Two giant Ethereum buyers are seizing the current market correction to extend their stakes within the asset.

Within the first few days of August, the whale wallets collectively spent over $400 million on ETH, signaling renewed confidence within the asset’s long-term worth.

Ethereum Whales Purchase the Dip as On-chain Exercise Rises

One of the crucial notable transactions got here from a pockets tracked by Arkham Intelligence. Over a three-day interval, the pockets acquired roughly $300 million value of ETH by way of Galaxy Digital’s over-the-counter buying and selling desk.

The pockets presently has an unrealized lack of round $26 million.

Nevertheless, the sheer scale and fast tempo of the purchases recommend a strategic, long-term accumulation slightly than speculative short-term buying and selling.

One other key participant on this shopping for spree is Ethereum-focused agency SharpLink.

In line with Lookonchain, the corporate added 30,755 ETH to its stability sheet over the span of two days, spending $108.57 million at a median worth of $3,530 per token.

SharpLink now holds 480,031 ETH, with its present stash valued at roughly $1.65 billion.

These acquisitions got here as Ethereum dropped to a multi-week low close to $3,300. In line with knowledge from BeInCrypto, ETH has recovered barely and is buying and selling round $3,477 on the time of writing.

Business consultants famous that these whale actions are reflective of a broader, optimistic outlook for Ethereum.

In July, ETH surged previous $3,900, pushed by file institutional inflows, rising ETF publicity, and stablecoin-driven DeFi growth.

Specialists argue that this isn’t a short-lived rally however an indication of Ethereum’s increasing function in international finance.

A surge within the community’s on-chain exercise helps this view.

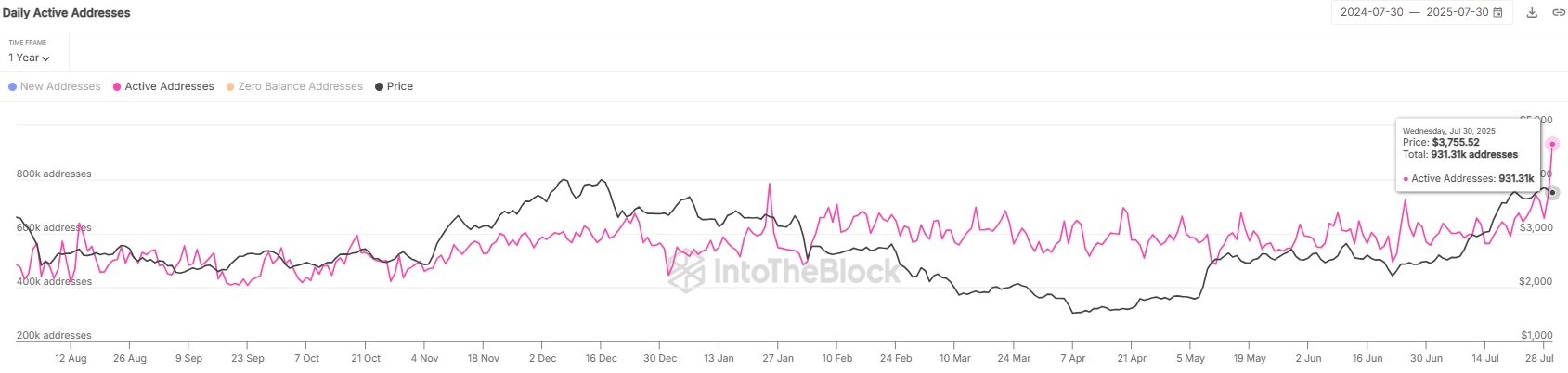

Sentora (previously IntoTheBlock) just lately reported that Ethereum registered 931,000 energetic addresses in a single day, its highest depend in almost two years. This uptick highlights rising person engagement and curiosity throughout the community.

Moreover, regulatory tendencies could additional strengthen Ethereum’s outlook as US officers are keen to steer international finance right into a blockchain-based period.

Well-liked enterprise capitalist Thomas Lee of Fundstrat urged that if Ethereum continues to dominate as the popular sensible contract platform for Wall Road companies, its valuation might rise considerably, doubtlessly reaching $60,000.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.