The Bitcoin worth surge above $120,000 has reignited hypothesis about the place the flagship cryptocurrency stands within the present cycle. Whereas worth motion alone gives solely a part of the image, on-chain information from the Satoshimeter indicator means that Bitcoin continues to be firmly within the mid-phase of its cycle, pointing to vital potential forward in its long-term trajectory.

Bitcoin Worth Nonetheless In Mid-Cycle Stage

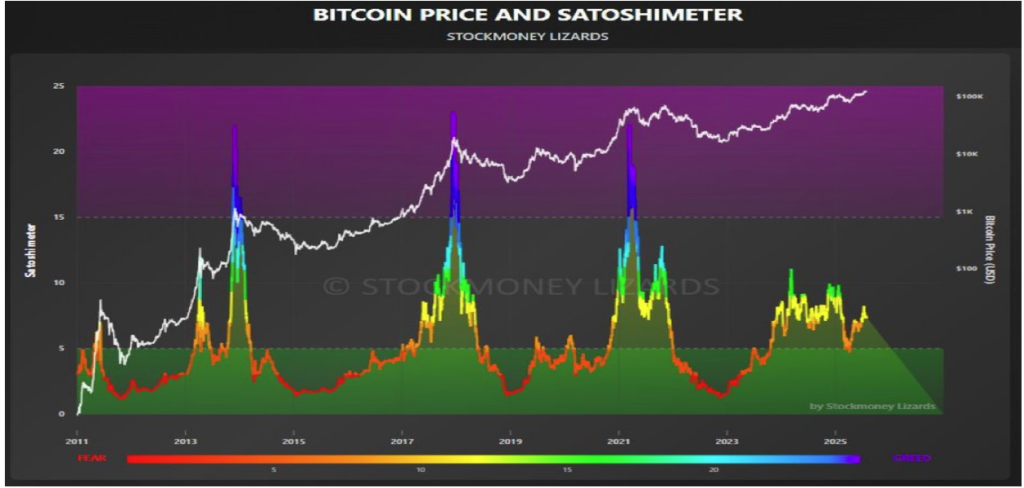

Bitcoin’s climb from $100,000 to a new ATH above $123,000 has introduced contemporary consideration to on-chain metrics used to establish the cryptocurrency’s present stage within the current market cycle. Amongst them, the Satoshimeter, an indicator developed by crypto analyst Stockmoney Lizard, gives a nuanced look into Bitcoin’s actions and worth place.

Associated Studying

In keeping with the professional’s evaluation launched on X social media, the Satoshimeter signaled that Bitcoin continues to be removed from the euphoric peak zones noticed in earlier bull markets. Stockmoney Lizard additionally claimed that Bitcoin’s rally is in its mid-cycle or intermediate part fairly than the last leg of the bull cycle.

Supporting this evaluation, the Satoshimeter employs on-chain metrics to map out Bitcoin’s cyclical conduct, figuring out each long-term bottoms and tops. Traditionally, this indicator’s readings round 1.6 have sometimes marked main bear market bottoms, as seen within the worth chart within the years 2011, 2015, 2019, and 2022. Increased values, alternatively, beforehand aligned with cycle peaks and sometimes signaled sharp corrections.

As of now, the Satoshimeter continues to be properly under the higher extremes, signaling that the Bitcoin worth isn’t but within the overheated zone. The analyst’s chart illustrates this development clearly. Every previous market high is marked by a steep spike within the indicator, aligning with parabolic worth motion and excessive sentiment.

In distinction, present indicator readings are elevated however steady, sitting within the mid-range, properly under ranges seen at previous cycle tops. This means that Bitcoin’s broader bullish construction stays intact, with potential for additional upside on the desk.

Bitcoin To Attain $200,000 This Cycle?

Primarily based on the Satoshimeter’s present degree, Stockmoney Lizards initiatives an prolonged run within the Bitcoin worth. Whereas the current leap above $123,000 displays rising momentum, the analyst anticipates a stair-step development towards a possible excessive of $200,000 earlier than a major market correction units in.

Associated Studying

This projection relies not solely on the readings from the Satoshimeter indicator but additionally on the actions seen in prior cycles, the place BTC sometimes moved by way of a number of phases of accumulation, breakout, and parabolic progress. As of writing, the flagship cryptocurrency is buying and selling at $113,759, reflecting an 8.3% decline from its all-time excessive. With $200,000 set as its subsequent peak goal, this means a possible rally of greater than 75% within the present cycle.

Featured picture from Unsplash, chart from TradingView