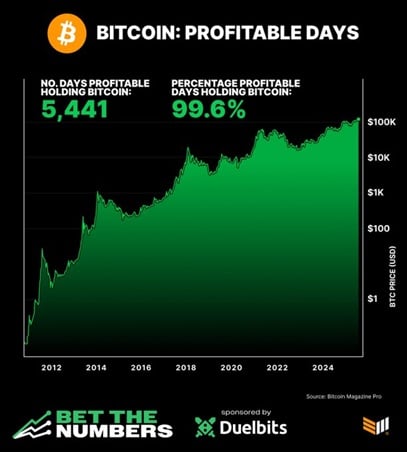

Supply – Bitcoin Journal Twitter

Its year-to-date efficiency exhibits a 72% enhance, reflecting continued power and upward momentum. Over its historical past, Bitcoin has delivered earnings on greater than 5,441 days, that means holders have seen positive factors on over 99.6% of all days.

Simply earlier than the most recent bout of volatility, Bitcoin ended July at a document month-to-month shut of $115,750, highlighting its general bullish pattern.

Supply – Crypto Jack

Analysts proceed to level to technical and market indicators that assist a constructive outlook. Crypto Jack just lately noticed that Bitcoin is holding sturdy at a key assist stage, suggesting a possible transfer above $117,000 if bullish momentum continues.

Coinvo additionally famous that Bitcoin appears to be repeating the identical market cycle sample seen in 2013, 2017, and 2021. If this pattern continues, it might mark the beginning of one other main upward rally within the crypto market.

Bitcoin Demand Surges as Establishments and Firms Speed up Accumulation

Bullish sentiment for Bitcoin extends past Michael Saylor. Institutional gamers proceed to drive the cryptocurrency’s development. BlackRock’s Bitcoin ETF (IBIT) has attracted over 1 million traders, with 75% of them being new to the agency.

This exhibits that conventional traders more and more use ETFs as an entry level into the Bitcoin market. BlackRock’s IBIT now manages $87 billion in belongings and contributes a big share of all spot Bitcoin ETF buying and selling quantity.

Bitcoin Archive X reviews that Japan’s Metaplanet plans to lift as much as 555 billion yen (round $3.6 billion USD) to purchase extra Bitcoin, becoming a member of the rising wave of company adoption.

Strikes like these from publicly traded corporations mirror a rising pattern of company treasuries diversifying into Bitcoin and reinforcing its position in world finance.

Many long-term holders view the current dip as a transparent shopping for alternative. Main firms proceed to build up BTC, whereas each institutional and retail traders movement into the market by means of ETFs.

As Bitcoin adoption accelerates, demand can also be rising for scalable options to assist its increasing ecosystem. That’s the place Bitcoin Layer 2 tasks come into play. With this pattern gaining momentum, Bitcoin Hyper stands out as the very best altcoin to purchase now.

Finest Bitcoin Different to Purchase in August 2025

Bitcoin Hyper works like Bitcoin however comes with stronger safety, higher decentralization, and sooner speeds.

Bitcoin is understood for being protected, however it runs slowly and doesn’t assist good contracts by default. Present Layer-2 instruments like Lightning solely assist with funds, and different sidechains usually make issues too difficult.

Bitcoin Hyper chooses a unique path. It retains Bitcoin’s sturdy safety however handles hundreds of transactions per second with immediate finality. It makes use of a “canonical BTC bridge,” which locks your Bitcoin on-chain and provides you wrapped BTC on Bitcoin Hyper to check out new options.

The Bitcoin Hyper presale is booming, with roughly $6.3 million already raised and about $200,000 coming in day by day. Proper now, $HYPER tokens value $0.0125, however that value will quickly go up as the subsequent presale stage.

After the presale, Bitcoin Hyper will launch on a DEX. Individuals on Telegram are additionally speaking about attainable CEX listings. Crypto skilled Borch Crypto thinks these plans might make $HYPER surge in value later this 12 months. CryptoDNES even referred to as it the very best altcoin to purchase.

The roadmap seems promising too. A public testnet will go dwell in August so builders can take a look at Bitcoin Hyper’s good contracts, which work with Solana. By October, validator staking and Chainlink oracle assist will start.

The staking setup is one other massive cause why persons are leaping in early. Staking rewards go as much as 160% per 12 months, with roughly 324 million $HYPER tokens already locked in.

Go to Bitcoin Hyper

This text has been supplied by one in every of our business companions and doesn’t mirror Cryptonomist’s opinion. Please remember our business companions could use affiliate applications to generate revenues by means of the hyperlinks on this text.