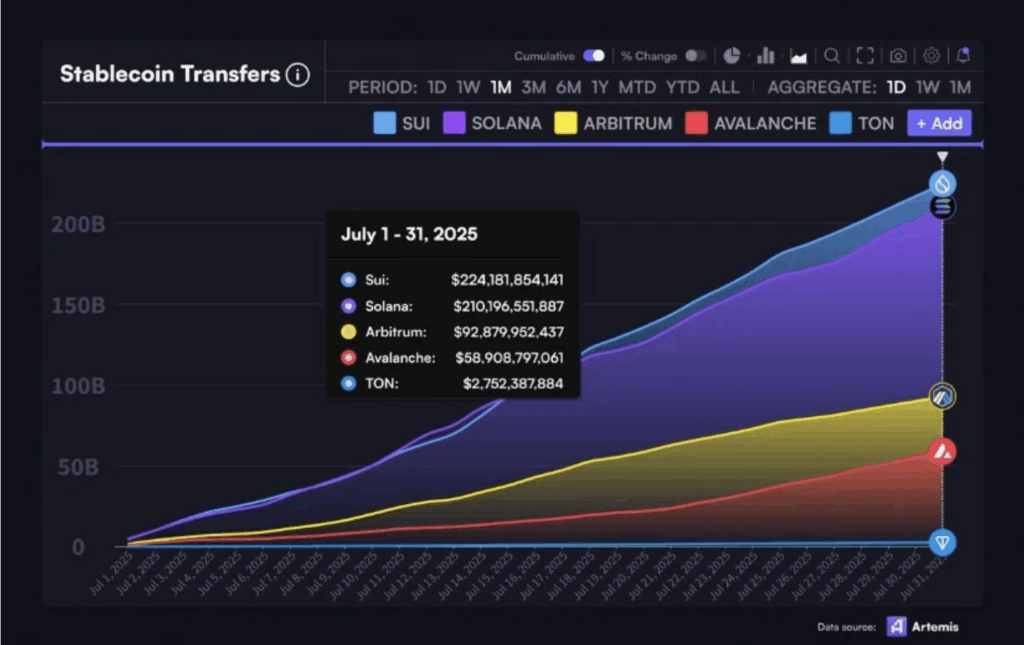

- SUI beat Solana in July stablecoin quantity: first time ever.

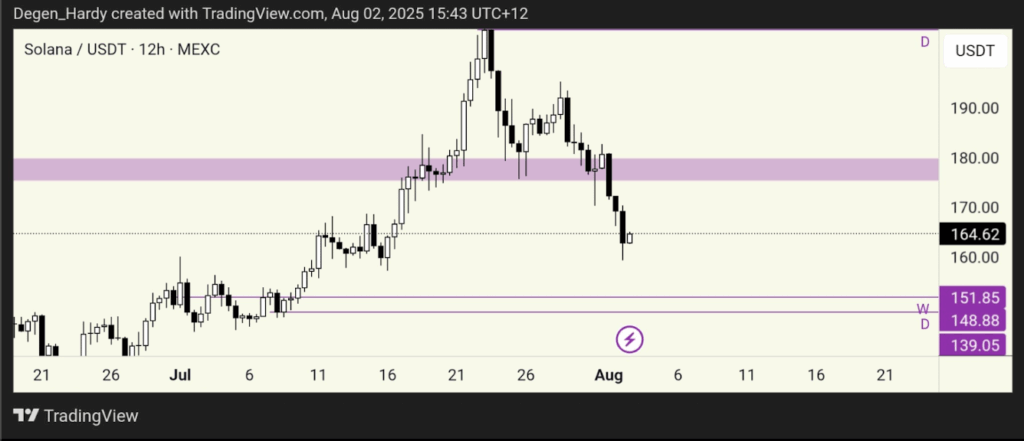

- Worth motion broke help, now testing $151/$148.

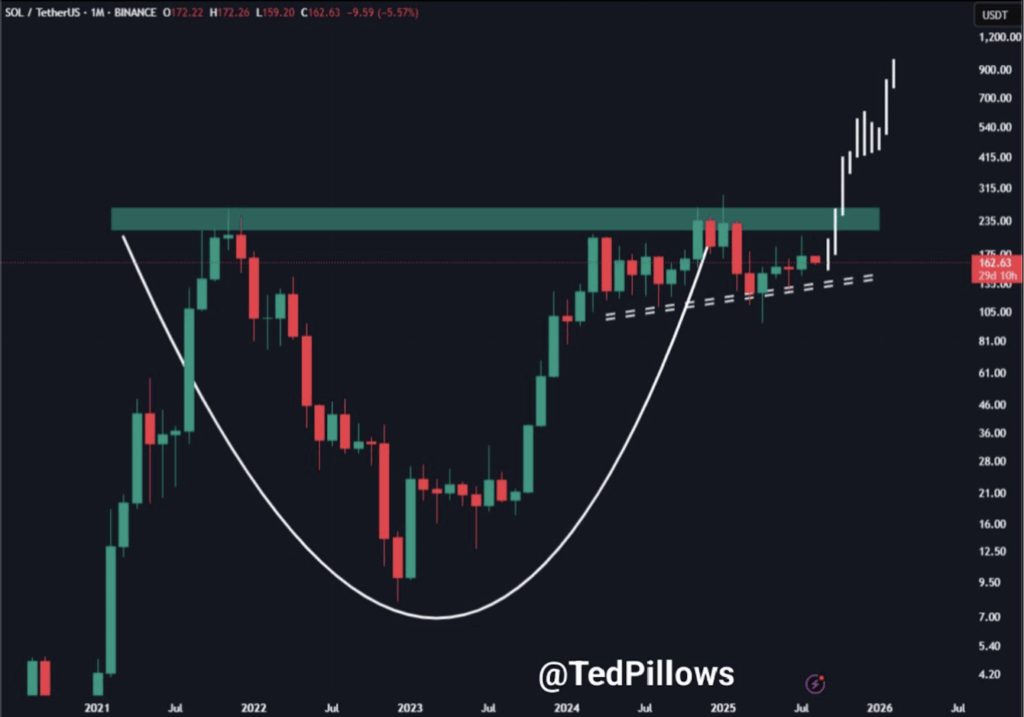

- Brief-term appears bearish, however cup & deal with could also be forming.

Solana’s been driving excessive for months… however currently? The wind’s shifting. It simply misplaced a key edge in stablecoin quantity, and the charts aren’t trying too sizzling both. Merchants are break up—some see warning indicators, others suppose we’re simply increase steam earlier than the subsequent massive transfer.

SUI Overtakes Solana in Stablecoin Transfers

For the primary time in a protracted whereas, Solana’s not the highest canine in month-to-month stablecoin transfers. July’s knowledge (because of Artemis and shared by Torero_Romero) confirmed SUI clocking in at $224.3B—beating Solana’s $210.7B. That’s not an enormous hole, but it surely’s a primary. And that type of shift makes folks discover.

It doesn’t imply Solana’s toast—removed from it. Its ecosystem continues to be stacked. Nevertheless it does recommend that newer chains like SUI are beginning to chew into its dominance, particularly if this pattern retains up. That would bleed into worth motion if SOL doesn’t bounce again quickly.

SOL Worth Dips, Help Zones Get Examined

On the value entrance, issues have turned, nicely… messy. Solana’s damaged beneath its current chop zone, and now eyes are on the $151 and $148 ranges—each are untested zones that may act as short-term help.

Hardy’s chart confirmed the breakdown clearly. Since topping out round $206, SOL’s been caught in a sluggish fade. And the truth that mid-range patrons didn’t step up? That’s not the strongest look.

May $170 Get Rejected Once more?

Karman_1s laid out a possible roadmap: possibly SOL will get a weak bounce as much as the $170 space, however odds are it’ll smack into resistance and roll over. If that occurs, worth may fall again towards $145 and even decrease. That zone’s trying heavy, and with out sturdy bullish quantity, it’s laborious to argue in opposition to additional draw back.

Mainly, until patrons get up quickly, this might play out like a traditional decrease excessive rejection earlier than extra bleeding.

The Bullish Wildcard: Cup and Deal with Formation

Now right here’s the twist. Whereas short-term charts are trying gloomy, TedPillows noticed one thing attention-grabbing—a possible cup and deal with forming on the upper timeframe.

Yep, that old-school bullish sample. And it’s clear: rounded base, tight deal with forming, and a neckline that would set off a breakout if worth holds this correction zone ($140–$150). If that performs out, SOL might make a run for brand new all-time highs. Significantly.

So whereas the near-term strain is actual, the larger construction may nonetheless be pointing up.

So, Is This a Breakdown or Only a Breather?

Brief reply? Each are nonetheless attainable.

Solana’s clearly underneath some warmth—on-chain competitors is selecting up, and the charts present weak spot. But when this dip holds agency round $140 to $150, and quantity begins creeping again in, this complete correction may simply be a part of an even bigger setup.

The important thing battle’s occurring round $170. Reclaim it? Bulls are again. Lose $145? The bears tighten their grip. Both method, this subsequent stretch might outline SOL’s subsequent massive transfer.