A number of US financial indicators are within the pipeline this week, though not as sizzling as those witnessed prior to now week.

By frontrunning the next occasions, merchants and buyers can buffer their portfolios towards sudden affect.

Preliminary Jobless Claims

This US financial sign, due each Thursday, will point out the variety of United States residents who filed for unemployment insurance coverage for the primary time final week.

Economists surveyed by MarketWatch anticipate a modest improve to 221,000 after the 218,000 reported within the week ending July 26.

“Preliminary claims for jobless advantages fell final week [the one ended July 26] and are operating under their year-earlier stage. Persevering with claims proceed to level to a barely much less tight labor market in comparison with a yr in the past,” economist correspondent Nick Timiraos indicated.

This US financial sign is especially necessary as labor market information progressively grows as a big macro for Bitcoin (BTC).

The jobless claims information will comply with the nonfarm payroll (NFP) information, launched on August 1. The NFP information exacerbated Bitcoin’s current drop, coming in properly under expectations.

With information signaling a deteriorating labor market, potential greenback instability might push retail and institutional buyers towards crypto in the long term.

If final week’s jobless claims proceed the development of coming in greater than the earlier week or, worse, exceeding expectations, the perceived labor market weak point might bode properly for Bitcoin as buyers pivot towards financial uncertainty.

For perspective, a shock improve in jobless claims would sign financial weak point, probably supporting looser Fed coverage. Such an consequence can be bullish for danger property like crypto.

ISM Companies PMI

Past labor market information, crypto markets may also be watching the ISM Companies PMI (Buying Managers’ Index).

This financial indicator, derived from month-to-month surveys of personal sector corporations, measures enterprise exercise in areas akin to new orders, stock ranges, manufacturing, provider deliveries, and employment.

After a studying of fifty.8% in June, economists undertaking a modest improve to 51.1% in July. If the ISM Companies PMI rises above the anticipated 51.1%, it indicators stronger financial exercise and will dampen hopes for Fed price cuts. Such an consequence is probably bearish for Bitcoin as tighter liquidity persists.

Nonetheless, a lower-than-expected studying, particularly under 50, would counsel financial weak point and lift expectations of financial easing, probably boosting crypto costs.

If the info meets forecasts, markets might tread water, with merchants awaiting extra decisive indicators like jobless claims.

In Tuesday’s run-up to this specific US financial sign, Bitcoin’s subsequent transfer hinges on whether or not the providers sector exhibits indicators of overheating or slowdown, key components to the Fed’s inflation and coverage stance.

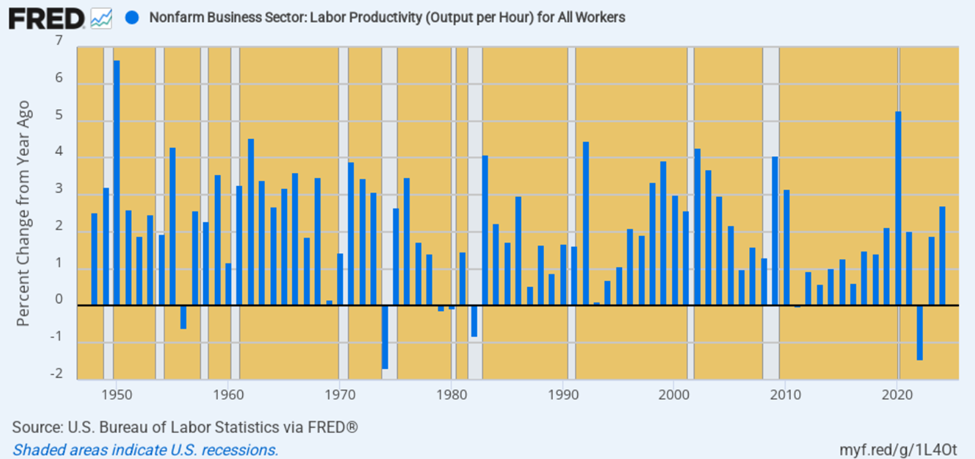

US Productiveness and Unit Labor Prices

Additional, the US productiveness and unit labor prices will likely be important watches this week, due Thursday, August 7. Collectively, they reveal whether or not wage progress is inflationary.

These information factors point out wage progress within the second quarter (Q2). In Q1, US productiveness dropped by 1.5%, however now economists undertaking a 1.9% improve.

In the meantime, US unit labor prices had been 6.6% greater within the first quarter, however economists undertaking a modest surge of 1.3% in Q2.

Rising labor prices with out growing productiveness would point out sticky inflation, which is anticipated to bode positively for Bitcoin.

Extra carefully, the mismatch might shift Fed expectations, with crypto identified to reply properly to indicators of disinflation or financial slowdown.

Nonetheless, if labor prices rise on the similar tempo as productiveness, corporations can afford to pay extra with out elevating costs. Such a situation would assist actual wage progress with out triggering inflation. That is nonetheless usually bullish for Bitcoin because it promotes financial progress with out tightening liquidity.

When labor prices fall whereas productiveness rises, it’s a extremely disinflationary and business-friendly situation. That is bullish for the crypto as falling inflation pressures increase the percentages of price cuts or liquidity assist, favoring danger property.

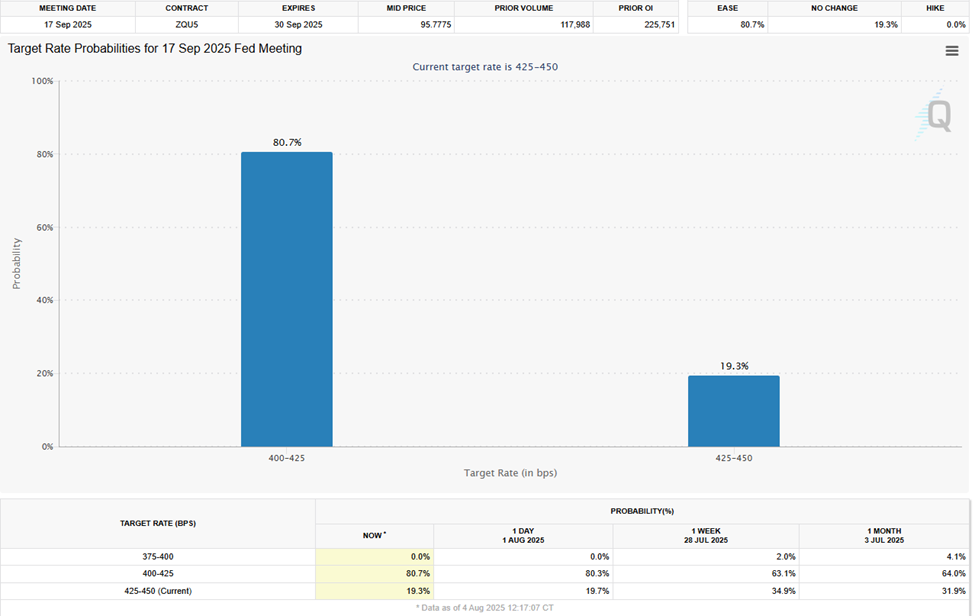

Primarily based on the CME FedWatch Device, rate of interest bettors see an 80.7% probability the Fed will minimize rates of interest within the September 17 assembly.

Atlanta Fed President Raphael Bostic Speech

Past information factors amongst US financial indicators, merchants and buyers additionally monitor feedback from policymakers. This week, the Atlanta Fed President Raphael Bostic will converse on Thursday, and markets will likely be eager for indicators on policymakers’ financial outlook.

Atlanta Fed President Raphael Bostic is thought to lean hawkish on financial coverage, favoring a cautious strategy to rate of interest cuts.

“When you’re hoping for price cuts, don’t maintain your breath. Atlanta Fed President Raphael Bostic not too long ago acknowledged he solely helps one price minimize this yr, highlighting the Fed’s uncertainty attributable to tariffs,” one consumer stated not too long ago.

As one of many Fed’s policymakers, Bostic’s tone on inflation, charges, or steadiness sheet coverage can sharply shift market expectations.

If his remarks are hawkish, it might be bearish for Bitcoin. Nonetheless, a dovish stance can be bullish, particularly if it contrasts with Powell’s tone.

The publish 4 US Financial Alerts That May Derail Bitcoin’s Restoration This Week appeared first on BeInCrypto.