In style altcoin Solana has struggled to take care of upward momentum since rallying to a cycle excessive of $206 on July 22. Over the previous week alone, the asset has declined by 14%, reflecting the dip in short-term investor confidence.

Nevertheless, on-chain information means that the coin would possibly witness a near-term restoration, with early indicators pointing to a shift in sentiment that might gas a rebound within the classes forward.

Lengthy-Time period Holders Are Doubling Down on Solana

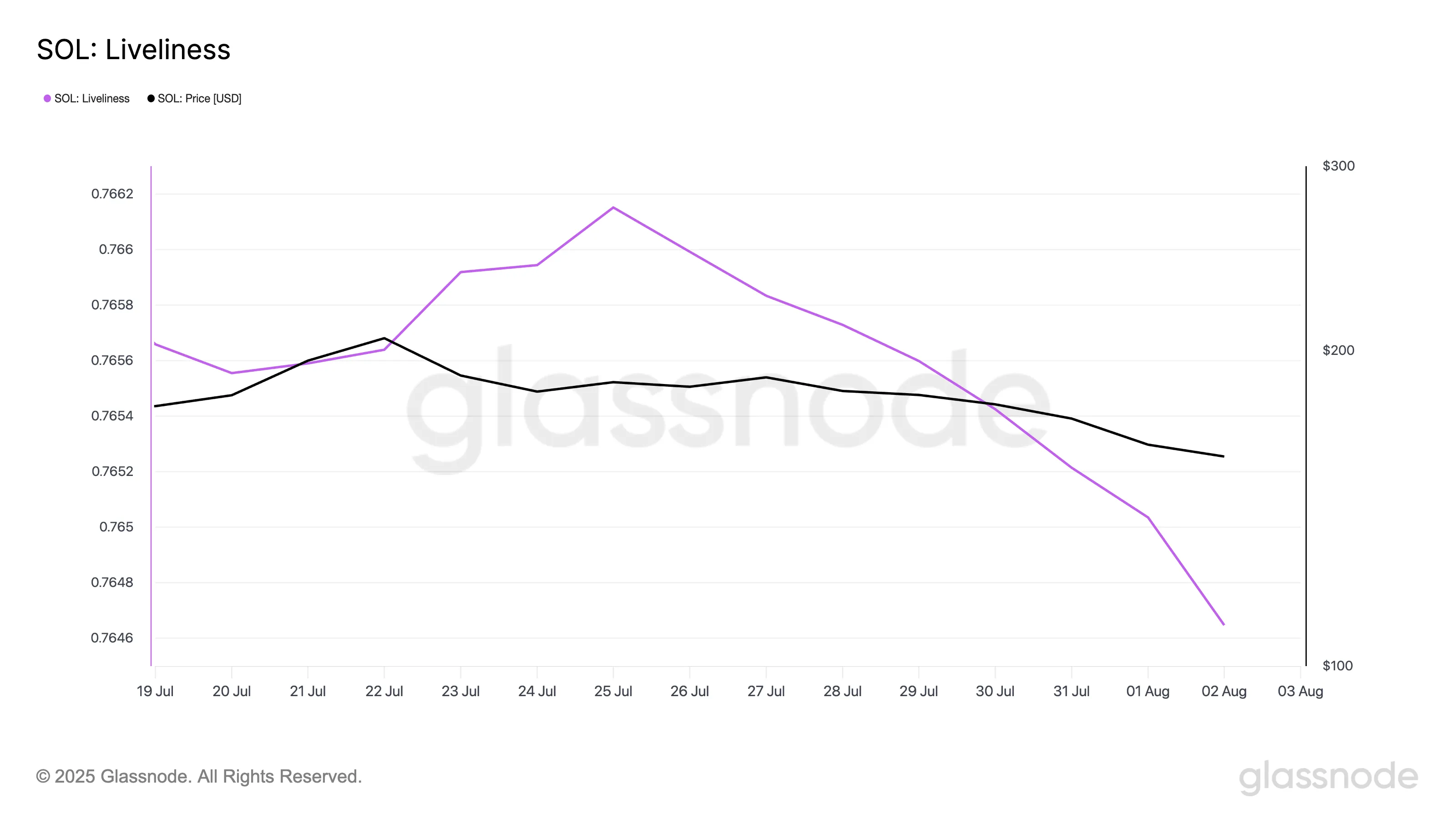

Whereas short-term merchants have been offloading their holdings, long-term holders (LTHs) are re-entering accumulation mode. This behavioral change is clear in Solana’s Liveliness, which has steadily declined since July 25.

Per Glassnode, this metric, which tracks the motion of beforehand dormant tokens, plunged to a weekly low of 0.76 yesterday, confirming the decline in sell-offs amongst SOL’s LTHs.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Liveliness tracks the motion of long-held tokens by calculating the ratio of coin days destroyed to the full coin days amassed. When it rises, it means that extra dormant tokens are being moved or bought, typically signaling profit-taking by LTHs.

Converesly, as with SOL, when this metric falls, it signifies that these traders are transferring their belongings off exchanges and opting to carry.

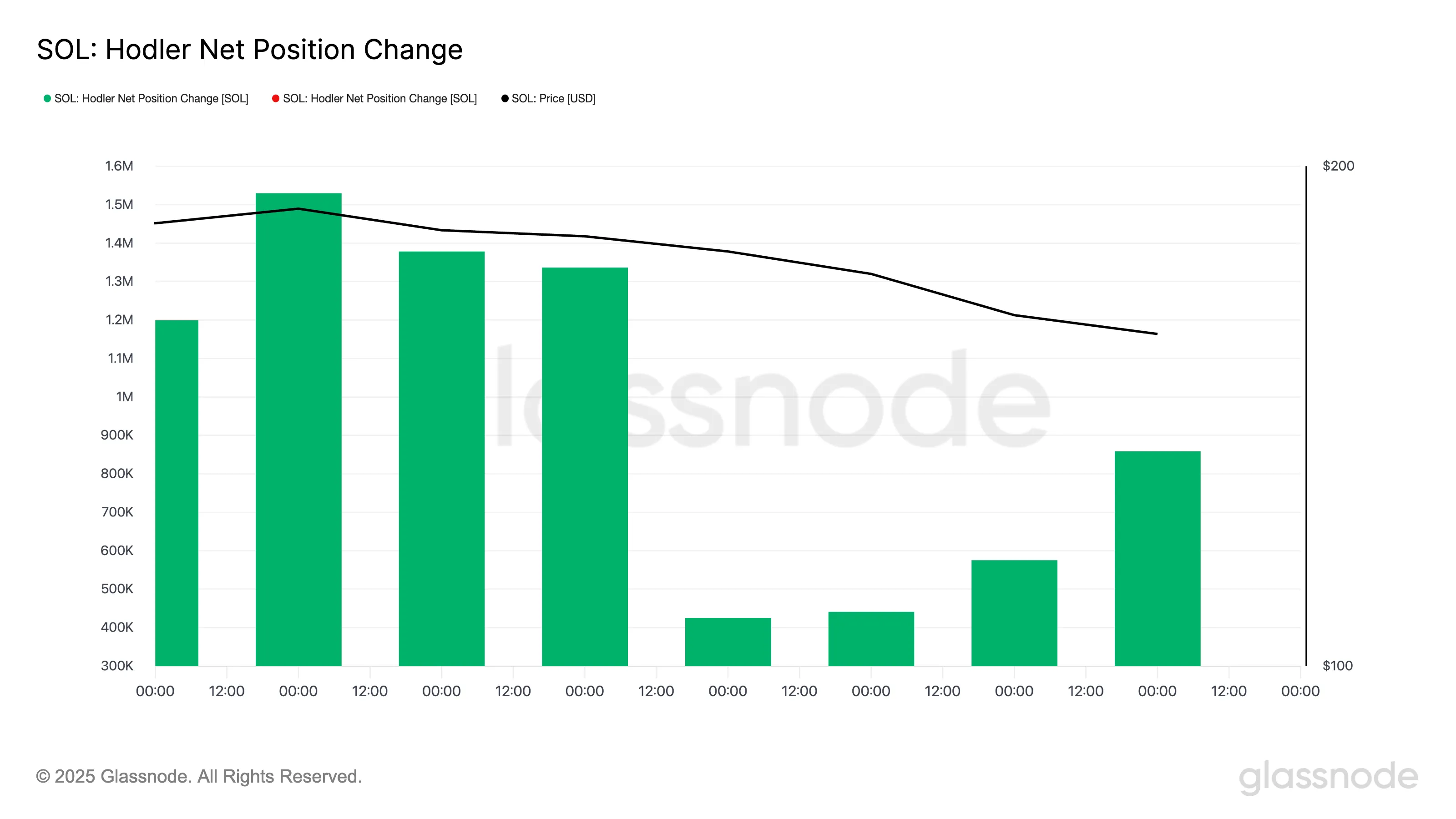

Furthermore, since July 30, SOL’s Hodler Internet Place Change has recorded a gradual uptick. This confirms that extra cash are being moved into long-term storage, regardless of the asset’s lackluster worth motion.

Glassnode information exhibits that this metric, which measures the 30-day change within the provide held by LTHs, has climbed by 102% over the previous 4 days. When this metric rises like this, it signifies that LTHs are accumulating extra cash fairly than promoting them.

Solana Merchants Are Promoting at a Loss — Is a Backside Lastly Forming?

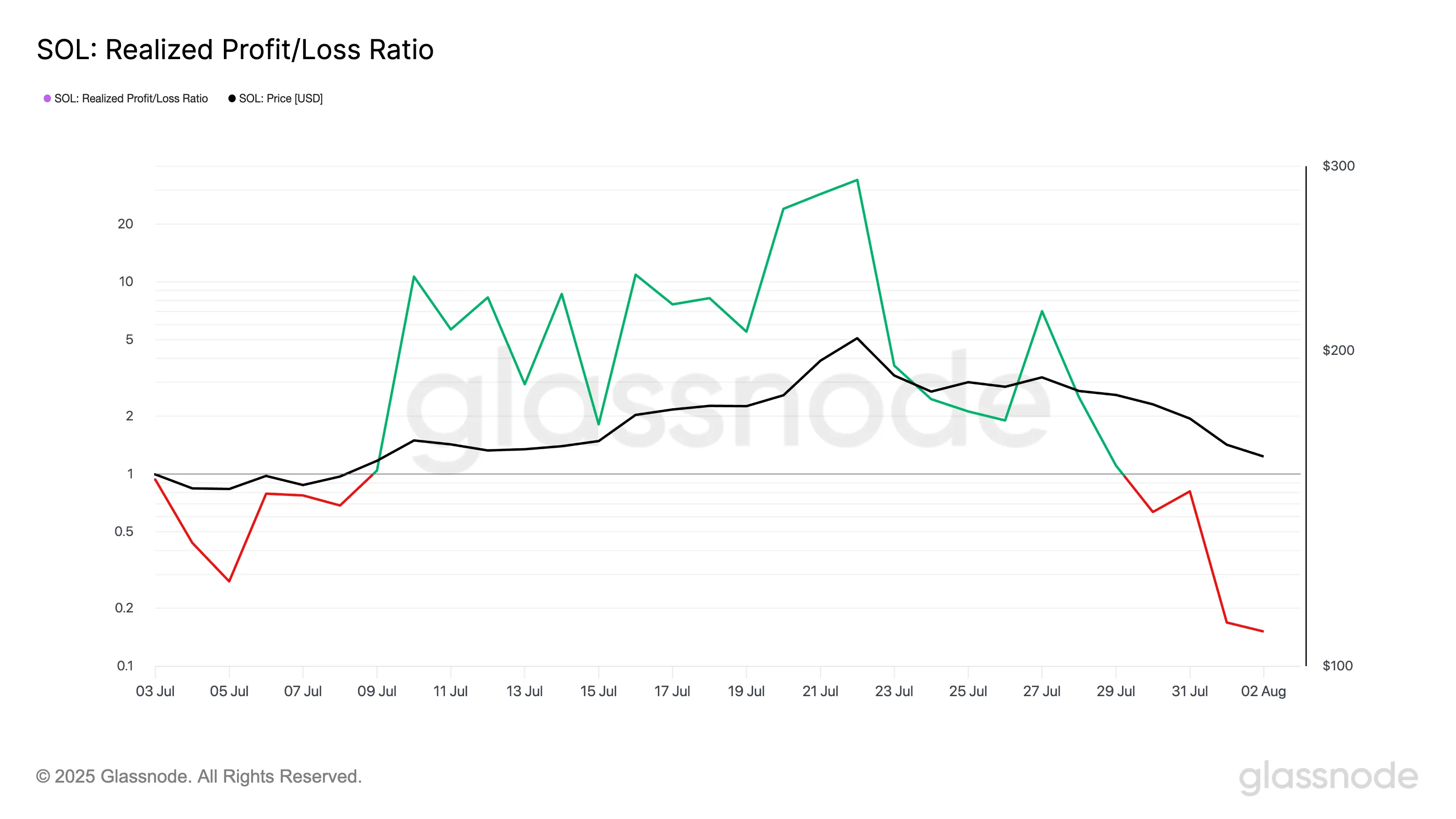

The sustained decline in SOL’s Realized Revenue/Loss Ratio helps the bullish outlook above. On-chain information exhibits that this metric closed at a 30-day low of 0.15 on August 2, indicating that many merchants exiting positions proceed to take action at a loss.

Traditionally, the market tends to stabilize when most members promote under their value foundation.

With fewer holders prepared to dump their tokens at a loss, promoting strain might cut back, paving the best way for SOL to discover a native backside forward of any bullish catalyst that might set off a rebound.

Solana Hangs within the Steadiness—Assist at $158 Faces Severe Take a look at

SOL trades at $160.55 at press time, holding above a key assist ground at $158.80. If buy-side strain grows, SOL might provoke a bullish reversal and development towards $176.33.

Nevertheless, if selloffs persist and the assist ground weakens, SOL’s worth might fall to $145.90.

Disclaimer

Consistent with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.