Key Takeaways

NUPL-MVRV and Coin Days Destroyed sign early promoting strain from long-term holders. Inventory-to-Movement drops sharply as shorts dominate, hinting at doable correction forward.

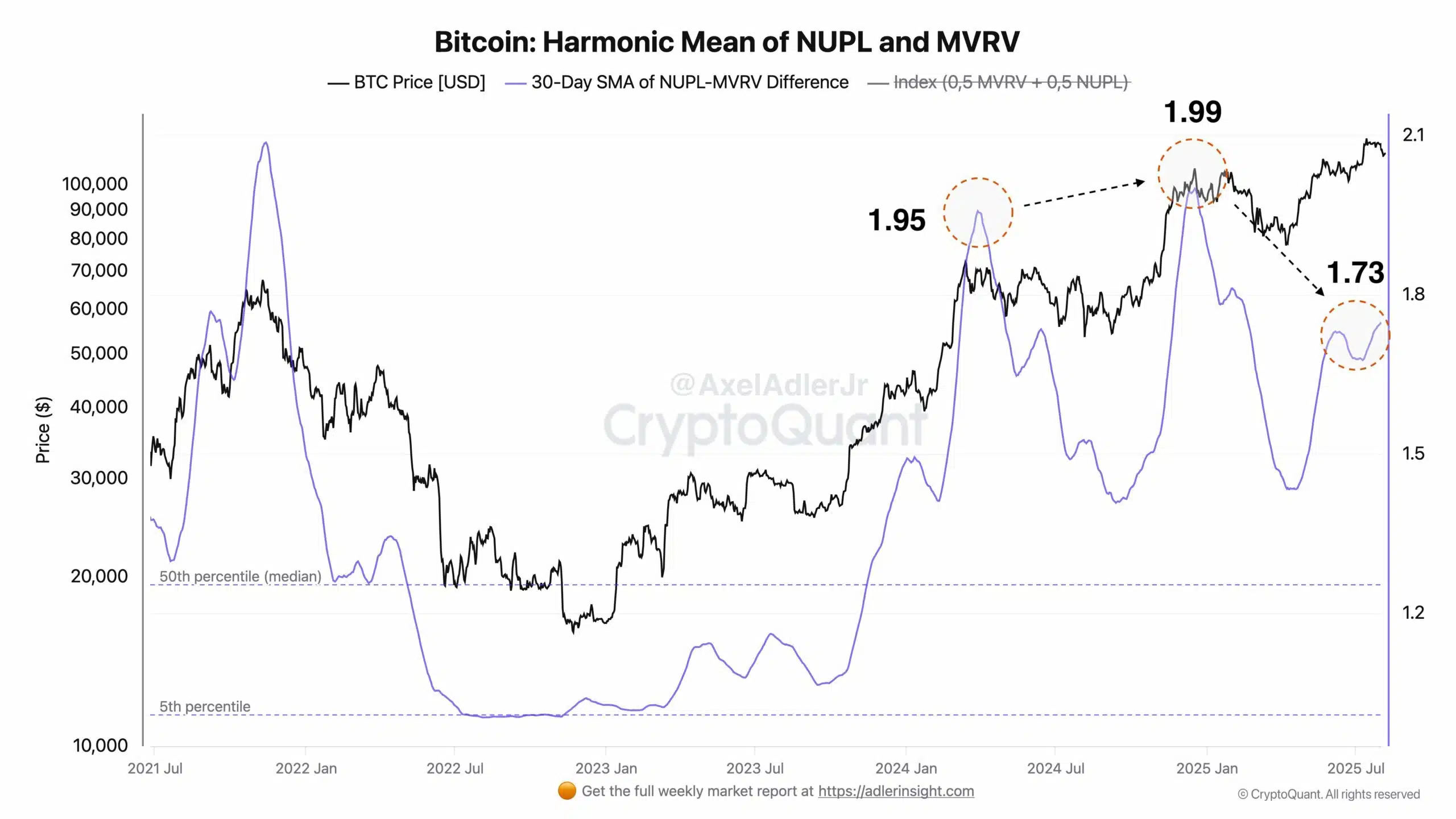

Bitcoin’s [BTC] harmonic imply of NUPL and MVRV has dropped from 1.99 in December 2024 to 1.73, forming a decrease excessive that displays waning investor danger urge for food.

This development means that holders are starting to promote into energy somewhat than accumulate, placing strain on upside momentum.

Though the market nonetheless posts short-term rallies, every surge brings a smaller premium above value foundation.

On the time of writing, Bitcoin traded at $114,539 after a 0.8% each day achieve. Until the metric reverses increased, the danger of broader correction grows as profit-taking begins to outweigh demand at present ranges.

Supply: X/Axel Adler Jr

Are long-term holders quietly making ready for an exit?

Coin Days Destroyed (CDD) rose by 2.57% to 9.4393 million, signaling elevated motion of older cash usually held by long-term buyers.

This metric multiplies the variety of days a coin is held by the amount moved, making it particularly delicate to long-dormant provide.

Subsequently, a rising CDD usually marks intervals when seasoned holders exit throughout perceived market tops.

The most recent uptick suggests extra long-term buyers are taking earnings, aligning with the bearish divergence seen in NUPL-MVRV.

As extra mature cash enter circulation, market strain may mount regardless of the continued short-term bullish sentiment.

Supply: CryptoQuant

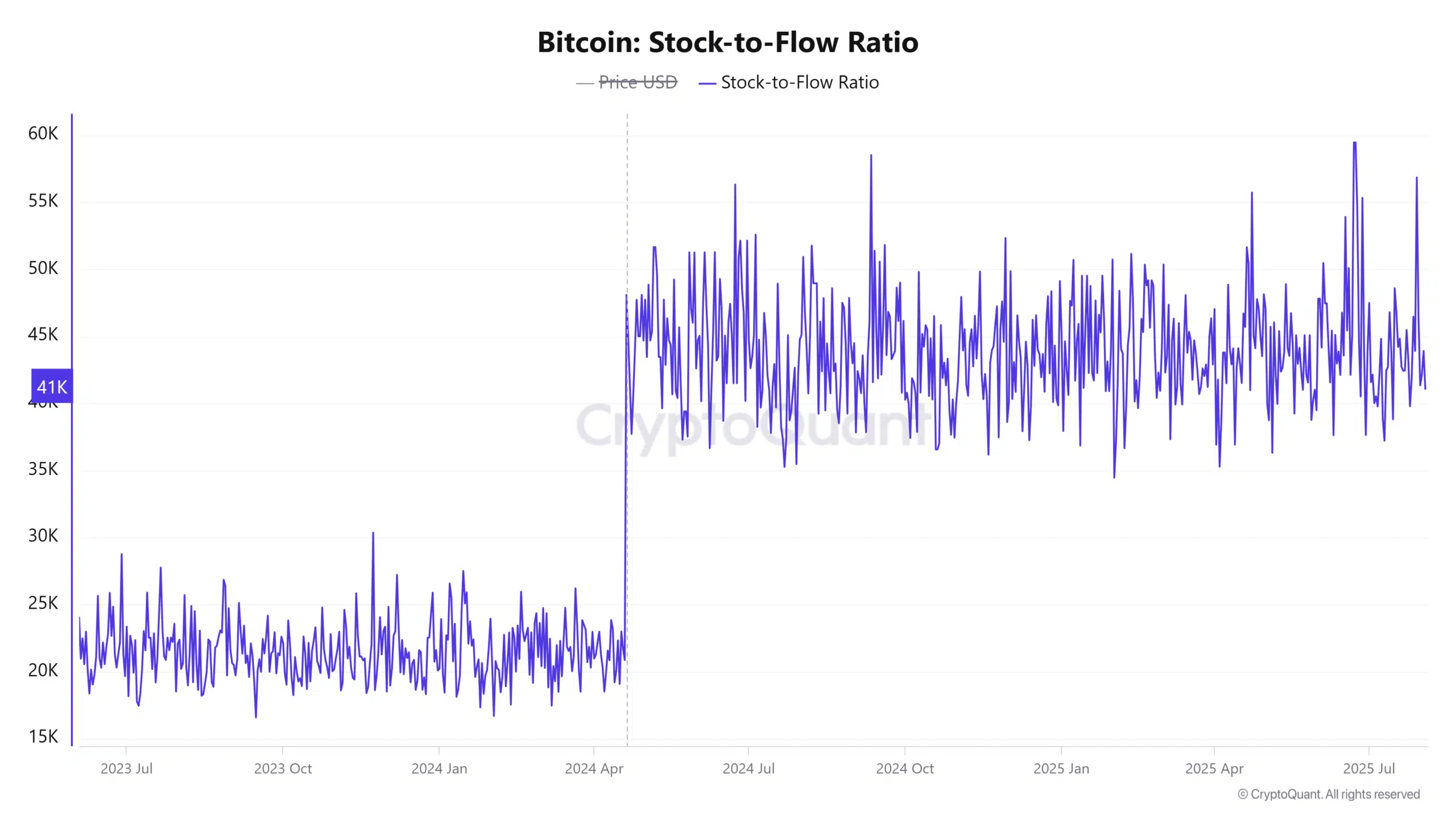

Has Bitcoin’s shortage narrative misplaced its grip?

Bitcoin’s Inventory-to-Movement (S2F) Ratio has plunged by 57.14% to 909.78K, a pointy decline that questions the energy of the asset’s scarcity-driven valuation mannequin.

This metric compares the present circulating provide to the speed of recent issuance and has traditionally supported long-term bullish outlooks.

Nonetheless, the current drop indicators a weakening conviction within the shortage thesis.

Traders could now be trying towards macroeconomic cues or risk-on sentiment somewhat than provide dynamics.

If confidence within the mannequin continues to say no, the long-term narrative that helps sustained upside momentum could battle to achieve traction once more.

Supply: CryptoQuant

Do derivatives merchants count on extra draw back for Bitcoin?

As of the 4th of August, the Lengthy/Brief Ratio on Bitcoin dropped to 0.944, with brief positions making up 51.43% versus 48.57% in longs.

This shift beneath parity means that derivatives merchants are positioning for extra draw back.

The ratio has remained below strain since mid-July, displaying persistent bearish bias.

Subsequently, sentiment within the derivatives market not helps a assured rally, particularly amid rising spot-side profit-taking.

If this short-heavy positioning continues and lengthy curiosity stays suppressed, the promoting momentum may intensify, undermining any bullish makes an attempt at reclaiming increased resistance zones within the close to time period.

Supply: CoinGlass

Will Bitcoin survive this convergence of bearish indicators?

Bitcoin faces a confluence of bearish metrics: a declining NUPL-MVRV, rising CDD, plummeting S2F ratio, and bearish derivatives sentiment.

Though value stays elevated close to $114K, the muse seems more and more fragile.

Until demand from new capital or macro catalysts re-emerges strongly, the danger of a market-wide correction continues to rise.