Launched by Vitalik Buterin, Joseph Lubin, Charles Hoskinson, Gavin Wooden and others, the Ethereum (ETH) blockchain advanced into the spine of the worldwide cryptocurrency financial system.

It pioneered the sensible realization of the good contracts idea, originated dozens of second-layer blockchains and, to some extent, formed Web3 as we all know it immediately.

On this information, U.In the present day makes a look-back on key milestones Ethereum (ETH) achieved to date — and gives an outline of some main upcoming developments.

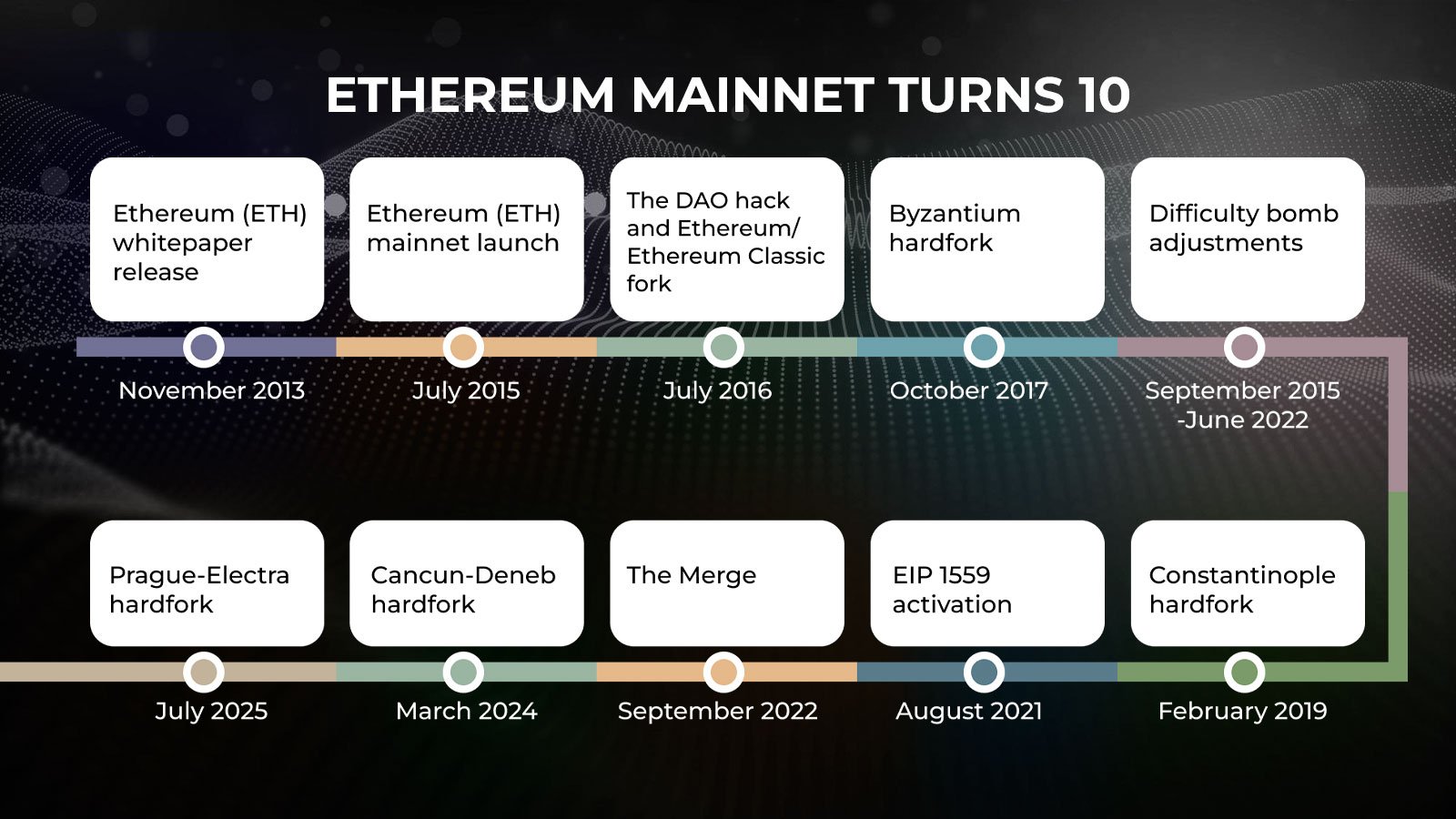

Ethereum (ETH) mainnet is 10 years outdated: Key milestones

Ethereum, the primary and largest programmable blockchain (decentralized community appropriate not just for funds, but in addition for good contract execution), went reside on mainnet July 30, 2015. Listed here are Ethereum’s (ETH) most important milestones.

- Ethereum (ETH) whitepaper launch — November 2013

- Ethereum (ETH) ICO and mainnet launch — July 2014-July 2015

- The DAO hack adopted by Ethereum/Ethereum Basic fork — June-July 2016

- Byzantium onerous fork — October 2017

- Issue bomb changes — September 2015-June 2022

- Constantinople onerous fork — February 2019

- EIP 1559 activation — August 2021

- The Merge — September 2022

- Cancun-Deneb onerous fork — March 2024

- Prague-Electra onerous fork — July 2025

In these 10 years, Ethereum (ETH) cemented itself because the spine for the worldwide digital property economical phase.

Regardless of extreme competitors from Solana (SOL) and its personal L2 platforms like Polygon (POL), Optimism (OP), Arbitrum (ARB) and Base (BASE), Ethereum (ETH) stays the dominant blockchain for decentralized functions of every kind.

What’s Ethereum?

Ethereum (ETH) is a programmable blockchain, i.e., a decentralized protocol able to working good contracts — remoted autonomous software program packages. Because of this chance, Ethereum (ETH) acts because the “world pc” for decentralized functions or dApps.

Ethereum (ETH) was launched on mainnet in 2015 after a profitable $18 million preliminary coin providing (ICO).

Ethereum (ETH) was launched by six co-founders: Vitalik Buterin, Gavin Wooden, Joseph Lubin, Mihai Alisie, Anthony Di Iorio and Charles Hoskinson. Vitalik Buterin is named Ethereum’s (ETH) inventor, whereas Gavin Wooden was the primary CTO, and Joseph Lubin launched the key Ethereum (ETH) growth studio ConsenSys.

Ethereum (ETH) pioneered the utilization of blockchains for decentralized functions, shifting its technical function far past sending transactions, which was informal for early-stage blockchains like Bitcoin (BTC), Litecoin, or XRP Ledger (XRPL).

Ethereum turns 10: Why this issues

Ethereum (ETH) celebrating its tenth anniversary is a large milestone for your complete cryptocurrency ecosystem and the decentralized functions scene globally.

- Sustainability. Ethereum (ETH) managed to create sustainable and balanced technical and economical methods that don’t want exterior fundraising.

- Management. Regardless of savage rivalry within the blockchain phase, Ethereum (ETH) stays the largest blockchain by TVL, the whole variety of lively dApps and lots of exercise metrics.

- Flexibility. Ethereum (ETH) promptly adapts to adjustments within the blockchain phase, activating increasingly more options and adjusting its tech design.

- Ecosystem. Ethereum (ETH) originated an array of Layer-2 blockchains and Ethereum Digital Machine, an execution engine for good contracts.

Additionally, Ethereum (ETH) and its stack — Solidity, Hardhat, Typescript — stays the gateway to blockchain growth for the brand new era of engineers.

Ethereum (ETH) blockchain 10 key milestones: Overview

On this transient overview, we’re going to observe the key occasions that formed Ethereum (ETH) and paved the way in which for its technical excellence.

Ethereum (ETH) whitepaper launch

The Ethereum whitepaper was launched by Vitalik Buterin in November 2013. On the time, Buterin was a 19-year-old software program engineer in Canada and the co-founder of Bitcoin Journal. The whitepaper proposed a brand new blockchain platform designed to transcend Bitcoin by enabling programmable good contracts.

Buterin envisioned Ethereum as a decentralized world pc that builders might use to construct trustless functions. Key earliest figureheads and co-founders included Gavin Wooden, Joseph Lubin, Mihai Alisie, Anthony Di Iorio and Charles Hoskinson. Their shared motivation focused overcoming Bitcoin’s restricted scripting skills and making a extra versatile, general-purpose platform.

Ethereum aimed to democratize blockchain growth by permitting anybody to deploy decentralized functions (dApps), not solely transacting on-chain. The whitepaper unlocked the alternatives of a brand new period of decentralized finance, governance and digital infrastructure.

Ethereum (ETH) mainnet activation

The Ethereum (ETH) mainnet launched July 30, 2015, with the discharge of its first reside model, Frontier.

The Ethereum Basis non-profit, based mostly in Switzerland, coordinated growth and neighborhood efforts main as much as the launch. The platform launched good contracts and the Ethereum Digital Machine (EVM), enabling decentralized functions (dApps) on-chain.

Ethereum’s ICO (preliminary coin providing) occurred from July 22 to Sept. 2, 2014, accepting Bitcoin (BTC) in trade for Ethereum (ETH), the eponymous asset of the brand new blockchain. The preliminary price was 1 BTC for two,000 ETH, and the sale raised round 31,000 BTC (about $18 million). Over 60 million ETH have been distributed to contributors, making it one of the profitable and influential token launches in crypto historical past.

The DAO saga

In June 2016, The DAO — a decentralized enterprise fund constructed on Ethereum — was hacked as a result of a vulnerability in its good contract code. An attacker exploited a recursive name bug to empty 3.6 million ETH (price about $60 million on the time and about $12 billion in present costs) from The DAO’s funds.

The DAO had raised over $150 million in ETH throughout its crowdfunding section, making it the biggest crowdfunding challenge ever then.

The hack led to an intense debate within the Ethereum neighborhood. Some argued for immutability (the “code is regulation” precept), whereas others supported reversing the hack — reorganizing the Ethereum (ETH) blockchain as an entire — to revive stolen funds.

Because of this, Ethereum underwent a tough fork (backward-incompatible community improve) on July 20, 2016, splitting the chain: Ethereum (ETH) with restored funds and Ethereum Basic (ETC), which preserved the unique chain and code.

Byzantium onerous fork

Ethereum Byzantium onerous fork was activated Oct. 16, 2017, at block 4,370,000 as a part of Ethereum’s Metropolis improve section. Its key rationale was to enhance community safety, privateness and scalability whereas making ready the protocol for future consensus adjustments. Byzantium additionally launched options to make good contract growth easy and lower block rewards from 5 ETH to three ETH to stop Ether from deflation.

Main Ethereum Enchancment Proposals (EIPs) included EIP-649 (issue bomb delay and block reward discount), EIP-658 (transaction standing codes) and EIP-197/198 (assist for zk-SNARKs to allow privateness tech). The final EIPs pair laid the inspiration for zero-knowledge tech on Ethereum, i.e., for superior privateness of worth transfers.

Byzantium was extensively seen as a easy and profitable improve that strengthened Ethereum’s place as a wise contract platform and demonstrated the community’s capability to coordinate complicated protocol enhancements.

Issue bomb changes

Issue bomb was the mechanism in Ethereum (ETH) on proof of labor — a blockchain consensus based mostly on mining — that ultimately made including the subsequent block increasingly more tough. On the one hand, it pushed ETH miners nearer to switching to proof of stake — as this was the endgame aim for Ethereum from the very starting. However, if reached too early, it could make ETH mining fully unprofitable and severely threaten ecosystem stability.

Because of this, to strike the stability between these two catalysts, Ethereum (ETH) builders postponed the issue bomb mechanism 5 occasions — in Byzantium (2017), Constantinople (2019), Muir Glacier (2020), London (2021) and Grey Glacier (2022) upgrades (onerous forks).

When Ethereum (ETH) lastly migrated to proof of stake (PoS), the issue bomb idea turned irrelevant as in staking methods, blocks are validated in one other means.

Constantinople onerous fork

The Constantinople onerous fork was activated Feb. 28, 2019, at block 7,280,000. Additionally a part of the Metropolis transition, Constantinople aimed to enhance community effectivity, efficiency and future-proofing for Ethereum 2.0. The improve was delayed from its authentic January date as a result of a last-minute vulnerability present in one of many EIPs. Constantinople additionally included a block reward discount from 3 ETH to 2 ETH, reducing inflation.

Key EIPs included EIP-145 (bitwise shifting for cheaper computations), EIP-1052 (environment friendly good contract verification) and EIP-1283 (fuel price enhancements for SSTORE operations). EIP-1234 delayed the issue bomb, sustaining affordable block occasions. Because of this, Ethereum turned extra developer-friendly, cost-effective and achieved extra optimized information logistics.

EIP 1559 activation

EIP 1559 activation was among the many boldest tokenomic upgrades for Ethereum (ETH). It fully rewrote the community charges design. As a substitute of an auction-based charges mannequin, it launched base charges and so-called “miner suggestions.” The precise quantity of charges for this or that block relied on community exercise: The extra transactions have been included into the block, the upper the charges.

Additionally, EIP 1559 — launched by the London onerous fork in August 2021 — pioneered the periodical base price burns. As such, if ETH issuance doesn’t sustain with burn occasions, ETH turns into scarcer step-by-step.

EIP 1559 is a robust tokenomic mechanism in Ethereum (ETH) that provides one other layer of verifiable shortage for ETH as a token.

It made transaction charges extra predictable, improved person expertise and launched deflationary stress on the ETH provide. Since activation, hundreds of thousands of ETH have been burned, serving to offset new issuance. Though it didn’t immediately decrease fuel costs, it laid necessary groundwork for Ethereum’s financial coverage and sustainability.

The Merge

The Merge was Ethereum’s (ETH) hotly-anticipated transition from proof of labor (PoW) to proof of stake (PoS), accomplished Sept. 15, 2022, at block 15,537,393. It mixed Ethereum’s (ETH) authentic execution layer (mainnet) with the Beacon Chain, which had been working staking structure since Dec. 1, 2020. This marked the tip of Ethereum (ETH) mining and the beginning of a extra energy-efficient consensus mannequin.

The motivation behind The Merge was to considerably cut back Ethereum’s (ETH) power consumption, enhance community sustainability and lay the inspiration for future scalability upgrades like sharding — splitting the blockchain into an ecosystem of interconnected shards (subblockchains). PoS additionally enhanced Ethereum’s (ETH) safety and financial mannequin by decreasing ETH issuance and enabling ETH staking as a type of community validation.

The Merge lowered Ethereum’s (ETH) power utilization by over 99.9% and ushered in a brand new period of eco-friendly blockchain operation. The transition from one sort of blockchain consensus to a different was a game-changing transfer from Ethereum (ETH): In three years, no blockchains replicated this improve.

Cancun-Deneb onerous fork

The Cancun-Deneb improve (additionally known as Dencun) was activated March 13, 2024, at block 19,078,888. It was one of many first upgrades that individually affected the execution layer (Cancun) and consensus layer (Deneb). Dencun’s most anticipated characteristic was EIP-4844, also referred to as proto-danksharding, which launched a brand new transaction sort known as “blobs.”

The improve focused the development of information availability and vital discount of Layer-2 transaction charges. With EIP-4844, giant information chunks utilized by rollups are saved extra effectively, paving the way in which for future full sharding. As such, the biggest EVM L2s comparable to Optimism and Arbitrum have been those who benefited essentially the most from EIP-4844 going reside.

Dencun improved Ethereum’s efficiency for rollups, made the community cheaper for customers and demonstrated Ethereum’s capability to roll out complicated adjustments throughout each consensus and execution layers.

Prague-Electra onerous fork

Activated Could 7, 2025, Prague-Electra (or Pectra) onerous fork was among the many most bold adjustments in Ethereum (ETH) design post-Merge. It included 11 EIPs targeted on performance, safety, operability and cost-efficiency for Ethereum (ETH) and its second-layer options.

Its most important adjustments, EIP-7251 “INCREASE_MAX_EFFECTIVE_BALANCE” and EIP-7702 “Set EOA (Externally Owned Account) account code,” paved the way in which for elevating most validator stability to 2,048 ETH and for blurring the road between good contracts and on-chain accounts on Ethereum (ETH). Externally owned accounts (really, on-chain wallets) have been geared up with various features solely good contracts had beforehand.

Additionally, Pectra improved BLS signatures design and streamlined operation logistics for validators. This improve builds on prime of Dencun and its EIP-4844 as a key enchancment.

Ethereum (ETH) value: How has it modified in 10 years?

Ether (ETH), the core native cryptocurrency of the Ethereum (ETH) ecosystem, is a fuel cryptocurrency, staking asset and was a miner reward in proof-of-work Ethereum in 2015-2022.

Ethereum (ETH) value dynamics normally function altcoin season indication — when it begins surging to the highs of the earlier cycle, it signifies that liquidity is flowing from Bitcoin (BTC) to altcoins.

|

Ether ICO value |

ETH Worth (2018 excessive) |

ETH Worth (2021 excessive) |

ETH Worth (present worth) |

Hole to ATH, % |

|

$0.311 |

$1,431 |

$4,891 |

$3,776 |

23.21 |

As such, Ethereum (ETH) stays the biggest cryptocurrency that hasn’t set a brand new all-time excessive on this cycle but. Bitcoin (BTC), BNB and XRP all set new information in 2025.

Bonus: What’s subsequent for Ethereum?

Ethereum (ETH) core builders have already outlined the subsequent steps for its growth. In late This autumn, 2025, the activation of the Fulu-Osaka (Fusaka) onerous fork is predicted. Fusaka is ready to introduce Peer Information Availability Sampling (PeerDAS) — validators will be capable to solely examine blobs off-chain as an alternative of downloading full datasets. It’ll save community sources and make the operations of validators more cost effective.

Additionally, the EOF replace will change the way in which Ethereum Digital Machine handles good contract bytecode to make it extra performant and cost-effective.

Anticipated in H1, 2026, Ethereum (ETH) Gloas-Amsterdam (Glamsterdam) improve will introduce lowered slot occasions and so-called Enshrined Proposal-Builder separation (ePBS) to additional speed up the scalability and cost-effectiveness of the community. Block time will drop to 6 seconds, whereas the elevated fuel restrict (to 45 million fuel) will guarantee extra highly effective computations design.

Wrapping up: Understanding Ethereum (ETH) disruption and ecosystem impact

In 10 years of its mainnet exercise, Ethereum (ETH) advanced into the biggest ecosystem within the blockchain world. Launched in 2013 because the “world pc,” it onboarded hundreds of dApps and originated dozens of L2 networks.

Since its mainnet activation July 30, 2015, Ethereum (ETH) went by way of 20+ onerous forks to regulate to altering demand, competitors and rising transactional quantity. Constantinople, London, Dencun and Pectra are among the many most bold of them.