Bitcoin has struggled to keep up its upward momentum since reaching a brand new all-time excessive of $122,054 on July 14. At press time, the main cryptocurrency trades across the $113,000 value degree, marking an almost 7.4% decline over the previous 19 days.

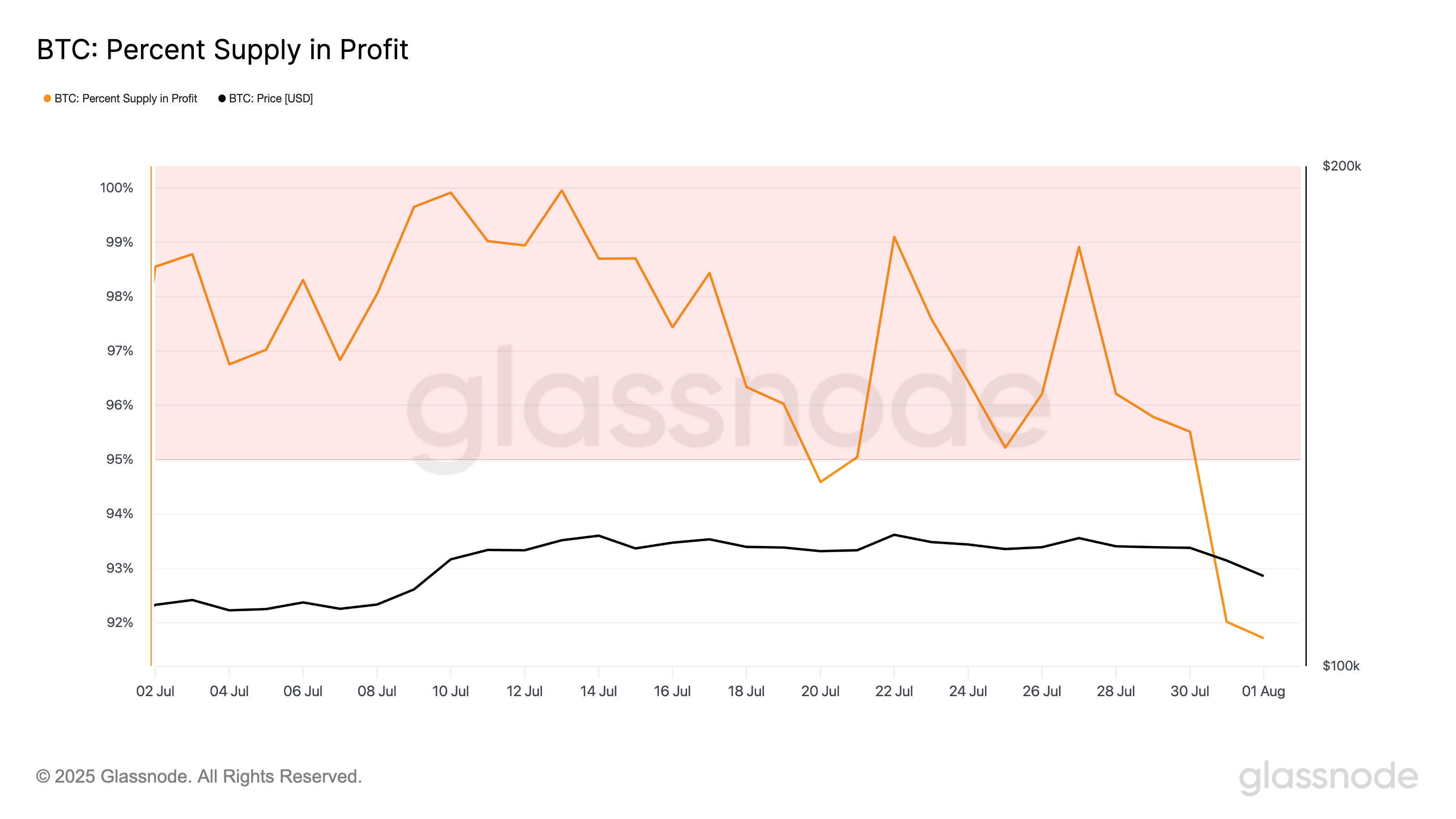

As a consequence of this pullback, the proportion of BTC’s provide in revenue has declined, signaling waning investor confidence. As the brand new buying and selling month runs its course, this development might be a precursor to steeper value corrections.

Bitcoin’s Profitability Falls to 41-Day Low

In response to Glassnode, BTC’s P.c Provide in Revenue fell to a 41-day low of 91.71% on August 1. This metric measures the proportion of BTC’s circulating provide presently held at a revenue. It measures market sentiment, usually peaking throughout euphoric rallies and falling as investor confidence wanes.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

When this metric falls, a rising portion of holders is both breaking even or recording losses. These market situations traditionally coincide with durations of market consolidation or potential value corrections.

The current decline to 91.71% means that the broader market is cooling off after weeks of upward value motion. It displays a shift in sentiment, as fewer holders stay comfortably in revenue.

This might dampen short-term shopping for stress and depart BTC susceptible to an extra dip over the following few buying and selling classes.

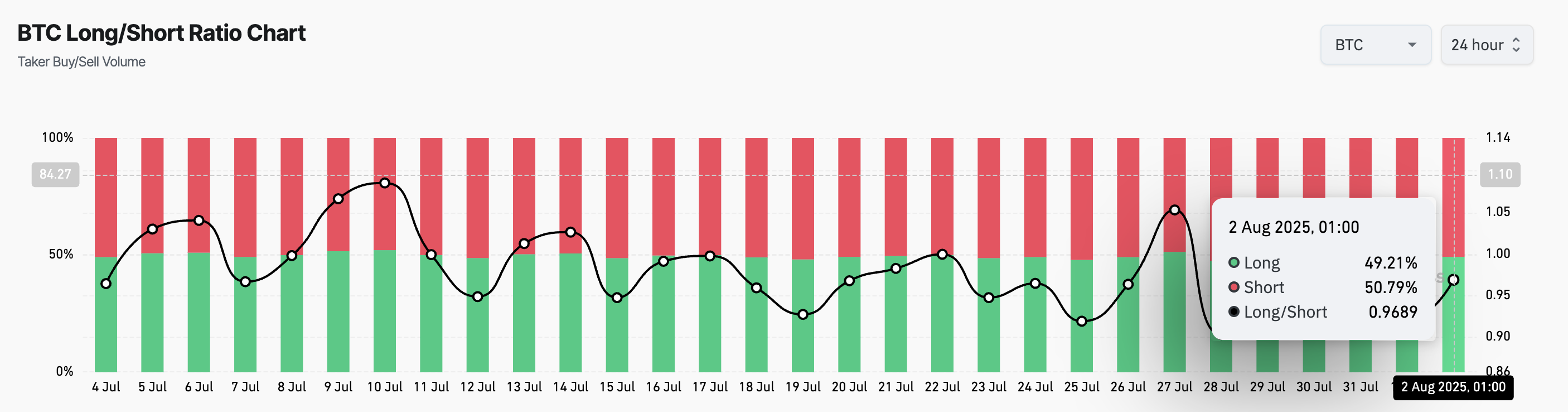

Bitcoin Faces Key Check as Futures Merchants Flip Bearish

BTC’s lengthy/brief ratio has tilted towards bearish territory, confirming that the bullish conviction amongst leveraged merchants may also be fading. At press time, this stands under one at 0.96.

The lengthy/brief metric measures the proportion of lengthy bets to brief ones in an asset’s futures market. A ratio above one indicators extra lengthy positions than brief ones. This means a bullish sentiment, as most merchants count on the asset’s worth to rise.

Then again, an extended/brief ratio under 1 implies that extra merchants are betting on the asset’s value to say no than these anticipating it to rise.

With fewer merchants keen to wager aggressively on continued upside, BTC might discover it troublesome to regain momentum until contemporary catalysts emerge.

Bitcoin’s Subsequent Transfer: Breakdown to $111,855 or Breakout Above $120,000?

Bitcoin’s each day buying and selling quantity has dropped from its July peaks, signaling decreased market participation. If profit-taking strengthens, the king coin may doubtlessly decline towards $111,855.

Nonetheless, if new demand enters the market, the coin’s value may regain energy and climb towards $116,952. A breach of this resistance is vital earlier than the coin can rally again above $120,000.

Disclaimer

Consistent with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.