There isn’t a query that 2025 has been a superb yr—to this point—for crypto exchange-traded funds (ETFs), garnering vital quantities of capital each week. Whereas the funding merchandise struggled firstly of the yr, as did a lot of the world monetary markets, the USA ETF market had a exceptional efficiency previously quarter.

Apparently, July marked the beginning of one other productive quarter for the crypto ETFs in the USA, with the funding merchandise posting capital inflows within the month. In keeping with the most recent market knowledge, July 2025 could be the very best month but for the digital asset-linked funds after registering tens of billions of {dollars} in capital inflow within the 30-day interval.

Crypto ETFs Outperform Vanguard’s S&P 500 Fund In July

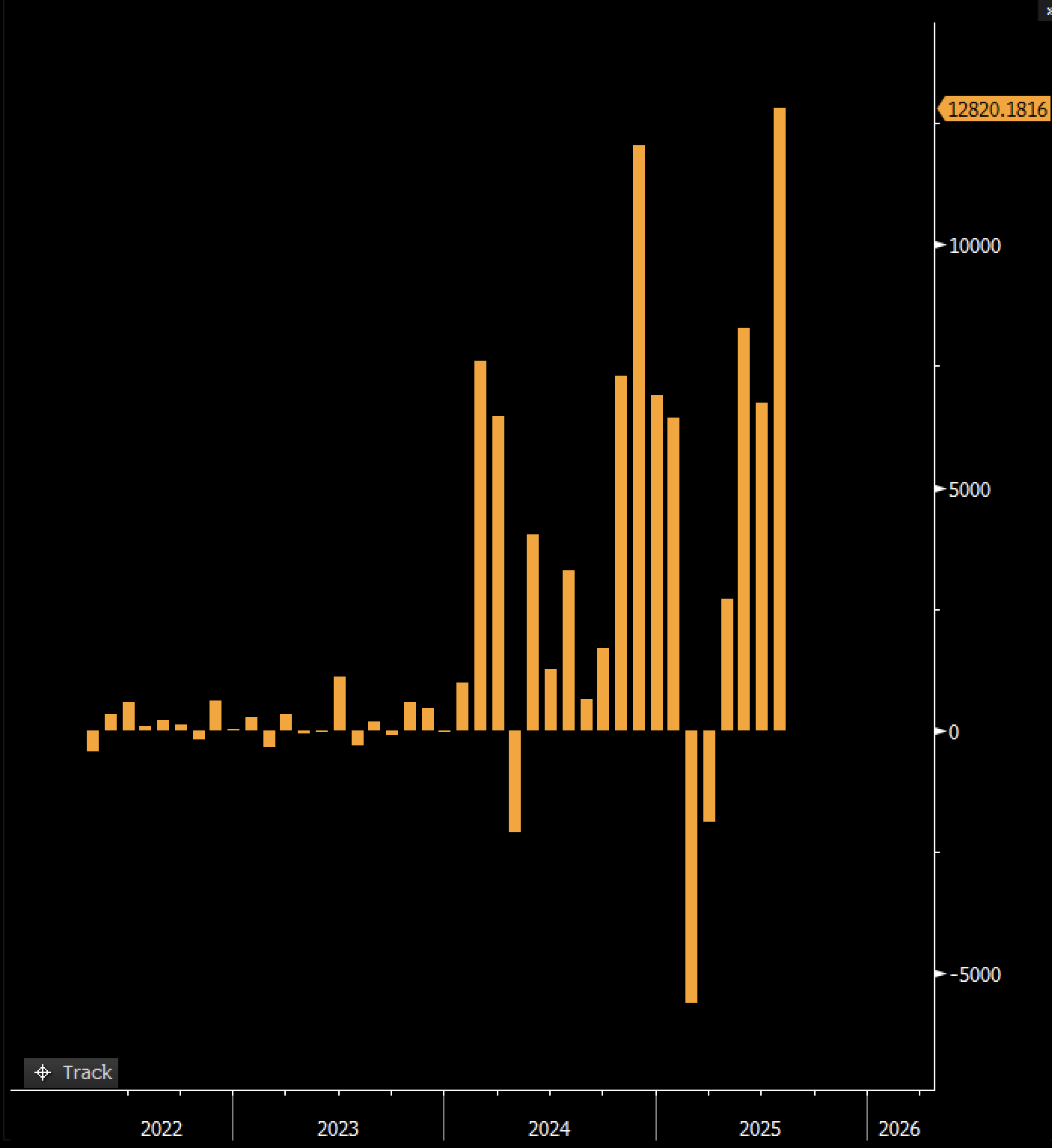

On Friday, August 1, Bloomberg ETF analyst Eric Balchunas took to the social media platform X to disclose that the US crypto ETF market simply had its finest month-to-month efficiency but in July 2025. In keeping with the most recent market knowledge, the funding merchandise took in additional than $12.8 billion in capital—at a tempo of $600 million per day—previously month.

To place into perspective, the tempo of every day additions in July is about twice the common of the crypto exchange-traded funds. In keeping with Balchunas, the digital asset-linked funding merchandise outperformed each single ETF, together with “the mighty VOO”—referring to Vanguard’s S&P 500 fund—over the previous month.

Balchunas added:

Additional, each ETF in class took in money (ex the transformed Trusts) w/ Bitcoin and Ether making equal contributions. Most all-around dominant efficiency for the reason that Eagles ended the Chiefs within the Tremendous Bowl. Will probably be onerous to prime.

Supply: @EricBalchunas on X

The US crypto ETF market is led by the Bitcoin spot ETFs, with a complete asset of over $146.48 billion at present beneath administration. The Bitcoin ETF is totally dominated by BlackRock’s IBIT, which has its complete belongings beneath administration (AUM) at over $84 billion, and is adopted by Constancy’s FBTC at virtually $23 billion.

In the meantime, the Ethereum spot exchange-traded funds, which launched greater than 6 months after their BTC counterparts, have a complete AUM of $20.1 billion. Unsurprisingly, BlackRock additionally leads this market, with its ETH ETF (ETHA) having a complete of $10.71 billion in belongings beneath administration.

Crypto Market Cap Drops 5%

In keeping with knowledge from CoinGecko, the overall crypto market capitalization stands at round $3.78 billion, having declined by 5% previously 24 hours. On Friday, the crypto market succumbed to large bearish stress, with the highest cash like Bitcoin, Ethereum, and Solana struggling main losses.

The crypto complete market cap on the every day timeframe | Supply: TOTAL chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.